Iran Vs. Saudi Arabia: Unpacking Their Economic Powerhouses

The Economic Giants of the Middle East: A First Look

When we talk about the economic powerhouses of the Middle East, Saudi Arabia and Iran invariably come to mind. Both nations command significant influence, not just regionally but globally, largely due to their immense hydrocarbon reserves. However, a closer look at their economic structures and output reveals distinct differences in their current standing and future aspirations. The comparison of **GDP Iran vs Saudi Arabia** offers a compelling narrative of two nations with shared resources but divergent paths. At a glance, the raw numbers paint a clear picture of Saudi Arabia's larger economic footprint. While both are major oil producers, their economic policies, geopolitical environments, and internal structures have led to different outcomes in terms of national wealth and global economic integration. Understanding these foundational figures is the first step in appreciating the complex economic tapestry of these two influential countries.Unpacking the Numbers: GDP and Global Standing

Let's dive directly into the core figures that define the economic scale of these two nations. According to available data, Saudi Arabia, with a GDP of approximately **$786.5 billion**, ranks as the 18th largest economy in the world. This impressive figure underscores its significant role in the global economy, driven predominantly by its vast oil wealth and strategic investments. Its annual GDP at market prices reflects the total value of all goods and services produced within its borders, valued at current market prices, without deducting for depreciation or taxes. In contrast, Iran's economy, while substantial, stands at a different scale. Iran ranked 29th globally with a GDP of approximately **$454 billion**. While still a formidable economy, especially considering the various external pressures it faces, this places it considerably behind Saudi Arabia in terms of overall economic output. The sheer difference in these headline figures, a gap of over $330 billion, highlights the disparity in their current economic magnitudes. This initial comparison sets the stage for a deeper exploration of the factors contributing to the differing economic strengths in the **GDP Iran vs Saudi Arabia** narrative.Beyond the Total: GDP Per Capita Insights

While total GDP provides a snapshot of a nation's overall economic size, GDP per capita offers a more intimate look at the average economic prosperity of its citizens. This metric divides the total economic output by the population, giving a clearer indication of living standards and individual wealth. Here, the contrast between Saudi Arabia and Iran becomes even more pronounced, revealing significant implications for their respective populations. Saudi Arabia boasts a significantly higher GDP per capita, standing at **$56,817.00**. This figure is remarkably higher than Iran's, which is recorded at **$18,504.00**. The difference is a staggering $38,313.00, meaning the average Saudi national enjoys a considerably higher level of economic output per person compared to their Iranian counterpart. This disparity in GDP per capita is crucial. It suggests that despite Iran's substantial overall GDP, the wealth is distributed among a larger population, or the economic output per individual is simply lower due to various structural and policy challenges. For the average citizen, a higher GDP per capita often translates to better access to goods, services, healthcare, and education, painting a vivid picture of the differing economic realities in the **GDP Iran vs Saudi Arabia** comparison.The Oil Lifeline: Saudi Arabia's Economic Backbone

Saudi Arabia's economic narrative is inextricably linked to its vast petroleum reserves. The oil sector is not just a part of its economy; it is its very foundation. Data indicates that the petroleum sector accounts for roughly **80% of budget revenues, 45% of GDP, and a staggering 90% of export earnings**. This overwhelming reliance on oil has historically provided immense wealth and stability, enabling the kingdom to fund ambitious development projects and maintain a robust welfare state. However, this dependence also exposes Saudi Arabia to the volatility of global oil prices, making economic diversification a strategic imperative. The sheer scale of its oil production and exports grants Saudi Arabia immense leverage in global energy markets and geopolitical affairs. Its ability to influence oil supply and prices has profound effects on the world economy. Yet, this very strength also presents its greatest challenge: how to transition from a rentier state, heavily reliant on a single commodity, to a more diversified, sustainable economy that can thrive in a post-oil world.Vision 2030: A Push for Diversification

Recognizing the inherent risks of over-reliance on oil, Saudi Arabia embarked on an ambitious transformation plan known as Vision 2030. This comprehensive framework aims to reduce the kingdom's dependence on oil, diversify its economy, and develop public service sectors such as health, education, infrastructure, recreation, and tourism. A key component of this vision is encouraging the growth of the private sector in order to create new industries, generate employment opportunities for Saudi nationals, and attract foreign investment. As part of its effort to attract foreign investment and integrate more deeply into the global economy, Saudi Arabia acceded to the World Trade Organization (WTO) in 2005. This step signaled its commitment to international trade rules and practices, fostering a more predictable and open business environment. Vision 2030 is not merely an economic plan; it is a societal transformation, aiming to create a vibrant society, a thriving economy, and an ambitious nation. The success of this vision will undoubtedly shape the future of Saudi Arabia's economic standing and its long-term position in the global **GDP Iran vs Saudi Arabia** dynamic.Iran's Economic Landscape: Challenges and Resilience

Iran's economy, much like Saudi Arabia's, is heavily influenced by its vast oil and gas reserves. However, its economic journey has been marked by a different set of challenges, primarily stemming from statist policies, inefficiencies, and, crucially, prolonged international sanctions. While reliance on oil and gas exports remains a significant factor, Iran's economy is notably more diversified than often perceived. It possesses significant agricultural, industrial, and service sectors that contribute substantially to its overall GDP, even under duress. The agricultural sector, for instance, plays a vital role in food security and employment, while its industrial base includes automotive manufacturing, petrochemicals, and mining. The service sector, encompassing everything from finance to tourism, also contributes significantly. This inherent diversification provides a degree of resilience, allowing the economy to absorb some of the shocks from external pressures that a purely oil-dependent economy might struggle with. Yet, the full potential of these sectors is often hampered by internal structural issues and external constraints.Navigating Sanctions and Internal Policies

The defining characteristic of Iran's modern economic history is its struggle with international sanctions. These punitive measures, imposed primarily by the United States and its allies over its nuclear program and regional activities, have severely restricted Iran's ability to export oil, access international financial markets, and attract foreign investment. This has led to significant economic contraction, currency depreciation, and high inflation, directly impacting the nation's GDP and the living standards of its citizens. Beyond sanctions, Iran's economy is marked by statist policies, where the government plays a dominant role in various sectors, leading to inefficiencies and a less dynamic private sector. While there have been attempts at economic reforms and privatization, the entrenched bureaucratic structures and the influence of various state-affiliated entities often impede genuine market liberalization. These internal and external pressures collectively contribute to the lower GDP per capita and the slower economic growth rate when compared in the **GDP Iran vs Saudi Arabia** context, despite its inherent economic potential and diverse sectors.Geographic Footprint and Population Dynamics

Beyond economic figures, the physical size and population of a country significantly influence its economic potential, resource distribution, and development challenges. When comparing Iran and Saudi Arabia, interesting contrasts emerge in their geographic footprint and demographic profiles, which in turn affect their respective economies. Saudi Arabia is a significantly larger country in terms of land area, with an expanse of approximately **2.15 million square kilometers**. This vast territory, much of it desert, includes immense oil fields and strategic coastlines. Iran, on the other hand, has an area of roughly **1.648 million square kilometers**. While smaller than Saudi Arabia, Iran's geography is more varied, encompassing mountains, plains, and coastal areas, supporting a more diverse range of agricultural and industrial activities. Despite Saudi Arabia being larger in area, it is not as heavily populated as Iran. This is a crucial demographic difference. Iran has a considerably larger population, which means that its economic output, while substantial in total GDP, is distributed among more people, contributing to its lower GDP per capita. A larger population can provide a bigger workforce and domestic market, but it also places greater demands on resources, infrastructure, and job creation. Saudi Arabia, with its smaller population relative to its land size and vast oil wealth, has historically been able to provide a higher standard of living and social services per capita. These demographic and geographic realities are fundamental to understanding the differing economic capacities and challenges faced by both nations in the broader **GDP Iran vs Saudi Arabia** comparison.Geopolitical Undercurrents: Shaping Economic Realities

The economic rivalry between Saudi Arabia and Iran cannot be fully understood without acknowledging their deep-seated geopolitical tensions. Saudi Arabia and Iran have historically been regional rivals, divided by sectarian, political, and geopolitical differences. This rivalry has played out across the Middle East, influencing conflicts, alliances, and, crucially, their economic development and international relations. These geopolitical undercurrents directly impact their economic strategies. For Saudi Arabia, its alliances with Western powers and its role as a stable oil supplier have facilitated foreign investment and integration into the global financial system. Its efforts to diversify its economy through Vision 2030 are also, in part, a response to the need for greater economic resilience in a volatile region. For Iran, its revolutionary ideology and foreign policy stances have often led to isolation and sanctions, forcing it to develop a more self-reliant, albeit less efficient, economy. The political systems further exacerbate these differences: Iran being an Islamic Republic with the Supreme Leader holding the highest authority and the President serving as the head of government, while Saudi Arabia is an absolute monarchy. These contrasting governance models influence everything from economic policy-making to the openness of their markets.Contrasting Governance Models and Their Economic Impact

The forms of government in Iran and Saudi Arabia are fundamentally different, and these differences have profound implications for their economic structures and policies. Iran operates as an Islamic Republic, a unique system where the Supreme Leader holds the highest authority, wielding significant power over all state affairs, including economic policy. The President serves as the head of government, but ultimate decisions often rest with the Supreme Leader and the clerical establishment. This centralized, often ideologically driven, decision-making process can lead to statist economic policies, a significant role for state-affiliated enterprises, and a cautious approach to foreign investment, especially from Western nations. The emphasis on self-sufficiency, partly driven by external pressures, has shaped an economy that, while diverse, struggles with inefficiencies and a lack of transparency. In contrast, Saudi Arabia is an absolute monarchy, where the King holds supreme power. While decisions are often made through consultation within the royal family, the top-down structure allows for swift and decisive policy implementation, particularly evident in the ambitious Vision 2030 reforms. This system has historically favored close ties with international businesses and governments, facilitating large-scale foreign investments and technology transfers. The stability offered by the monarchy, coupled with its vast oil wealth, has allowed it to pursue market-oriented reforms and actively seek global economic integration. The distinct political frameworks thus play a crucial role in shaping the economic trajectories and international standing of both nations in the ongoing **GDP Iran vs Saudi Arabia** narrative.The Hypothetical: Could Saudi Arabia Support Iran?

While Saudi Arabia and Iran have historically been regional rivals, divided by sectarian, political, and geopolitical differences, the idea of one supporting the other, even hypothetically, raises interesting questions about future regional dynamics. The statement "If Saudi Arabia chooses to support Iran, it could do so in several strategic ways" suggests a potential shift in their relationship, perhaps towards de-escalation or even cooperation. Economically, such support could manifest in various forms: * **Investment:** Saudi Arabian investment in Iranian infrastructure or industries, particularly in non-oil sectors, could provide a much-needed boost to Iran's economy, which has suffered from a lack of foreign capital. * **Trade Facilitation:** Easing trade barriers or facilitating regional trade routes could benefit both economies, leveraging their geographic proximity and complementary resources. * **Energy Cooperation:** Despite being competitors, collaboration on energy projects, perhaps in gas exploration or renewable energy, could create new avenues for mutual benefit. * **Political De-escalation:** A reduction in regional tensions, fostered by Saudi support or engagement, would undoubtedly improve Iran's economic outlook by potentially easing sanctions and encouraging international business engagement. However, such a scenario would require a fundamental shift in geopolitical alignments and a resolution of deep-seated mistrust. While currently a hypothetical, the economic benefits of regional stability and cooperation are undeniable, offering a glimpse into a potential, albeit challenging, future for the **GDP Iran vs Saudi Arabia** dynamic.The Road Ahead: Future Economic Trajectories

The economic trajectories of Iran and Saudi Arabia are poised for significant evolution, driven by both internal reforms and external geopolitical forces. For Saudi Arabia, the path forward is clearly defined by Vision 2030. Its success hinges on its ability to genuinely diversify away from oil, develop a robust private sector, and attract sustainable foreign investment beyond the energy sector. The challenge lies in creating millions of jobs for its young population and fostering an innovation-driven economy that can compete globally. If successful, Saudi Arabia could solidify its position as a diversified economic powerhouse in the region, less susceptible to oil price fluctuations and more integrated into the global economy. Iran, on the other hand, faces a more uncertain, yet potentially transformative, future. Its economic fate is heavily tied to the resolution of international sanctions and its ability to attract significant foreign investment and technology. While its diverse non-oil sectors offer a strong foundation, unlocking their full potential requires addressing internal inefficiencies, fostering a more transparent business environment, and navigating complex political dynamics. A lifting of sanctions could unleash a wave of economic growth, allowing Iran to fully leverage its human capital and natural resources. However, continued isolation would likely perpetuate its economic struggles, making the **GDP Iran vs Saudi Arabia** gap even wider. Both nations stand at critical junctures. Saudi Arabia is actively shaping its future through ambitious reforms, while Iran's future largely depends on external policy shifts and internal willingness to adapt. The economic performance of these two regional giants will not only determine their domestic prosperity but also profoundly influence the stability and development of the broader Middle East. ---Conclusion

In conclusion, the comparison of **GDP Iran vs Saudi Arabia** reveals two distinct economic narratives, each shaped by unique strengths, challenges, and geopolitical realities. Saudi Arabia, with its larger GDP and significantly higher GDP per capita, stands as the economic giant, fueled by vast oil reserves and propelled by ambitious diversification plans like Vision 2030. Its integration into the global economy and efforts to foster a vibrant private sector are key to its future resilience. Iran, while possessing a substantial and more diversified economy beyond oil, faces persistent headwinds from international sanctions and structural inefficiencies. Its lower GDP per capita reflects the impact of these pressures on the average citizen. Despite historical rivalries and contrasting political systems, the economic future of both nations remains intertwined with global energy markets and regional stability. Understanding these economic landscapes is crucial for anyone interested in the Middle East's future. What are your thoughts on the economic paths of these two nations? Do you believe Saudi Arabia's diversification efforts will fully succeed, or will Iran overcome its economic hurdles? Share your insights in the comments below, and explore more of our articles on global economic trends to deepen your understanding of these complex dynamics.

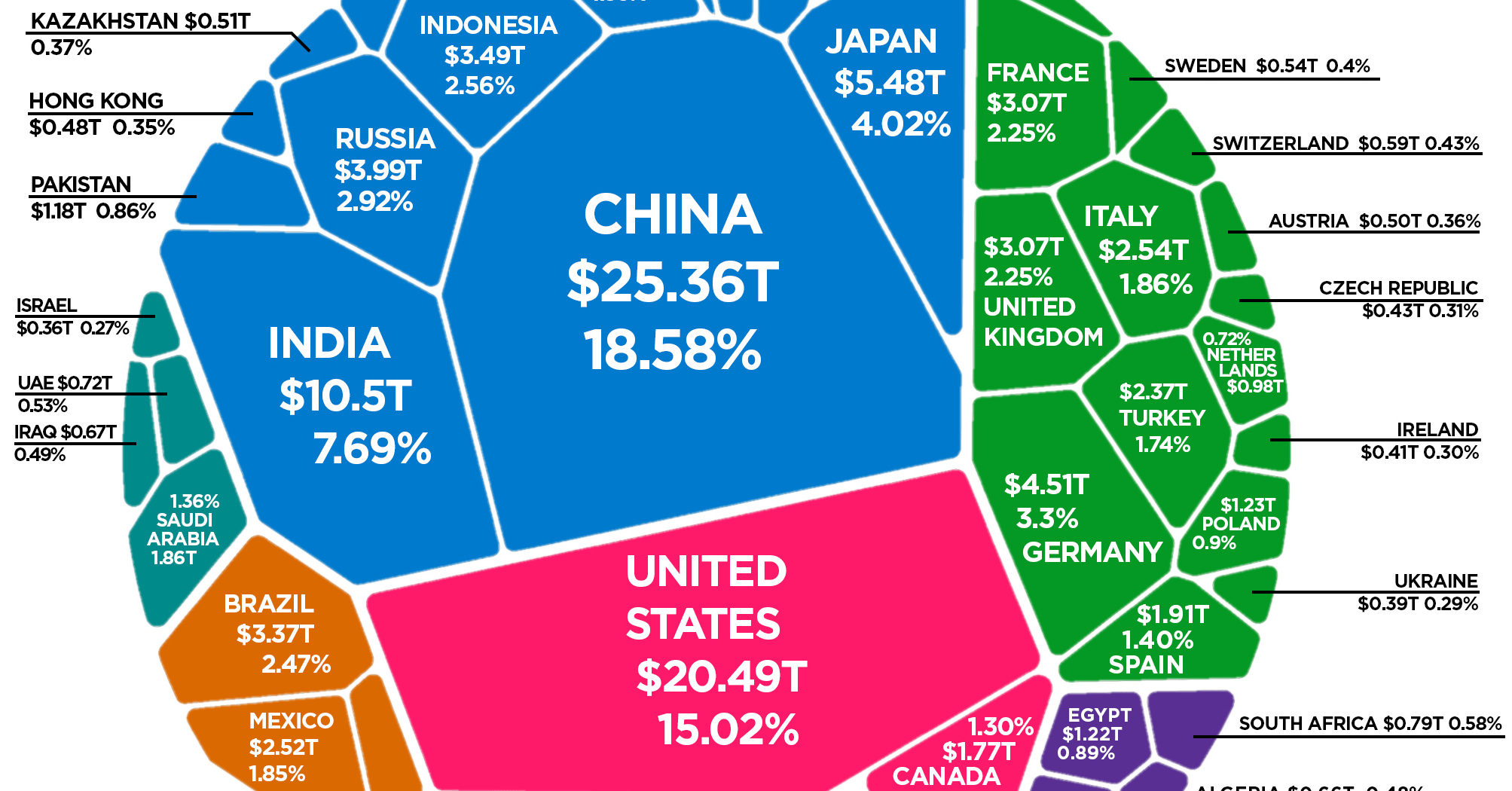

The Composition of the World Economy by GDP (PPP)

/gdp-increase-636251500-c69345ee97ba4db99375723519a2c1bd.jpg)

Real Gross Domestic Product (Real GDP) Definition

The World Economy in One Chart: GDP by Country