Iran's Economic Reality: Unpacking GDP PPP For Deeper Insight

Understanding a nation's true economic strength requires looking beyond simple figures. For Iran, delving into its Gross Domestic Product based on Purchasing Power Parity (GDP PPP) offers a far more nuanced and insightful perspective than nominal GDP alone. This critical economic indicator helps us grasp the real purchasing power within the country, providing a clearer picture of its economic landscape, the living standards of its population, and its standing on the global stage.

In a world where economic data can often be misleading due to fluctuating exchange rates and varying costs of living, GDP PPP acts as a vital equalizer. For those interested in international economics, potential investments, or simply understanding the daily lives of people in different countries, grasping the concept of GDP PPP, especially in a complex economy like Iran's, is absolutely essential. This article will meticulously explore Iran's GDP PPP, drawing on authoritative data to paint a comprehensive picture of its past, present, and potential future economic trajectory.

Table of Contents

- What is GDP PPP and Why It Matters?

- Iran's GDP PPP: The Macroeconomic View

- GDP Per Capita PPP: Measuring Individual Prosperity

- Nominal GDP vs. GDP PPP: Understanding the Distinction

- Factors Influencing Iran's GDP PPP

- The Future Outlook for Iran's Economy

- Implications for Investment and Global Standing

- Conclusion: A Holistic View of Iran's Economic Landscape

What is GDP PPP and Why It Matters?

To truly appreciate the economic fabric of a nation like Iran, it's crucial to first understand what Gross Domestic Product (GDP) based on Purchasing Power Parity (PPP) represents. At its core, GDP is the total monetary value of all finished goods and services produced within a country's borders in a specific time period. It's a fundamental measure of a nation's economic output. However, nominal GDP, which uses current market exchange rates, can be misleading because the cost of living and the purchasing power of money vary significantly from one country to another. This is where PPP comes into play.

Purchasing Power Parity (PPP) is a theoretical exchange rate that allows for the comparison of output and living standards between countries by adjusting for differences in local prices. Essentially, PPP asks: "How much would it cost to buy the same basket of goods and services in different countries?" By converting local currencies to "international dollars" using PPP rates, economists can make more accurate comparisons of economic size and individual wealth across borders. This means that when we discuss Iran's GDP PPP, we are looking at its economic output in terms of what that output can *actually buy* within Iran, rather than simply its value when converted at a volatile market exchange rate. This makes GDP PPP a more reliable indicator for assessing the real size of an economy and the welfare of its citizens, especially in countries where currency exchange rates might not fully reflect domestic purchasing power.

Iran's GDP PPP: The Macroeconomic View

When examining the overall economic output of Iran, the GDP PPP figure provides a robust measure of its national economy. According to the World Bank's collection of development indicators, compiled from officially recognized sources, Iran's GDP, PPP (current international $) was reported at a significant 1,600,138,342,500 USD in 2023. This substantial figure positions Iran as one of the larger economies globally when measured by purchasing power, a fact often overshadowed by its nominal GDP figures, which stood at 404.63 billion US dollars in 2023, according to official data from the World Bank. The stark difference between the nominal and PPP figures underscores the importance of using PPP for a more accurate understanding of the Iranian economy's true scale and capacity.

Historical data further illustrates this point. For instance, in 2008, Iran's GDP was estimated at $382.3 billion in nominal terms, but a much larger $842 billion when adjusted for PPP. This historical context highlights a consistent trend where Iran's economy, when viewed through the lens of purchasing power, appears considerably larger and more resilient than its nominal value might suggest. Such a significant disparity is a common characteristic of economies where domestic costs of goods and services are relatively lower compared to international benchmarks, allowing the local currency to stretch further within its borders. This also means that for international businesses or policymakers, understanding Iran's GDP PPP is crucial for evaluating market size and economic capacity.

Recent Trends in Iran's GDP PPP

Analyzing recent trends in Iran's GDP provides insight into its economic dynamism. While the provided data primarily focuses on nominal GDP growth for recent years, these figures indirectly influence the overall PPP valuation. Iran's nominal GDP for 2023 was 404.63 billion US dollars, marking a 2.6% increase from 2022. This followed a 2.85% increase in 2022 from 2021, and a substantial 46.25% increase in 2021 from 2020. However, it's vital to note the significant decline in 2020, where Iran's GDP was 262.19 billion US dollars, representing a 21.39% decline from 2019. This sharp drop in 2020 was likely influenced by a confluence of factors, including global economic slowdowns, domestic challenges, and ongoing international sanctions. The subsequent recovery and growth in 2021, 2022, and 2023, even if modest in some years, indicate a degree of resilience in the Iranian economy, which is further amplified when considering the purchasing power parity adjustments.

GDP Per Capita PPP: Measuring Individual Prosperity

While overall GDP PPP gives us a sense of the economy's size, GDP per capita, PPP, offers a more direct measure of the average standard of living and individual purchasing power within a country. This metric is calculated by dividing the total GDP PPP by the mid-year population. For Iran, this figure provides a crucial lens through which to understand the economic well-being of its citizens. The latest value for GDP per capita, PPP (current international $) in Iran, reported in 2023, was 17,660 USD, according to the World Bank. Another source from the World Bank indicates a GDP per capita PPP of 15,912.03 USD for 2023, which was an increase from 15,331 USD in the previous period. These figures demonstrate the average economic output and purchasing power available to each person in Iran, providing a more granular view of prosperity compared to the aggregate GDP PPP.

Iran's GDP Per Capita PPP vs. The World Average

To put Iran's GDP per capita PPP into perspective, it's useful to compare it against the global average. In 2023, the world average for GDP per capita, PPP, was 26,826 U.S. dollars, based on data from 183 countries. In comparison, Iran's GDP per capita, when adjusted by purchasing power parity, is equivalent to approximately 90 percent of the world's average, based on some interpretations of the data provided. More specifically, with a 2023 figure of 15,912 U.S. dollars, Iran's per capita PPP is roughly 59% of the world average. This indicates that while the purchasing power of an average Iranian is substantial when compared to many developing nations, it still lags behind the global mean. This gap highlights areas where economic development and wealth distribution could be further improved to elevate the living standards of the average citizen closer to global benchmarks.

A Historical Perspective on Iran's GDP Per Capita PPP

Tracing the historical trajectory of Iran's GDP per capita PPP reveals significant fluctuations and growth over time. The World Bank data shows that GDP per capita PPP in Iran averaged 12,745.84 USD from 1990 until 2023. It reached an all-time high of 15,912.03 USD in 2023, a testament to recent economic activities and adjustments. Conversely, the record low was 9,046.58 USD in 1990, marking the starting point of this specific data series. This historical average of 12,746 U.S. dollars from 1990 to 2023 provides a baseline against which current performance can be measured. The increase from the minimum value in 1990 to the maximum in 2023, despite various geopolitical and economic challenges over these decades, indicates a long-term upward trend in the average purchasing power of Iranians. This resilience and growth, even if sometimes uneven, are critical for understanding the underlying strength of the Iranian economy and its capacity to provide for its population over time.

In contrast to the PPP figures, Iran's nominal GDP per capita tells a different story, reflecting the impact of currency fluctuations and external pressures. For instance, Iran's nominal GDP per capita for 2020 was $2,989, representing a significant 21.99% decline from 2019. The gross domestic product per capita in Iran was last recorded at 5667.53 US dollars in 2023, which is equivalent to 45 percent of the world's average for nominal terms. Historically, nominal GDP per capita in Iran averaged 4435.95 USD from 1960 until 2023, reaching an all-time high of 7422.13 USD in 1976 and a record low of 2345.11 USD in 1960. This stark contrast between nominal and PPP per capita figures vividly illustrates why PPP is indispensable for a realistic assessment of living standards and economic well-being, as it filters out the noise of exchange rate volatility.

Nominal GDP vs. GDP PPP: Understanding the Distinction

The discussion around Iran's economic indicators frequently encounters two distinct measures: nominal GDP and GDP PPP. While both aim to quantify economic output, their methodologies and what they represent differ significantly, making it vital to understand their respective applications. Nominal GDP measures a country's economic output using current market prices and exchange rates. It reflects the raw monetary value of goods and services produced. For instance, Iran's nominal GDP was 404.63 billion US dollars in 2023. This figure is highly susceptible to currency fluctuations and inflation, meaning a sharp depreciation of the local currency can make a country's nominal GDP appear smaller on the international stage, even if the domestic production and purchasing power remain relatively stable.

In contrast, GDP PPP adjusts for these differences by converting local currencies to "international dollars" using purchasing power parity rates. This method accounts for the varying costs of goods and services across countries, providing a more accurate comparison of real economic size and living standards. As previously noted, Iran's GDP PPP was 1,600,138,342,500 USD in 2023, a figure significantly higher than its nominal counterpart. The substantial gap between Iran's nominal GDP and its GDP PPP highlights a key characteristic of its economy: while its official exchange rate might undervalue its currency in international markets, the domestic purchasing power within Iran is considerably higher. This distinction is crucial for investors, policymakers, and analysts seeking to understand the true scale of Iran's internal market and its capacity for production and consumption, rather than being misled by external currency valuations.

Factors Influencing Iran's GDP PPP

Several interconnected factors contribute to the dynamics of Iran's GDP PPP. One primary driver is its vast natural resources, particularly oil and gas, which form a significant portion of its economic output. Even with sanctions impacting oil exports and nominal revenue, the domestic utilization of these resources, often at subsidized rates, contributes to the internal purchasing power reflected in PPP figures. The structure of Iran's economy, with a large domestic market and significant state-owned enterprises, also plays a role. The relatively lower cost of non-tradable goods and services (like housing, local transportation, and many services) compared to international prices significantly boosts the PPP valuation, as these items are cheaper to acquire locally than in many Western economies.

Moreover, the impact of international sanctions, while severely affecting Iran's nominal GDP and its ability to engage with the global financial system, paradoxically reinforces the importance of PPP. Sanctions often lead to a depreciation of the official currency, making nominal GDP appear smaller. However, the domestic economy adapts, and the internal purchasing power, while perhaps strained, does not collapse proportionally. This resilience is partly due to a diversified non-oil sector, including agriculture, manufacturing, and services, which continue to produce goods and services for the local market. Government policies, including subsidies and price controls on essential goods, also influence the domestic cost of living, thereby impacting the PPP calculations. These internal economic mechanisms ensure that the real economic activity and the purchasing power of Iranians are better captured by GDP PPP than by nominal figures alone.

The Future Outlook for Iran's Economy

Forecasting the economic trajectory of Iran, particularly in terms of GDP PPP, involves considering various internal and external factors. The International Monetary Fund (IMF) regularly provides estimates for the largest economies in the world by GDP (PPP), including projections for 2025. While specific numerical forecasts for Iran's GDP PPP in 2025 are not explicitly detailed in the provided data beyond its inclusion in a list of countries by forecast estimated GDP (PPP), the very act of its inclusion among top economies underscores its significant economic weight on the global stage. Historically, there have been projections of substantial growth; for instance, in 2010, the nominal GDP was projected to double in the next five years, though such projections are subject to numerous variables and can often be revised.

The future of Iran's GDP PPP will largely depend on the interplay of several critical elements. Domestically, factors such as government economic reforms, infrastructure development, and the growth of non-oil sectors will be crucial. Externally, the evolution of international relations, particularly regarding sanctions, will play a paramount role. A significant easing or lifting of sanctions could unlock considerable economic potential, leading to increased foreign investment, technological transfer, and greater integration into the global economy, which would likely boost both nominal and PPP GDP. Conversely, continued or intensified sanctions would necessitate further reliance on domestic capabilities and resilience, maintaining the emphasis on internal purchasing power as reflected in GDP PPP.

Interpreting Economic Forecasts

When reviewing economic forecasts, particularly for complex economies like Iran, it's essential to understand their inherent limitations and the assumptions upon which they are built. Forecasts, whether from the IMF or other reputable institutions, are not guarantees but rather informed predictions based on current trends, policy assumptions, and anticipated global conditions. They provide a valuable framework for understanding potential future scenarios but are subject to revision as circumstances evolve. For Iran, geopolitical developments, oil price volatility, and domestic policy shifts can significantly alter any projection. Therefore, while IMF estimates for 2025 provide a snapshot of expected economic standing, they should be viewed as a guide rather than a definitive outcome, encouraging continuous monitoring of the dynamic economic landscape.

Implications for Investment and Global Standing

The robust figures for Iran's GDP PPP carry significant implications for both potential investors and its global economic standing. For investors, particularly those eyeing consumer markets or seeking to establish local production, the high GDP PPP indicates a substantial domestic market with considerable purchasing power. Despite nominal GDP figures that might deter some, the PPP metric reveals that the average Iranian, and by extension the collective Iranian market, has a much greater capacity to consume goods and services than a simple exchange rate conversion would suggest. This makes Iran an attractive, albeit challenging, market for businesses willing to navigate its unique operating environment. The household final consumption expenditure, for instance, was 544,405.95 international dollars million in 2016 yearly, illustrating the scale of domestic demand.

Globally, Iran's position among the largest economies by GDP (PPP) in 2025, as estimated by the IMF, reinforces its importance as a significant economic player. This standing suggests that despite external pressures, the underlying economic engine of Iran remains powerful. For international bodies and policymakers, recognizing Iran's true economic size through GDP PPP is crucial for effective engagement, whether in trade negotiations, regional development initiatives, or geopolitical considerations. It underscores that Iran is not a small, isolated economy, but one with substantial internal capabilities and a large consumer base, making it a country whose economic health and trajectory have broader regional and even global implications. Understanding Iran's GDP PPP is thus not just an academic exercise but a practical necessity for informed decision-making in the realms of finance, trade, and international relations.

Conclusion: A Holistic View of Iran's Economic Landscape

In conclusion, a deep dive into Iran's GDP PPP reveals an economic landscape far more complex and robust than often perceived through nominal figures alone. We've explored how Gross Domestic Product based on Purchasing Power Parity provides a truer measure of economic size and individual prosperity by accounting for local costs of living. Data from sources like the World Bank and IMF consistently show Iran as a significant economy when adjusted for purchasing power, with its overall GDP PPP reaching over 1.6 trillion international dollars in 2023, and its GDP per capita PPP reflecting a substantial average purchasing power, even if below the global mean.

The distinction between nominal GDP and GDP PPP is particularly pronounced for Iran, highlighting the resilience of its domestic economy despite external challenges. Historical trends indicate a long-term growth in the average Iranian's purchasing power, underscoring the country's capacity to provide for its population. For anyone seeking to understand Iran's economic health, its market potential, or its standing on the world stage, focusing on GDP PPP is indispensable. It offers a more accurate, human-centric view of economic reality, moving beyond mere currency conversions to reveal the actual purchasing power within the nation.

What are your thoughts on the significance of GDP PPP for understanding economies like Iran's? Share your insights in the comments below, or explore other articles on our site for more in-depth economic analyses. Your engagement helps us foster a deeper understanding of global economic dynamics.

- Images Of Joe Rogans Wife

- Rob Van Winkle

- Paris Jackson Mother Debbie Rowe

- Downloadhubcontect

- Jesse Metcalfe Children

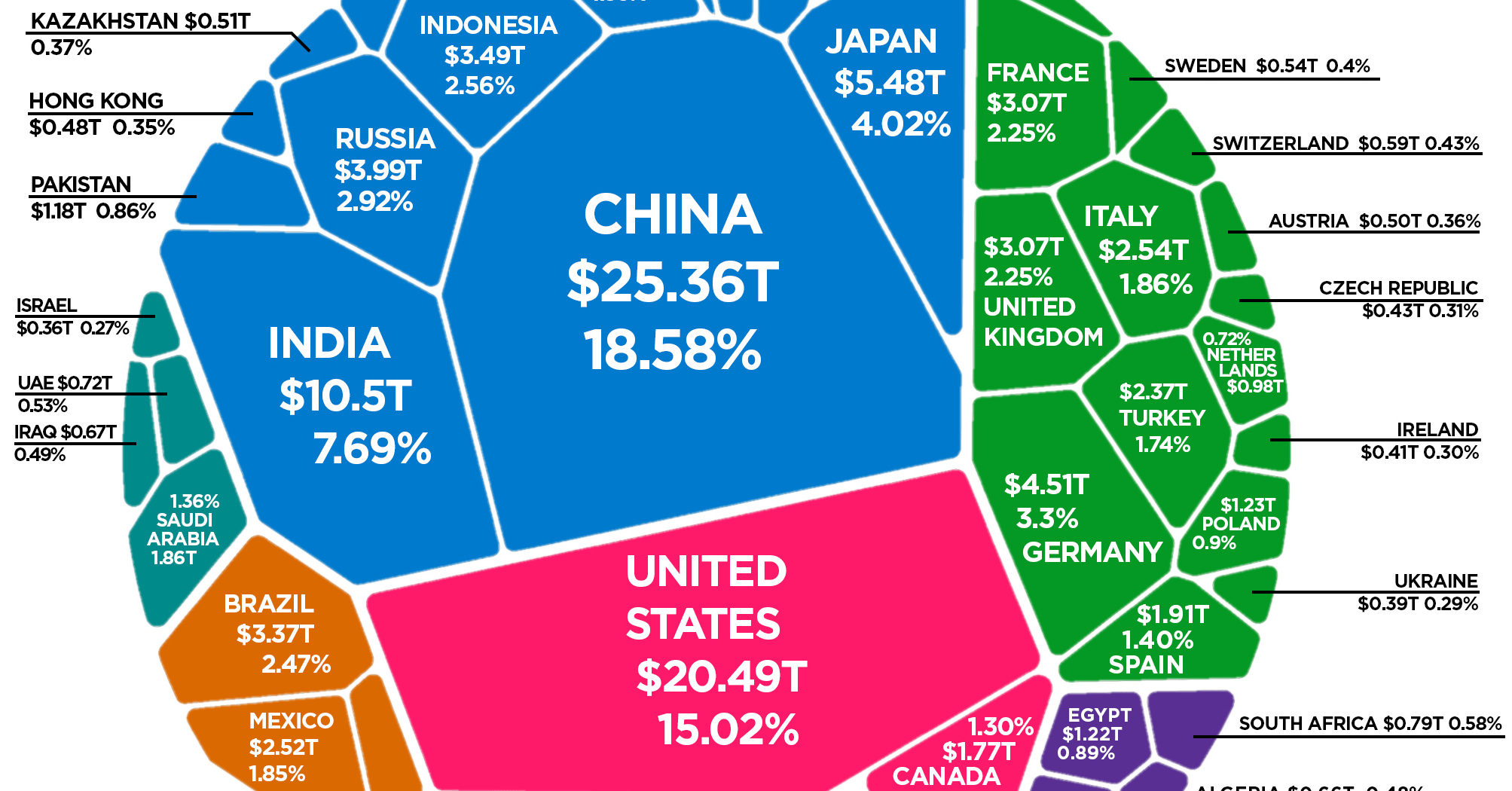

The Composition of the World Economy by GDP (PPP)

/gdp-increase-636251500-c69345ee97ba4db99375723519a2c1bd.jpg)

Real Gross Domestic Product (Real GDP) Definition

The World Economy in One Chart: GDP by Country