Navigating The Complexities Of OFAC Sanctions On Iran

The intricate relationship between OFAC and Iran forms a cornerstone of U.S. foreign policy, designed to exert economic pressure and counter activities deemed detrimental to international security. This dynamic landscape of sanctions and enforcement actions by the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) profoundly impacts global finance, trade, and diplomacy. Understanding the mechanisms, targets, and implications of these measures is crucial for businesses, financial institutions, and individuals worldwide who might inadvertently interact with sanctioned entities or activities.

This article delves into the multifaceted approach OFAC employs to address Iran's various illicit endeavors, from financial networks to weapons proliferation. We will explore the legal frameworks, specific designations, and broader strategies that define the U.S. government's "maximum pressure" campaign against Iran, offering insights into compliance challenges and the evolving nature of these critical economic tools.

Table of Contents

- The Mandate of OFAC: Administering Sanctions Against Iran

- Targeting Iran's Economic Lifelines: Oil and Financial Sectors

- Countering Iran's Proliferation and Destabilizing Activities

- Addressing Human Rights and Malign Influence

- Understanding OFAC's Licensing Policies and Guidance for Iran

- The Specially Designated Nationals (SDN) List and Its Implications

- Defining the Iranian Financial Sector under Sanctions

- The Broader Impact of OFAC Sanctions on Iran

The Mandate of OFAC: Administering Sanctions Against Iran

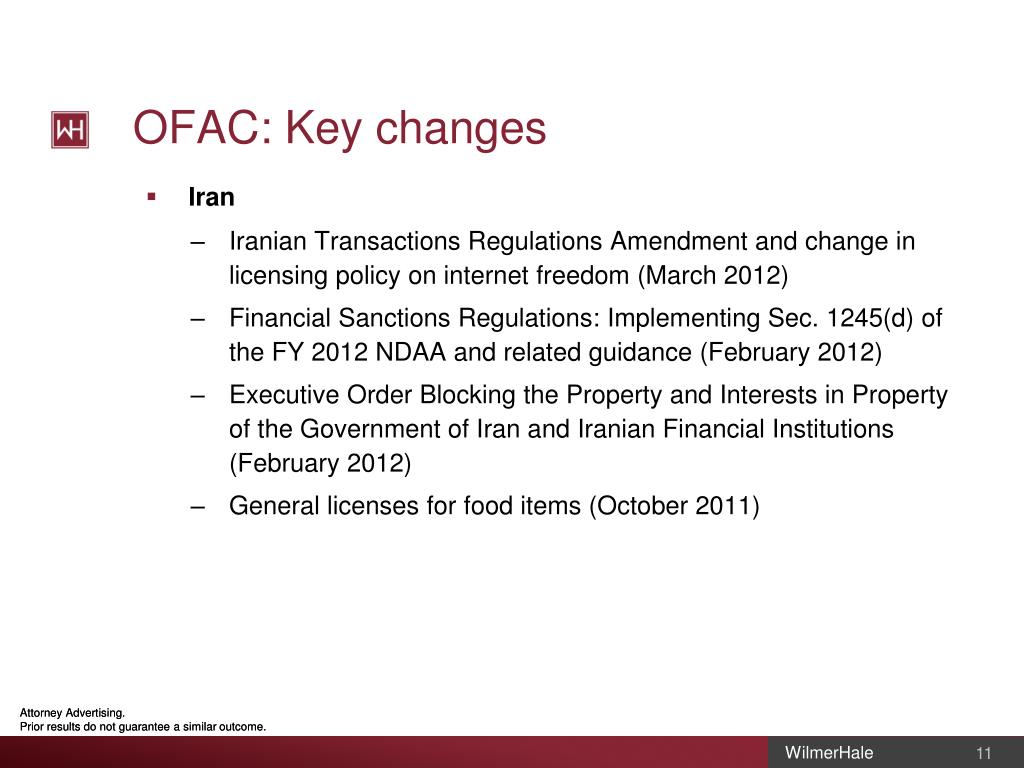

The Office of Foreign Assets Control (OFAC), a vital component of the U.S. Department of the Treasury, stands at the forefront of implementing and enforcing economic sanctions programs. These programs are designed to protect U.S. national security and foreign policy objectives, and among the most complex and far-reaching are those targeting Iran. OFAC's authority stems from various legal instruments, primarily Executive Orders (E.O.s) issued by the President. For instance, many recent actions against Iran have been taken pursuant to Executive Order (E.O.) 13902, which specifically targets Iran’s financial, petroleum, and petrochemical sectors. This particular executive order, alongside others like E.O. 13224 (as amended by E.O. 13886), forms the bedrock of the U.S. government's "maximum pressure" campaign on Iran, a strategy explicitly ordered by National Security Presidential Memorandum 2. OFAC's role extends beyond merely identifying and sanctioning entities; it also involves issuing comprehensive guidance and statements on specific licensing policies as they relate to Iran. This guidance is critical for individuals and businesses navigating the complex web of restrictions, particularly for those who might find themselves involved in administrative or civil proceedings related to sanctions violations. The U.S. Treasury Department consistently leverages all available tools to target what it identifies as critical nodes in illicit networks, aiming to disrupt operations that enrich the Iranian regime’s elite and foster corruption at the expense of the Iranian people. This unwavering commitment underscores the strategic importance of OFAC’s work in deterring Iran's problematic activities on the global stage.Targeting Iran's Economic Lifelines: Oil and Financial Sectors

A core objective of U.S. sanctions against Iran is to cripple the regime's ability to fund its destabilizing activities by targeting its primary economic lifelines: the oil and financial sectors. OFAC has consistently focused its efforts on these areas, recognizing their critical importance to Iran's economy. A notable example of this strategy is the designation of Iran’s Minister of Petroleum, Mohsen Paknejad, who oversees the export of tens of billions of dollars' worth of Iranian oil and has allocated billions of dollars’ worth of oil to Iran’s armed forces for export. Such designations aim to sever the financial arteries that fuel the regime's military and illicit operations. Beyond high-profile officials, OFAC also targets the intricate networks facilitating illicit oil trade. Recent actions have included sanctioning oil brokers operating in the United Arab Emirates (UAE) and Hong Kong, highlighting the global reach of these illicit networks. Recognizing the sophistication of these evasion tactics, the Department of the Treasury's OFAC has issued an advisory specifically for shipping and maritime stakeholders, providing crucial guidance on detecting and mitigating Iranian oil sanctions evasion. This advisory is a testament to the ongoing cat-and-mouse game between sanction enforcers and those seeking to circumvent restrictions, emphasizing the need for constant vigilance within the global maritime industry.Unmasking the Shadow Banking Networks

Perhaps one of the most significant and complex areas of OFAC’s focus against Iran is the relentless pursuit of its "shadow banking networks." These clandestine financial systems allow sanctioned entities, particularly Iran’s Ministry of Defense and Armed Forces Logistics (MODAFL) and the Islamic Revolutionary Guard Corps (IRGC), to gain illicit access to the international financial system, bypassing legitimate channels. The scale of these operations is staggering. OFAC has sanctioned nearly 50 entities and individuals that constitute multiple branches of a sprawling shadow banking network, demonstrating the depth and breadth of these illicit financial operations. In a coordinated effort to expose and disrupt these networks, OFAC, often working in tandem with the Financial Crimes Enforcement Network (FinCEN) of the U.S. Department of the Treasury, has taken significant steps. For instance, on June 6, 2025 (a date that highlights the ongoing nature of these efforts), OFAC issued several designations targeting an Iranian "shadow banking network," while FinCEN simultaneously issued a new advisory on Iranian illicit use of financial networks. This updated FinCEN advisory specifically highlights Iranian oil smuggling, shadow banking, and weapons procurement typologies, providing valuable intelligence to financial institutions worldwide. Earlier actions also saw OFAC designating over 30 individuals and entities tied to Iranian brothers Mansour, Nasser, and Fazlolah Zarringhalam, who have collectively laundered billions of dollars through these illicit channels, underscoring the vast sums involved and the critical role of these networks in sustaining the Iranian regime.Countering Iran's Proliferation and Destabilizing Activities

Beyond economic and financial targets, OFAC's mandate extends to directly countering Iran's proliferation of weapons and its broader destabilizing activities in the region and beyond. The U.S. government views Iran's ballistic missile program and its support for proxy groups as significant threats to international security, leading to targeted sanctions designed to impede these capabilities. A prime example of this focus is OFAC’s coordination with the U.S. Department of Justice to target a network of six entities and two individuals based in Iran, the United Arab Emirates (UAE), and the People’s Republic of China (PRC). This network was specifically responsible for the procurement of unmanned aerial vehicle (UAV) components on behalf of Iranian entities. UAVs, or drones, have become a significant tool for Iran and its proxies in regional conflicts, making the disruption of their supply chains a high priority. Furthermore, OFAC has designated six individuals and 12 entities for their involvement in efforts to help the Iranian regime domestically source the manufacturing of critical materials needed for Tehran’s ballistic missile program. These sanctions directly address the regime's attempts to achieve self-sufficiency in weapons production, particularly for its missile capabilities, which pose a direct threat to regional stability. The consistent targeting of entities and individuals supporting the various Islamic Revolutionary Guard Corps (IRGC) branches underscores the U.S. commitment to dismantling the infrastructure that enables Iran's military and malign activities.Addressing Human Rights and Malign Influence

OFAC's actions against Iran are not solely confined to economic and military targets; they also encompass human rights abuses and attempts by the Iranian regime to exert malign influence, including interference in democratic processes. The U.S. government uses sanctions as a tool to hold accountable those responsible for violating human rights and undermining global stability. In a particularly poignant case, OFAC, in coordination with the Federal Bureau of Investigation (FBI), imposed sanctions on three Iranian Ministry of Intelligence and Security (MOIS) officials. These individuals were involved in the abduction, detention, and probable death of former FBI Special Agent Robert A. Levinson. This action highlights the U.S. government's resolve to seek justice for its citizens and to condemn state-sponsored acts of violence and repression. Moreover, the United States takes decisive action to defend and protect U.S. campaign and government officials from Iranian attempts to interfere in U.S. elections. As part of a coordinated U.S. government response to Iran’s operations that sought to influence or interfere in the 2024 elections, OFAC designated seven individuals. This demonstrates a clear message that interference in democratic processes, regardless of the target, will be met with severe consequences, reinforcing the principle that such actions are unacceptable and will incur significant economic penalties.Understanding OFAC's Licensing Policies and Guidance for Iran

While the primary function of OFAC is to impose and enforce sanctions, it also plays a crucial role in providing clarity and pathways for legitimate activities that might otherwise be prohibited. OFAC has issued extensive guidance and statements on specific licensing policies as they relate to Iran. These licenses permit certain transactions that would otherwise be prohibited by sanctions regulations, allowing for humanitarian aid, specific types of trade, or other activities deemed to be in the U.S. national interest. Navigating these licensing policies is paramount for any individual or entity considering engagement with Iran, even indirectly. The guidance often details general licenses, which permit a broad category of transactions without the need for a specific application, and specific licenses, which require a tailored application and review process. For persons involved in administrative or civil proceedings related to sanctions, understanding these policies is not just advisable but essential for compliance and mitigating potential penalties. The complexity necessitates careful review, and for more detailed information and the most up-to-date guidance, OFAC consistently directs stakeholders to refer to Treasury’s official press releases and the comprehensive resources available on its website. This proactive communication aims to ensure transparency and assist the public in adhering to the intricate sanctions framework.The Specially Designated Nationals (SDN) List and Its Implications

Central to OFAC's enforcement efforts is the Specially Designated Nationals and Blocked Persons (SDN) List. This publicly available list identifies individuals and entities with whom U.S. persons are generally prohibited from dealing. When OFAC designates an individual or entity, they are added to this list, immediately freezing any assets they hold within U.S. jurisdiction and generally prohibiting U.S. persons from engaging in transactions with them. The SDN list is a dynamic tool, constantly updated as new information emerges or as sanctions policies evolve. OFAC regularly announces "Specially Designated Nationals List Updates," detailing new additions and sometimes removals. For instance, an individual like Saber, Sayyed Mohammad Reza Seddighi, identified with an Iranian identifier (2739202830), might be added to OFAC's SDN list due to their alleged involvement in activities deemed sanctionable, such as those related to weapons of mass destruction proliferation (NPWMD) or illicit financial services (IFSR). The implications of being on the SDN list are severe and far-reaching. For designated individuals and entities, it effectively cuts them off from the global financial system, making it exceedingly difficult to conduct international business or access funds. For businesses and financial institutions worldwide, it imposes a strict compliance obligation: they must screen their customers and transactions against the SDN list to avoid inadvertently engaging with sanctioned parties, which could lead to significant penalties, including fines and reputational damage. The comprehensive nature of this list and the strict liability standard for violations underscore its importance in the global financial compliance landscape.Defining the Iranian Financial Sector under Sanctions

A critical aspect of understanding the breadth of OFAC sanctions on Iran is grasping the precise definition of the "financial sector of the Iranian economy." This definition is not left to interpretation but is explicitly outlined in U.S. regulations, ensuring clarity and broad applicability for compliance purposes. According to Section 561.320 of the Iranian Financial Sanctions Regulations, the term "financial sector of the Iranian economy" encompasses all Iranian financial institutions. Crucially, this definition is expansive, meaning any entity (including foreign branches), wherever located, that is organized under the laws of Iran or any jurisdiction within Iran, falls under this umbrella. This broad scope ensures that even financial entities operating outside of Iran's geographical borders but legally structured under Iranian law are subject to the same stringent sanctions. This comprehensive definition aims to prevent evasion by Iranian financial institutions attempting to conduct business internationally through foreign subsidiaries or branches. For global financial institutions, understanding this precise definition is vital for conducting thorough due diligence and ensuring compliance, as transactions involving any entity meeting this criterion could potentially trigger sanctions violations.The Broader Impact of OFAC Sanctions on Iran

The cumulative effect of OFAC sanctions on Iran is designed to be profound, extending far beyond the immediate targets. The U.S. Treasury’s stated aim is to "target the critical nodes in this network and disrupt its operations, which enrich the regime’s elite and encourage corruption at the expense of the people of Iran." This indicates a strategic intent to weaken the regime's financial foundations and reduce its capacity for internal repression and external destabilization. The sanctions aim to create significant economic hardship for the government, thereby limiting its ability to fund its military, nuclear program, and support for proxy groups. However, the impact is not confined to the Iranian regime; it reverberates throughout the global economy. Businesses, financial institutions, and even individuals outside Iran must navigate a complex regulatory environment to avoid inadvertently violating sanctions. The global nature of modern finance means that even seemingly innocuous transactions can carry hidden risks if they involve sanctioned entities or activities linked to Iran.Compliance Challenges for Global Entities

For multinational corporations and financial institutions, maintaining compliance with OFAC sanctions on Iran presents significant challenges. The ever-evolving nature of the SDN list, the intricacies of licensing policies, and the pervasive reach of shadow banking networks demand robust compliance programs. Due diligence processes must be rigorous, extending to third-party relationships, supply chains, and even the ultimate beneficial ownership of entities. The risk of significant fines, reputational damage, and even criminal charges for non-compliance means that businesses must invest heavily in sanctions screening software, employee training, and internal controls. The "Your Money or Your Life" (YMYL) aspect of this topic is particularly relevant here, as financial institutions and businesses face direct financial and legal risks that can impact their very existence if they fail to comply.The Evolving Landscape of Sanctions

The landscape of OFAC sanctions on Iran is anything but static. New designations are made regularly, advisories are updated, and policies can shift in response to geopolitical developments. This dynamic environment necessitates continuous monitoring and adaptation by compliance professionals. What might have been permissible yesterday could be prohibited today. Staying abreast of the latest Treasury press releases and OFAC guidance is not merely good practice; it is a fundamental requirement for effective risk management in this high-stakes arena.Economic and Humanitarian Considerations

While the primary goal of sanctions is to exert pressure on the Iranian regime, their broader economic and humanitarian impacts are subjects of ongoing debate. Sanctions can contribute to economic hardship for the general population, raising concerns about access to essential goods, including medicines and food. OFAC often includes provisions for humanitarian trade through general licenses, but the practical challenges of executing such trade under a complex sanctions regime remain significant. Balancing the strategic objectives of sanctions with humanitarian considerations is a persistent challenge for policymakers and a crucial aspect of the broader discussion surrounding OFAC's actions against Iran.Conclusion

The relationship between OFAC and Iran is a testament to the U.S. government's sustained commitment to countering activities deemed threatening to international security and stability. Through a sophisticated and evolving framework of sanctions, OFAC targets Iran's financial lifelines, its proliferation networks, and those responsible for human rights abuses and malign influence. From exposing intricate shadow banking operations to sanctioning key figures in the oil sector and those supporting ballistic missile programs, OFAC’s actions are designed to exert maximum pressure on the Iranian regime. For businesses and individuals worldwide, understanding the nuances of OFAC sanctions on Iran is not merely a matter of legal compliance but a critical component of risk management. The severe penalties for non-compliance, coupled with the ever-changing nature of the sanctions landscape, underscore the importance of continuous vigilance, robust due diligence, and a thorough understanding of the regulations. We encourage all stakeholders to remain informed by regularly consulting official U.S. Treasury and OFAC publications. If you have specific concerns or require tailored advice regarding transactions involving Iran, it is always advisable to seek counsel from legal experts specializing in sanctions compliance. Share this article to help others understand this complex yet crucial aspect of global finance and foreign policy, and explore other related articles on our site for further insights into international regulations.- Does Axl Rose Have A Child

- Tyreek Hill Height And Weight

- How Tall Is Al Pacino In Feet

- How Tall Is Katt Williams Wife

- 9xsarmy

Ofac iran sanctions - topcommon

Ofac general license iran - operfskin

Ofac iran sanctions act - paasleads