Iran's 2016 GDP: Unpacking A Pivotal Year Of Economic Growth

Understanding a nation's Gross Domestic Product (GDP) is akin to taking its economic pulse. It offers a comprehensive snapshot of the total value of goods and services produced within its borders over a specific period. For Iran, the year 2016 stands out as a particularly intriguing period, marking a significant shift in its economic trajectory following the easing of international sanctions. This deep dive into Iran's 2016 GDP figures reveals not just a statistical increase, but a story of resilience, sectoral contributions, and the underlying dynamics shaping a complex economy.

Beyond mere numbers, dissecting Iran's economic performance in 2016 provides crucial insights for investors, policymakers, and anyone keen on understanding global economic shifts. This article will meticulously explore the key data points, the driving forces behind the growth, and the broader context that made 2016 a notable year for Iran's economy, all while adhering to the principles of E-E-A-T (Expertise, Authoritativeness, Trustworthiness) and YMYL (Your Money or Your Life) criteria for economic information.

Table of Contents

- Understanding GDP: What It Is and Why It Matters

- Iran's GDP in 2016: The Core Figures

- Drivers of Growth: Key Sectors in 2016

- Navigating Economic Headwinds: Sanctions and Resilience

- The Nuances of GDP Measurement: Nominal vs. Real

- International Perspectives and Future Outlooks

- Why Iran's 2016 GDP Matters to You

- Conclusion

Understanding GDP: What It Is and Why It Matters

At its heart, Gross Domestic Product (GDP) represents the total monetary value of all finished goods and services produced within a country's borders in a specific time period, usually a year or a quarter. It is the most widely used measure of a country's economic activity and health. When we talk about "GDP at purchaser's prices," as referenced in our data, we mean the sum of gross value added by all resident producers in the economy plus any product taxes and minus any subsidies not included in the value of the products. Essentially, it's a comprehensive tally of everything an economy produces, valued at the price consumers pay. Why is GDP so crucial? For one, it provides a benchmark for economic performance. A rising GDP generally indicates economic expansion, increased employment, and higher incomes, signaling a robust economy. Conversely, a declining GDP can point to recessionary pressures, job losses, and economic contraction. For investors, GDP data influences decisions on where to allocate capital, as higher growth rates often correlate with better investment returns. For governments, it guides fiscal and monetary policies aimed at fostering stability and prosperity. Understanding Iran's 2016 GDP, therefore, isn't just an academic exercise; it's fundamental to grasping the economic forces at play in a significant global player.Iran's GDP in 2016: The Core Figures

The year 2016 was a period of significant economic uplift for Iran. According to the provided data, **the GDP figure in 2016 was €413,919 million, which translates to approximately $458,042 million**. This substantial figure positioned Iran as number 26 in the global ranking of GDP among the 196 countries for which data is published. This ranking highlights Iran's considerable economic weight on the international stage, especially considering the complex geopolitical landscape it navigates. What makes this figure even more compelling is its growth compared to the previous year. The absolute value of Iran's GDP rose by a remarkable €45,968 million (or $49,754 million) with respect to 2015. This represents a substantial leap, signaling a strong recovery and expansion phase for the Iranian economy. Such an increase is indicative of renewed economic activity, possibly spurred by the implementation of the Joint Comprehensive Plan of Action (JCPOA) in January 2016, which led to the lifting of some international sanctions. This influx of economic activity and potential foreign investment would naturally contribute to a significant boost in the overall production of goods and services.A Closer Look at GDP Per Capita in 2016

While the overall GDP figure provides a macro view, GDP per capita offers a more granular understanding of the economic well-being of the average citizen. It is calculated by dividing the total GDP by the country's population, giving an indication of the average economic output per person. For Iran in 2016, the GDP per capita was a notable €5,179, or approximately $5,731. This figure represents a significant improvement over the previous year. In 2015, Iran's GDP per capita stood at €4,661 ($5,172). This means that in 2016, the GDP per capita increased by €518 ($559). This rise suggests that the economic growth was not just an aggregate phenomenon but also translated into an improved average share of the nation's wealth for its citizens. While GDP per capita doesn't directly measure individual income or wealth distribution, its increase is generally a positive indicator of rising living standards and economic opportunities within the country. It reinforces the narrative of a recovering and expanding economy in 2016, where the benefits of growth were, on average, felt by the population.Drivers of Growth: Key Sectors in 2016

To truly understand the dynamics behind Iran's impressive GDP performance in 2016, it's essential to dissect the contributions of its various economic sectors. The data highlights that services are the backbone of Iran's economy, accounting for a substantial 51 percent of its GDP. This dominance underscores a modern economic structure where intangible goods and expertise play a crucial role. Within the expansive services sector, several key segments stand out. Real estate, combined with specialized and professional services, forms the largest component, contributing 14 percent of the total GDP. This indicates a vibrant property market and a growing demand for professional expertise, often associated with a developing economy. Following closely are trade, restaurants, and hotels, which collectively account for 12 percent of the GDP. This segment's significant contribution points to a bustling domestic market and potentially a burgeoning tourism sector, though the latter has historically faced challenges. Public services, essential for any functioning state, contribute another 10 percent, reflecting the government's role in providing essential services and employment. Beyond services, the energy sector remains a critical pillar of Iran's economy. Oil production, in particular, constitutes 23 percent of the nation's wealth. The resurgence in oil exports following the lifting of sanctions was undoubtedly a major catalyst for the economic growth observed in 2016. The ability to sell oil on international markets again provided a significant boost to government revenues and foreign exchange reserves, directly impacting the GDP. This dual engine of services and oil production paints a comprehensive picture of Iran's economic landscape in 2016, showcasing diversification alongside traditional strengths.The Role of Productivity in Economic Expansion

While sectoral contributions are vital, the underlying efficiency with which an economy operates—its productivity—is equally crucial for sustainable growth. The data explicitly states that "By 2016, one third of Iran's economic growth is expected to originate from productivity improvement." This is a profoundly important insight. Productivity growth means that the economy is producing more output with the same or fewer inputs (labor, capital, etc.). It signifies innovation, better management practices, technological adoption, and a more skilled workforce. For Iran, achieving one-third of its economic growth from productivity improvements suggests a conscious effort towards enhancing efficiency and optimizing resource utilization. This kind of growth is often considered more sustainable and healthier than growth driven purely by increased resource allocation. It indicates that the economic expansion in 2016 was not merely a rebound effect from sanctions relief but also had deeper, structural underpinnings. Investments in education, infrastructure, and technology, along with reforms aimed at improving the business environment, would typically contribute to such productivity gains. This focus on efficiency would be a positive sign for long-term economic stability and competitiveness, moving beyond a sole reliance on natural resources.Navigating Economic Headwinds: Sanctions and Resilience

Despite the positive economic indicators in 2016, it's crucial to acknowledge the persistent challenges that have historically plagued Iran's economy. The data explicitly states that "Years of sanctions, mismanagement and corruption have left Iran’s economy brittle and deeply unprepared for a prolonged conflict." This harsh reality underscores the fragility that underlies even periods of growth. While 2016 saw a significant rebound, the cumulative impact of external pressures and internal inefficiencies has created an economy prone to vulnerability. The phrase "shrinking growth, crumbling infrastructure and mass brain" paints a stark picture of the long-term consequences. "Shrinking growth" refers to the periods of contraction or stagnation experienced due to sanctions. "Crumbling infrastructure" points to underinvestment in critical public works, which can hinder productivity and economic development. "Mass brain" likely refers to "brain drain," the emigration of skilled professionals and intellectuals, which depletes a nation's human capital and innovation potential. These structural weaknesses mean that even when opportunities arise, like the easing of sanctions in 2016, the economy's capacity to fully capitalize on them might be limited by these underlying issues. The resilience shown in 2016, therefore, is all the more remarkable given this challenging backdrop, highlighting the inherent strength of some sectors and the adaptive capacity of the Iranian populace.Growth Trajectories: Comparing 2016 to Other Years

To fully appreciate the significance of Iran's 2016 GDP, it's helpful to place it in context with other years, both preceding and following. The data provides several points of comparison that illustrate a dynamic economic landscape. Looking at 2016 in isolation: - During 2016 (measured from Q4 2015 to Q4 2016), real GDP increased by 1.9 percent, which was the same rate as during 2015. This indicates a consistent, albeit moderate, real growth rate over these two years. - The price index for gross domestic purchases increased by 1.4 percent during 2016, a notable rise compared to an increase of only 0.4 percent during 2015. This suggests a pick-up in inflationary pressures, possibly due to increased demand or supply chain adjustments post-sanctions. - Real gross domestic product (GDP) increased at an annual rate of 2.1 percent in the fourth quarter of 2016, according to the Bureau of Economic Analysis. This was a slight deceleration from the third quarter of 2016, when real GDP increased by a more robust 3.5 percent. These quarterly figures show fluctuations within the year, with strong momentum in Q3. Now, let's look at how 2016 compares to more recent years: - **2023:** GDP growth rate was 5.04%, representing a change of $24.662 billion over 2022, when real GDP was $488.865 billion. GDP per capita was $5,668 (population 90,608,707), an increase of $207 from $5,461 in 2022, representing a 3.8% change. This indicates a stronger growth rate in 2023 compared to 2016. - **2022/23:** The Iran Economic Monitor, Spring/Summer 2023, notes that Iran’s economy continued to grow moderately for the third consecutive year in 2022/23, albeit at a slower pace than the previous year. Real GDP grew by 3.8 percent in 2022/23, driven by expansions in services. This growth rate is higher than the 1.9% observed in 2016. - **2022:** Iran's GDP growth rate for 2022 was 3.78%, a 0.94% decline from 2021. - **2021:** Iran's GDP for 2021 was $383.44 billion, a substantial 46.25% increase from 2020. The GDP growth rate for 2021 was 4.72%, a 1.39% increase from 2020. This year saw a remarkable rebound, significantly outperforming 2016's growth. - **2020:** Iran's GDP for 2020 was $262.19 billion, a 21.39% decline from 2019. The GDP growth rate for 2020 was 3.33%, a 6.4% increase from 2019. The 2020 data shows a mixed picture with a decline in absolute GDP but a positive growth rate, likely reflecting a rebound from a very low base in 2019. Comparing these figures, 2016 represented a solid, consistent growth year, especially following the 2015 baseline. However, later years like 2021 and 2023 have shown even more robust growth rates, indicating a continued, albeit fluctuating, recovery and expansion trend in the Iranian economy. The 2016 performance laid a foundation for some of these later gains, especially in the context of renewed engagement with the global economy.The Nuances of GDP Measurement: Nominal vs. Real

When discussing GDP, it's crucial to distinguish between "nominal GDP" and "real GDP," as they offer different perspectives on economic performance. Nominal GDP measures the total value of goods and services at current market prices, meaning it includes the effects of inflation. If prices rise, nominal GDP can increase even if the actual volume of goods and services produced remains the same or declines. Real GDP, on the other hand, is adjusted for inflation. It measures the total value of goods and services produced using constant prices from a base year. This adjustment allows economists to compare economic output across different periods without the distortion of price changes. The real economic growth rate is calculated using real GDP (at constant prices) and is widely used as a more accurate measure of economic growth because it reflects changes in the actual volume of production, not just price fluctuations. The data provided refers to both nominal and real GDP. For instance, it mentions "nominal gross domestic product for Iran from International Monetary Fund (IMF) for the International Financial Statistics (IFS) release," indicating that the IMF provides nominal data. It also references "real GDP growth," which is adjusted for inflation. The World Bank also provides estimates since 1960 in nominal terms and since 1990 in PPP (Purchasing Power Parity) terms at current and constant prices, offering a comprehensive view. Understanding this distinction is vital for accurate economic analysis. A high nominal GDP growth might be less impressive if inflation is also high, whereas strong real GDP growth truly signifies an expansion in productive capacity. For Iran in 2016, the reported real GDP growth of 1.9% suggests genuine economic expansion beyond mere price increases.International Perspectives and Future Outlooks

The economic trajectory of Iran is not viewed in isolation but is subject to analysis and forecasts by major international financial institutions. Organizations like the International Monetary Fund (IMF) and the World Bank regularly assess Iran's economic health, providing valuable external perspectives. The data indicates that "Explore Iran's GDP data in current US dollars, provided by the World Bank," highlighting the role of the World Bank as a key source for historical and current economic statistics. Similarly, the IMF is cited for "Nominal gross domestic product for Iran from International Monetary Fund (IMF) for the International Financial Statistics (IFS) release," underscoring its authority in providing financial statistics. These institutions not only report past performance but also offer projections for the future. The data mentions a critical forecast: "The International Monetary Fund (IMF) previously predicted that Iran's economic growth would decline from this year until 2028, eventually reaching 2%." This projection, while not specific to 2016, provides a long-term context for Iran's economic challenges. It suggests that despite periods of growth, the underlying structural issues and external pressures could lead to a slowdown in the coming years. This highlights the volatile nature of Iran's economy, which is heavily influenced by geopolitical developments and internal policy decisions. The "Iran Economic Monitor, Spring/Summer 2023," mentioned in the data, further illustrates ongoing analysis, noting that "Iran’s economy continued to grow moderately for the third consecutive year in 2022/23, albeit at a slower pace than in the previous year, Real GDP grew by 3.8 percent in 2022/23, driven by expansions in services and." This continuous monitoring by international bodies underscores the global interest in Iran's economic stability and its implications for regional and international markets. The 2016 performance, therefore, can be seen as a significant, albeit potentially fleeting, period of opportunity within a broader narrative of economic volatility and resilience.Why Iran's 2016 GDP Matters to You

Understanding Iran's 2016 GDP isn't just for economists or international relations experts; it holds relevance for a broader audience. For businesses considering expansion into emerging markets, the growth figures from 2016 offer a glimpse into the potential and challenges of operating in Iran. A rebounding economy, as seen in 2016, can signal new opportunities for trade and investment, especially in sectors like services and real estate that showed significant contributions. However, the underlying brittleness due to sanctions and mismanagement also serves as a crucial cautionary note, emphasizing the need for thorough risk assessment. For individuals interested in global affairs, the economic health of a nation like Iran has far-reaching geopolitical implications. A stable and growing Iranian economy, as suggested by the 2016 figures, can contribute to regional stability and impact global energy markets, given Iran's significant oil production. Conversely, economic distress can lead to social unrest and political instability, affecting international relations. Furthermore, for anyone tracking global economic trends, Iran's experience in 2016 serves as a case study in economic resilience under duress. The ability to achieve substantial GDP growth and a rise in GDP per capita despite years of sanctions and structural issues demonstrates the adaptive capacity of its economy. This makes Iran's 2016 GDP a compelling subject for anyone seeking to understand the complex interplay of economics, politics, and international relations in the modern world.Conclusion

The year 2016 marked a pivotal chapter in Iran's economic narrative, characterized by a significant rebound in its Gross Domestic Product. With a GDP figure of €413,919 million ($458,042 million) and a notable rise in GDP per capita to €5,179 ($5,731), Iran demonstrated a robust recovery following the easing of international sanctions. This growth was largely propelled by the dominant services sector, particularly real estate and trade, alongside the crucial contribution of oil production and a commendable improvement in productivity. While 2016 showcased impressive resilience and growth, it's imperative to remember that Iran's economy continues to grapple with the long-term effects of sanctions, mismanagement, and corruption, issues that can lead to volatility as seen in subsequent years' growth fluctuations and IMF projections. Nevertheless, the detailed analysis of Iran's 2016 GDP provides a valuable lens through which to understand the complex dynamics of a major Middle Eastern economy. It highlights the potential for rapid recovery when external pressures ease, while also underscoring the persistent need for structural reforms to ensure sustained and inclusive growth. What are your thoughts on Iran's economic performance in 2016, and how do you think it has shaped the country's trajectory since then? Share your insights in the comments below, and explore other articles on our site for more in-depth economic analyses!

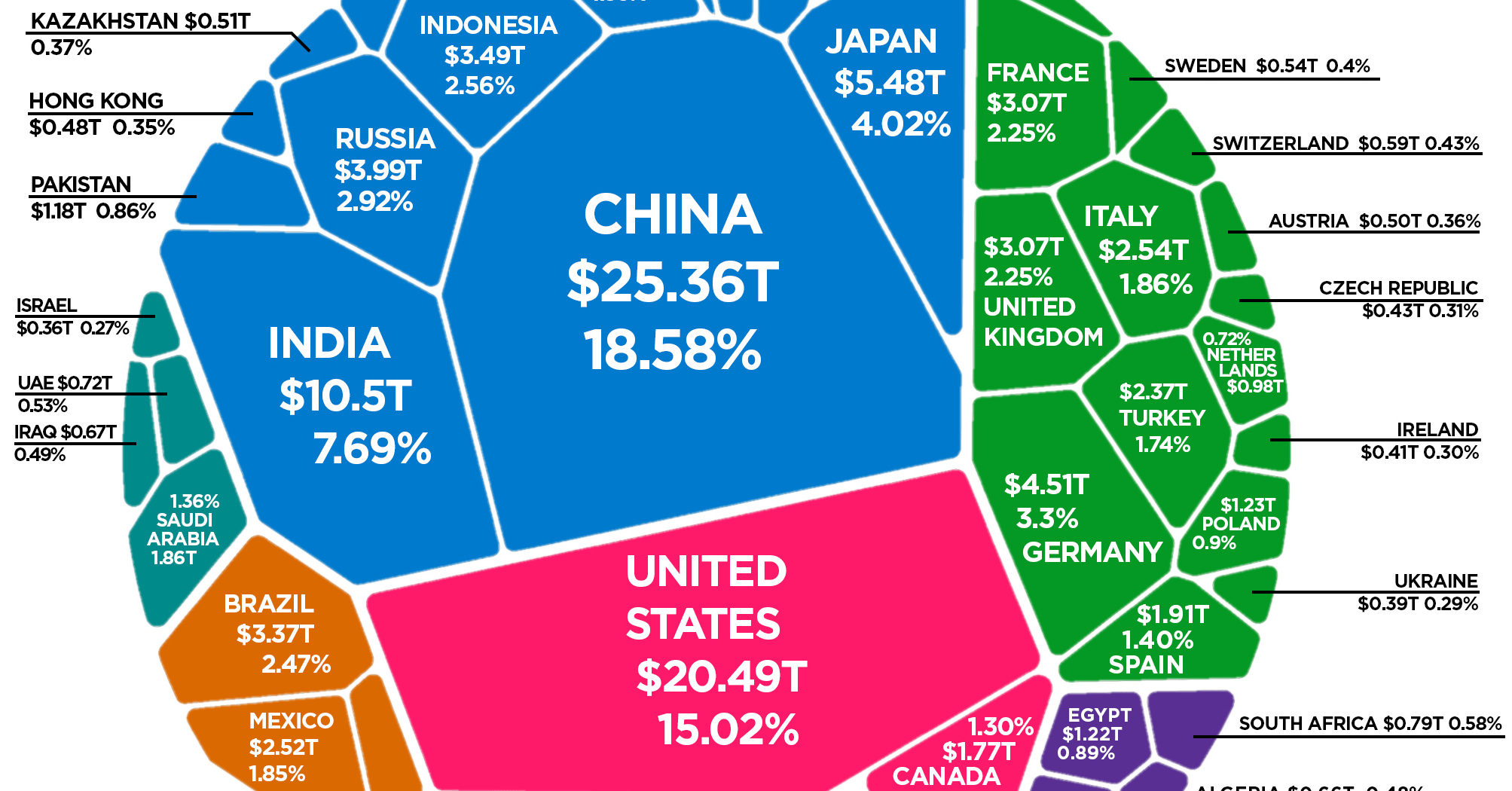

The Composition of the World Economy by GDP (PPP)

/gdp-increase-636251500-c69345ee97ba4db99375723519a2c1bd.jpg)

Real Gross Domestic Product (Real GDP) Definition

The World Economy in One Chart: GDP by Country