Unpacking Iran's GDP In 2017: A Year Of Significant Growth

The year 2017 stands out as a particularly intriguing period for Iran's economy, marked by significant shifts and notable growth in its Gross Domestic Product (GDP). Understanding the nuances of GDP Iran 2017 provides crucial insights into the nation's economic resilience and the complex interplay of internal policies and external pressures. This article delves deep into the economic landscape of Iran during that pivotal year, examining the figures, the factors at play, and the broader context that shaped its financial trajectory.

For many, economic data can seem abstract, but GDP figures are powerful indicators of a nation's health and potential. In 2017, Iran presented a fascinating case study, showcasing a period of robust expansion that contrasted sharply with challenges faced in subsequent years. By dissecting the GDP Iran 2017 data, we can gain a clearer picture of the opportunities and vulnerabilities inherent in its economic structure.

Table of Contents

- Understanding GDP: The Economic Barometer

- Iran's Economic Snapshot: A Robust 2017

- The Growth Trajectory: From 2016 to 2017

- Factors Influencing Iran GDP in 2017

- Beyond 2017: A Glimpse into Iran's Economic Evolution

- Underlying Challenges and Economic Resilience

- Iran as a Transition Economy and Global Competitiveness

- Conclusion: The Legacy of 2017

Understanding GDP: The Economic Barometer

Before diving into the specifics of GDP Iran 2017, it's essential to grasp what Gross Domestic Product truly represents. GDP is a fundamental measure of the economic activity within a country. As defined, "GDP at purchaser's prices is the sum of gross value added by all resident producers in the economy plus any product taxes and minus any subsidies not included in the value of the products." Essentially, it's the total monetary value of all finished goods and services produced within a country's borders in a specific time period. It acts as a comprehensive scorecard for a nation's economic health, reflecting its productivity, consumption, and investment. Understanding this definition is key to appreciating the figures we will discuss for Iran in 2017 and beyond. It's a metric calculated without making adjustments for the depreciation of fabricated assets or the depletion and degradation of natural resources, providing a snapshot of current economic output.Iran's Economic Snapshot: A Robust 2017

The year 2017 marked a period of notable economic expansion for Iran, especially when viewed in the context of its often-turbulent economic history. The data for GDP Iran 2017 paints a picture of a nation experiencing significant growth, a rebound from earlier challenges, and a moment of relative economic optimism. This period was largely influenced by the post-Joint Comprehensive Plan of Action (JCPOA) environment, which had brought some relief from international sanctions, allowing for increased oil exports and foreign investment, albeit temporarily.Absolute GDP and Global Standing

In 2017, Iran's economic output was substantial. The gdp figure in 2017 was €431,096 million, which translates to approximately $486,829 million (USD). This impressive figure positioned Iran as number 26 in the ranking of GDP among the 196 countries for which data is published. This ranking underscores Iran's significant economic weight on the global stage, despite the various headwinds it has historically faced. To put this into perspective, its absolute GDP placed it among the top quartile of global economies, reflecting a considerable productive capacity and resource base. The sheer volume of its economic activity in 2017 was a testament to its potential when external constraints were somewhat eased.GDP Per Capita: What It Means for Iran

While the absolute GDP provides a macro view, GDP per capita offers a more granular understanding of the average economic well-being of a nation's citizens. In 2017, the gdp per capita of Iran was €5,318, or $6,005 (USD). This figure represents the total economic output divided by the population, giving an indication of the average income per person if the GDP were evenly distributed. It's a crucial metric for assessing living standards and economic development. This per capita figure was €139 ($274) higher than in 2016, when it stood at €5,179 ($5,731). The increase in GDP per capita signifies an improvement in the average economic prosperity of Iranians during that year, suggesting that the overall economic growth was translating, at least in part, into better conditions for individuals. This rise, though modest, was a positive sign for the general populace, indicating a period where the economic pie was not only growing but also, on average, providing a larger slice for each citizen.The Growth Trajectory: From 2016 to 2017

The transition from 2016 to 2017 was particularly dynamic for Iran's economy, showcasing a remarkable acceleration in growth. The absolute value of gdp in Iran rose €17,177 million ($28,787 million) with respect to 2016. This substantial increase highlights a period of strong recovery and expansion. More specifically, the gdp of Iran leapt by 8.36% from 418,976,679,729 US dollars in 2016 to 454,012,768,724 US dollars in 2017. This robust growth rate was a significant achievement, especially considering the economic volatility Iran has often experienced. The data further emphasizes this positive momentum: "Since the 11.19% drop in 2015, gdp rocketed by 17.66% in 2017." This statement is critical. It indicates that the 2017 growth was not merely incremental but a powerful surge that effectively reversed a previous downturn. The 17.66% "rocket" in GDP signifies a strong rebound, likely fueled by the partial lifting of international sanctions following the nuclear deal. This allowed Iran to significantly increase its oil exports and reintegrate, to some extent, into the global financial system, providing a much-needed boost to its economy. The growth data reported at 13.396% for 2017 further solidifies this narrative of strong economic performance. This period represents a peak in recent economic history for Iran, demonstrating the potential for rapid recovery when external pressures are alleviated.Factors Influencing Iran GDP in 2017

The impressive performance of GDP Iran 2017 was not a random occurrence but the result of a confluence of factors, both internal and external. The most significant external factor was undoubtedly the partial easing of international sanctions following the implementation of the Joint Comprehensive Plan of Action (JCPOA) in January 2016. This agreement opened doors for Iran to increase its oil production and exports, which are vital to its economy. The data mentions that "gdp in 2017/18, as iran’s oil production initially slowed in 2018," implying that in 2017, oil production was still a strong driver of growth before a slowdown began in the subsequent year. The ability to sell more oil on the international market directly boosted government revenues and foreign exchange reserves, stimulating various sectors of the economy. Internally, the government's economic policies, aimed at attracting investment and fostering domestic production, also played a role. While the economy still grappled with issues like "mismanagement and corruption," the period of sanctions relief provided a window of opportunity for some economic revitalization. The increased flow of capital and goods, coupled with a more stable international trade environment, contributed to the overall rise in gross value added by resident producers across the economy, which is the core component of GDP at purchaser's prices. The renewed access to global markets and financial institutions, even if partial, injected a sense of optimism and facilitated transactions that were previously impossible, leading to the substantial growth observed in 2017. This period served as a crucial demonstration of how external policy shifts can profoundly impact Iran's economic trajectory.Beyond 2017: A Glimpse into Iran's Economic Evolution

While 2017 was a year of significant growth for Iran, it's crucial to place this performance within a broader historical and future context. The economic narrative of Iran is one of volatility, heavily influenced by geopolitical dynamics, particularly the imposition and lifting of international sanctions. The data provided offers glimpses into the years immediately following 2017, painting a picture of an economy grappling with renewed pressures and attempting to find new pathways to growth. Understanding these subsequent years helps to underscore the unique nature of the 2017 surge and the challenges that followed.Economic Volatility and the Impact of Sanctions

The positive momentum seen in GDP Iran 2017 did not sustain itself uniformly in the years that followed. The growth data for 2018, for instance, was reported at 4.300%, a noticeable decrease from the 13.396% recorded for 2017. This slowdown was largely attributable to the re-imposition of U.S. sanctions in 2018, which severely curtailed Iran's oil exports and access to the global financial system. The impact of these renewed sanctions became even more pronounced in 2020, with "Iran gdp for 2020 was 262.19 billion US dollars, a 21.39% decline from 2019." This sharp contraction highlights the severe vulnerability of Iran's economy to external pressures, particularly those targeting its vital oil sector. However, the data also indicates a degree of resilience and adaptation. "Iran gdp for 2021 was 383.44 billion US dollars, a 46.25% increase from 2020." This significant rebound in 2021, despite ongoing sanctions, suggests that Iran's economy found ways to mitigate some of the adverse effects, possibly through increased non-oil exports, domestic production, or alternative trade routes. Looking further ahead, the nominal (current) gross domestic product (GDP) of Iran is projected at $404,626,000,000 (USD) as of 2023, and the real GDP (constant, inflation adjusted) reached $513,527,000,000 in 2023. The GDP growth rate in 2023 was 5.04%, representing a change of $24,662,000,000 over 2022, when real GDP was $488,865,000,000. These figures, provided by the International Monetary Fund (IMF), suggest a continued, albeit fluctuating, recovery path, demonstrating that while sanctions cause significant pain, they do not necessarily halt all economic activity. The economic journey post-2017 is a testament to the ongoing struggle between external pressure and internal resilience.Real vs. Nominal GDP and Purchasing Power Parity

When analyzing GDP figures, it's important to distinguish between nominal (current) GDP and real (constant, inflation-adjusted) GDP. Nominal GDP reflects the current market prices, while real GDP adjusts for inflation, providing a more accurate picture of actual economic output growth. The data provides both, with the nominal GDP for Iran from the IMF's International Financial Statistics (IFS) release, and the real GDP figures for 2023. This distinction is crucial for understanding genuine economic expansion versus growth driven purely by price increases. Furthermore, the concept of Purchasing Power Parity (PPP) offers another lens through which to view Iran's economic size. "The latest value for gdp, ppp (constant 2011 international $) in Iran was 1,062,040,000,000 as of 2020." PPP GDP converts a country's GDP to international dollars using purchasing power parity rates, which account for differences in the cost of living and goods between countries. This often results in a higher figure for developing economies compared to their nominal GDP, as goods and services tend to be cheaper domestically. The data notes that "Over the past 30 years, the value for this indicator has fluctuated between 1,172,670,000,000 in 2017 and 486,487,000,000 in 1990." This shows that in PPP terms, Iran's economy in 2017 was at its peak in the last three decades, highlighting its significant economic scale when the cost of living is factored in. The PPP figures underscore Iran's substantial domestic economic activity and its true purchasing power, which is often underestimated when only nominal exchange rates are considered.Underlying Challenges and Economic Resilience

Despite the impressive GDP Iran 2017 figures, the Iranian economy has long been characterized by deep-seated structural issues. The data explicitly states that "Years of sanctions, mismanagement and corruption have left Iran’s economy brittle and deeply unprepared for a prolonged conflict." This brittleness manifests in various ways, including "shrinking growth, crumbling infrastructure and mass brain" drain. The brain drain, or the emigration of highly skilled and educated individuals, represents a significant loss of human capital, which is detrimental to long-term economic development and innovation. The impact of sanctions, while easing temporarily in 2017, has historically forced Iran to develop a more resilient, albeit less efficient, domestic economy. This has led to the growth of various non-oil sectors and an emphasis on self-sufficiency. The rebound in 2021, despite ongoing sanctions, is a testament to this underlying resilience and the ability of the economy to adapt, even under immense pressure. However, persistent issues like mismanagement and corruption continue to hinder its full potential, diverting resources and discouraging both domestic and foreign investment. These internal challenges, combined with the external pressure of sanctions, create a complex and often unpredictable economic environment. The journey of Iran's economy is a continuous balancing act between leveraging its vast natural resources and human capital, and navigating the intricate web of geopolitical tensions and internal inefficiencies.Iran as a Transition Economy and Global Competitiveness

The International Monetary Fund (IMF) classifies Iran as a "transition economy," meaning it is "changing from a planned to a market economy." This classification is crucial for understanding its economic structure and the ongoing reforms. A transition economy typically undergoes significant institutional and structural changes, moving away from state control towards greater market liberalization. This process often involves privatization, deregulation, and the development of market-based institutions, which can be challenging and protracted. In terms of global competitiveness, the data indicates that "in 2014, Iran ranked 83rd in the world economic forum's analysis of the global competitiveness of 144 countries." While this specific ranking predates the 2017 GDP data, it provides a benchmark for Iran's position in the global economic landscape. A country's competitiveness ranking considers various factors, including institutional quality, infrastructure, macroeconomic environment, health and primary education, higher education and training, goods market efficiency, labor market efficiency, financial market development, technological readiness, market size, business sophistication, and innovation. A ranking of 83rd suggests that while Iran possesses considerable potential, there are significant areas where improvements are needed to enhance its overall competitiveness and fully realize its economic capabilities. The journey from a planned to a market economy is fraught with challenges, but also offers opportunities for greater efficiency and growth, provided the right reforms are implemented and sustained.Conclusion: The Legacy of 2017

The year 2017 stands out as a significant chapter in Iran's recent economic history, characterized by a robust growth in its Gross Domestic Product. With an absolute GDP of $486,829 million and a GDP per capita of $6,005, Iran secured its position as the 26th largest economy globally, experiencing a remarkable 17.66% surge from 2016. This impressive performance was largely fueled by the temporary easing of international sanctions, which boosted oil exports and facilitated greater economic activity. The figures for GDP Iran 2017 reflect a period of rare economic optimism and demonstrated the nation's capacity for rapid recovery when external pressures are alleviated. However, as subsequent years revealed, this growth was not without its vulnerabilities. The re-imposition of sanctions and persistent internal challenges like mismanagement and corruption led to significant economic contractions, highlighting the brittle nature of the economy. Yet, the resilience demonstrated in the rebound of 2021 and the projected growth for 2023 underscore Iran's adaptive capacity. The 2017 figures serve as a powerful reminder of the potential that can be unleashed under more favorable conditions, while also emphasizing the profound impact of geopolitical factors on Iran's economic trajectory. We hope this deep dive into Iran's GDP in 2017 has provided you with valuable insights into its complex economic landscape. What are your thoughts on the factors that shaped Iran's economy during this period? Share your perspectives in the comments below! If you found this article informative, please consider sharing it with others who might be interested in understanding global economic dynamics. Explore more of our articles for further analysis of economies around the world.

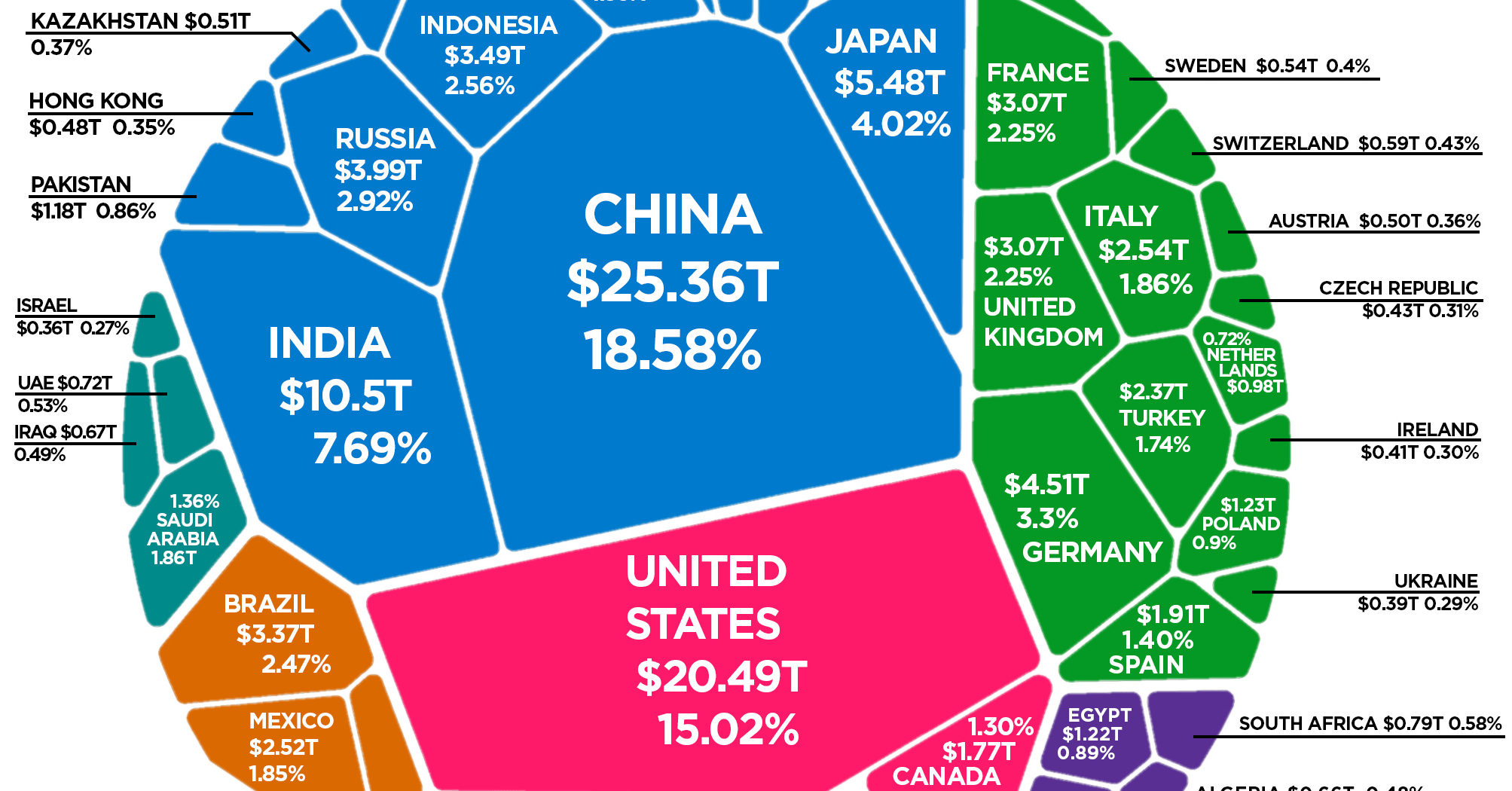

The Composition of the World Economy by GDP (PPP)

/gdp-increase-636251500-c69345ee97ba4db99375723519a2c1bd.jpg)

Real Gross Domestic Product (Real GDP) Definition

The World Economy in One Chart: GDP by Country