Decoding Iran's Economic Pulse: A Deep Dive Into GDP Growth

The economic trajectory of any nation is often best understood through the lens of its Gross Domestic Product (GDP) growth rate. For Iran, a country frequently navigating complex geopolitical landscapes and internal economic reforms, its GDP growth rate serves as a critical indicator of its resilience, challenges, and future potential. This article delves into the intricate details of Iran's economic performance, examining recent trends, historical data, and the multifaceted factors that shape its financial landscape. Understanding these dynamics is crucial for anyone seeking to grasp the broader implications of Iran's position in the global economy.

From the ebbs and flows of annual percentages to the substantial figures in billions of US dollars, Iran's economic narrative is one of adaptation and fluctuating fortunes. We will explore how various sectors contribute to this growth, the impact of global events, and the internal policies that either propel or constrain its progress. By dissecting the available data, we aim to provide a comprehensive and accessible overview of Iran's GDP growth, shedding light on its past achievements, current realities, and future outlook.

Table of Contents

- Understanding Iran's Economic Landscape: A Decade in Review

- Iran's GDP Growth Rate: A Year-by-Year Analysis (2019-2023)

- Iran's GDP in Monetary Terms: Billions and Beyond

- Per Capita Perspective: What Does It Mean for Iranians?

- Projections and Challenges: The Outlook for 2024 and Beyond

- The Nuance of Data: Official Figures vs. Independent Assessments

- External Factors and Structural Inefficiencies: Shaping Iran's Economic Future

- Navigating Economic Complexity: A Holistic View of Iran's GDP Journey

- Conclusion

Understanding Iran's Economic Landscape: A Decade in Review

Iran's economic journey over the past decade has been marked by significant volatility, reflecting a complex interplay of internal policies, regional dynamics, and international pressures. When examining the nation's economic health, the **Iran GDP growth rate** stands out as a crucial metric. Over the last decade, Iran's economy has averaged a growth rate of 2.78%. This figure, while seemingly modest, encapsulates periods of both contraction and robust expansion, painting a picture of an economy constantly adapting to changing circumstances. The growth rate of GDP is typically measured as the annual percentage change of GDP at market prices, based on constant local currency. For comparative purposes, aggregates are often based on constant 2010 US dollars, providing a standardized baseline to assess real economic expansion, free from the distortions of inflation or currency fluctuations. This consistent methodology allows for a clearer understanding of the underlying economic performance, helping to identify genuine trends in production and service output rather than just nominal value increases. The decade's average reflects the country's efforts to diversify its economy beyond oil, albeit with varying degrees of success, and its capacity to absorb external shocks while striving for internal stability.Iran's GDP Growth Rate: A Year-by-Year Analysis (2019-2023)

A closer look at Iran's recent economic performance reveals a dynamic pattern of recovery and adjustment. The **Iran GDP growth rate** has shown considerable movement in the years leading up to and following the global economic shifts of the early 2020s.Navigating the Peaks and Troughs: 2019-2021

The period from 2019 to 2021 showcases Iran's resilience in the face of significant challenges. In 2020, Iran's GDP growth rate was 3.33%, representing a notable 6.4% increase from 2019. This growth, even after adjusting for inflation, indicated a positive shift from previous periods. It's worth noting that this 3.33% growth in 2020 marked a recovery from a much lower figure four years prior, which had seen growth as high as 13.4 percent, suggesting a reaction to specific economic conditions or policy changes at that time. Following this, the **Iran GDP growth rate** for 2021 saw further acceleration, reaching 4.72%. This was a significant 1.39% increase from the 2020 figure, demonstrating a continued upward trend in the immediate post-pandemic period, as global economies began to rebound and demand for commodities, including oil, started to pick up. This upward trajectory hinted at a burgeoning recovery, driven by both internal economic activities and a potentially more favorable external environment.The Recent Trajectory: 2022-2023

The momentum, however, faced a slight moderation in 2022. The **Iran GDP growth rate** for 2022 was recorded at 3.78%, which represented a 0.94% decline from the robust growth observed in 2021. This modest slowdown could be attributed to a variety of factors, including renewed international pressures, internal policy adjustments, or fluctuations in global energy markets. Despite the slight dip, the growth remained positive, indicating underlying economic activity. Looking at 2023, Iran's economy showed renewed strength. The GDP growth rate in 2023 was 5.04%, marking a substantial increase from the 3.78% recorded in 2022. This impressive growth rate in 2023 translated into a significant change of $24,662,000,000 US dollars over 2022, when the real GDP stood at $488,865,000,000. This 5.04% growth rate in 2023 also favorably compares to the world average of 3.43%, based on data from 184 countries, highlighting Iran's relatively strong performance in a global context. Historically, the average for Iran from 1961 to 2023 has been 4.06 percent, positioning the 2023 figure above its long-term average, suggesting a period of notable economic expansion.Iran's GDP in Monetary Terms: Billions and Beyond

Beyond percentage growth rates, understanding the sheer scale of Iran's economy in monetary terms provides another crucial dimension to its economic profile. These figures, often expressed in US dollars, allow for direct comparison with other global economies and offer insight into the country's overall economic output.Total GDP Figures: 2022-2023

According to official data from the World Bank, the gross domestic product (GDP) in Iran was worth $404.63 billion US dollars in 2023. This figure represents approximately 0.38 percent of the world economy, underscoring Iran's position as a mid-sized economy on the global stage. Delving into the specific annual figures, Iran's GDP for 2022 was $413.39 billion US dollars, which marked a significant 15.12% increase from 2021. This substantial jump in nominal GDP reflects a combination of real growth and potentially inflationary effects or changes in exchange rates. However, the subsequent year saw a slight contraction in nominal terms: Iran's GDP for 2023 was $401.50 billion US dollars, representing a 2.88% decline from 2022. This discrepancy between the positive real GDP growth rate (5.04%) and the decline in nominal US dollar GDP highlights the impact of currency fluctuations and inflation on the reported dollar value of the economy. When looking at "economic growth" specifically, Iran's economic growth for 2022 was $394.36 billion US dollars, a 2.85% increase from 2021. For 2023, this figure rose to $404.63 billion US dollars, marking a 2.6% increase from 2022. These figures, provided by the World Bank, offer a consistent measure of Iran's economic output in current US dollars, allowing for a clearer understanding of its scale and year-on-year changes. In the global ranking of GDP, Iran holds the 41st position among the 196 countries for which data is published, with its 2024 GDP figure estimated at €370,921 million, equivalent to $401,357 million. This ranking underscores its significant, albeit not dominant, role in the global economic landscape.Per Capita Perspective: What Does It Mean for Iranians?

While aggregate GDP figures provide a macro-level view of a nation's economic output, GDP per capita offers a more granular understanding of the average economic well-being of its citizens. It divides the total economic output by the population, giving an indication of the average income or production per person. This metric is particularly insightful for Iran, given its large and growing population. In 2023, with a population of 90,608,707 people, the GDP per capita in the Islamic Republic of Iran was $5,668. This figure represents a modest increase of $207 from $5,461 in 2022. This change translates to a 3.8% increase in GDP per capita, aligning closely with the overall positive **Iran GDP growth rate** for the same period. To put this into historical context, in 2008, Iran's GDP per capita was estimated at $5,470 (or $12,800 in purchasing power parity terms). Comparing the 2023 figure to that of 2008 shows a relatively slow increase in per capita income over a 15-year span, highlighting the challenges in significantly improving the average living standards despite periods of overall economic growth. Factors such as population growth, inflation, and the distribution of wealth can all influence how changes in overall GDP translate to the individual level. While the recent increase is positive, sustained and more substantial growth in GDP per capita would be essential for a significant improvement in the quality of life for the average Iranian citizen.Projections and Challenges: The Outlook for 2024 and Beyond

Forecasting Iran's economic future involves navigating a landscape filled with both potential and significant hurdles. Recent data and international predictions offer a glimpse into what the coming years might hold for the **Iran GDP growth rate**. For 2024, preliminary figures suggest continued, albeit tempered, growth. The gross domestic product of Iran is projected to grow by 3.5% compared to last year. More specifically, the economic growth in Iran for the year 2024 is estimated at 3.48%. This figure, while positive, is lower than the 4.99% recorded in 2014 and the 5.04% seen in 2023, indicating a potential deceleration from its recent peak. The GDP figure in 2024 is estimated to be around $401,357 million (or €370,921 million). However, a closer look at more recent data reveals a concerning trend. Recent data released by Iran's central bank indicates a significant slowdown in the first half of 2024. The country's GDP growth in the first six months of 2024 has reportedly halved compared to the same period in 2023. According to these statistics, Iran's economic growth stood at 5.3% in the first half of last year but dropped significantly to 2.9% during the first six months of this year. This sharp decline suggests that the positive momentum from 2023 might be facing new headwinds. Furthermore, the data indicates that the GDP growth rate has fallen across all sectors except agriculture, pointing to a broad-based slowdown in industrial and service sectors. International Monetary Fund (IMF) predictions paint a more cautious picture for the medium term. The IMF forecasts that Iran's economic growth rate will continue to decline, potentially reaching as low as 2% within the next five years. This prediction underscores the vulnerability of Iran's economy to external factors and structural inefficiencies, which could hinder sustained high growth rates. The challenges include the ongoing impact of international sanctions, fluctuations in global oil prices, and internal structural issues such as a lack of economic diversification, bureaucratic hurdles, and the need for significant infrastructure investment. The future **Iran GDP growth rate** will heavily depend on how these internal and external pressures are managed.The Nuance of Data: Official Figures vs. Independent Assessments

When analyzing economic data, particularly for countries like Iran that operate under unique political and economic circumstances, it's crucial to consider the source and potential biases. While official figures from government bodies and international organizations like the World Bank and IMF provide valuable insights, independent assessments often offer a different perspective, highlighting potential discrepancies or challenges in data collection and reporting. The data points discussed so far largely stem from official reports, including those from Iran's central bank and international bodies. These figures, such as the 5.04% GDP growth rate in 2023 or the 2.9% growth in the first half of 2024, are the publicly available metrics used for economic analysis. However, a critical caveat emerges when considering the reliability of some of these figures. Calculations by independent entities, such as Iran International, indicate that the central bank's figures are, in some cases, "overly optimistic and, in some cases, manipulated." This divergence between official and independent calculations introduces a layer of complexity to understanding the true state of Iran's economy. Such claims of manipulation or over-optimism, if substantiated, would imply that the actual **Iran GDP growth rate** might be lower or that the economic challenges are more severe than officially reported. This highlights the importance of cross-referencing data from multiple credible sources and maintaining a degree of skepticism when evaluating economic performance, especially in contexts where transparency might be limited. For investors, policymakers, and researchers, acknowledging this nuance is vital for making informed decisions and developing realistic expectations regarding Iran's economic trajectory.External Factors and Structural Inefficiencies: Shaping Iran's Economic Future

Iran's economic performance, particularly its **Iran GDP growth rate**, is profoundly influenced by a confluence of external pressures and inherent structural inefficiencies. These factors often dictate the pace and direction of its economic development, making it a subject of continuous analysis and debate. Foremost among external factors are international sanctions. Decades of various sanctions, primarily from the United States, have severely constrained Iran's ability to engage in international trade, access global financial markets, and attract foreign investment. This has particularly impacted its crucial oil and gas sector, limiting export revenues and hindering modernization efforts. The volatility of global oil prices also plays a significant role; as a major oil producer, Iran's economic health is highly susceptible to swings in commodity markets. When oil prices are high and sanctions are less restrictive, the economy tends to perform better, but downturns or tightened sanctions can quickly reverse positive trends, leading to sharp contractions in the GDP growth rate. Geopolitical tensions in the broader Middle East also contribute to economic uncertainty, deterring long-term investments and impacting trade routes. Internally, Iran faces a range of structural inefficiencies that impede sustainable and diversified growth. The economy remains heavily reliant on oil revenues, making it vulnerable to external shocks. Despite efforts to diversify, other sectors often struggle to achieve their full potential due to a challenging business environment. Bureaucratic hurdles, a complex regulatory framework, and perceived corruption can deter both domestic and foreign private sector investment. Furthermore, the banking sector faces challenges, including non-performing loans and limited integration with international financial systems, which constrains credit availability and economic activity. A significant portion of the economy is also controlled by state-owned enterprises or quasi-governmental entities, which can lead to inefficiencies, lack of competition, and misallocation of resources. Addressing these deep-seated structural issues, alongside navigating external pressures, will be critical for Iran to achieve consistent and robust GDP growth rates in the long term.Navigating Economic Complexity: A Holistic View of Iran's GDP Journey

The journey through Iran's GDP data reveals a complex and often contradictory economic narrative. From the average growth rate over the last decade to the year-on-year fluctuations, and from the billions in total GDP to the per capita income, each data point adds a layer to this intricate picture. The **Iran GDP growth rate** is not merely a number; it is a reflection of the nation's struggle for economic stability and prosperity amidst significant internal and external challenges. We've seen periods of commendable growth, such as the 5.04% in 2023, which surpassed the global average, demonstrating the economy's underlying potential and resilience. Yet, we've also observed moderations and declines, like the halving of growth in the first half of 2024, alongside predictions of further slowdowns by international bodies like the IMF. The discrepancies between official figures and independent assessments further underscore the need for a nuanced understanding, acknowledging that economic realities can be more challenging than what some data might initially suggest. The reliance on oil, the persistent impact of international sanctions, and the need for comprehensive structural reforms continue to be defining features of Iran's economic landscape. While the country has shown an ability to adapt and achieve growth in specific periods, sustained and inclusive development hinges on addressing these fundamental issues. The future trajectory of Iran's economy, and consequently its GDP growth rate, will depend on its capacity to foster a more diversified, transparent, and resilient economic environment that can withstand external shocks and leverage its considerable human and natural resources effectively.Conclusion

The journey through Iran's economic data, particularly its **Iran GDP growth rate**, reveals a narrative of resilience, adaptation, and persistent challenges. From the notable 5.04% growth in 2023 to the projected slowdowns in 2024 and beyond, the figures underscore the profound impact of external factors and inherent structural inefficiencies on the nation's economic performance. While Iran has demonstrated an impressive capacity to rebound and achieve growth even under duress, the path to sustained prosperity remains complex and fraught with obstacles. Understanding these dynamics is not just an academic exercise; it's crucial for businesses considering engagement, policymakers assessing regional stability, and individuals seeking to comprehend the broader implications of global economic interconnectedness. The insights gained from analyzing Iran's GDP growth highlight the importance of economic diversification, prudent policy-making, and navigating the intricate web of international relations. As Iran continues its economic journey, its ability to foster internal reforms and manage external pressures will be paramount in shaping its future growth trajectory. We hope this comprehensive analysis has provided you with valuable insights into Iran's economic landscape. What are your thoughts on the future of Iran's economy? Share your perspectives in the comments below, or explore more of our articles on global economic trends to deepen your understanding.- Averyleigh Onlyfans Sex

- Maria Burton Carson

- Daisy From Dukes Of Hazzard Now

- Faith Jenkins Net Worth 2024

- Xxbrist

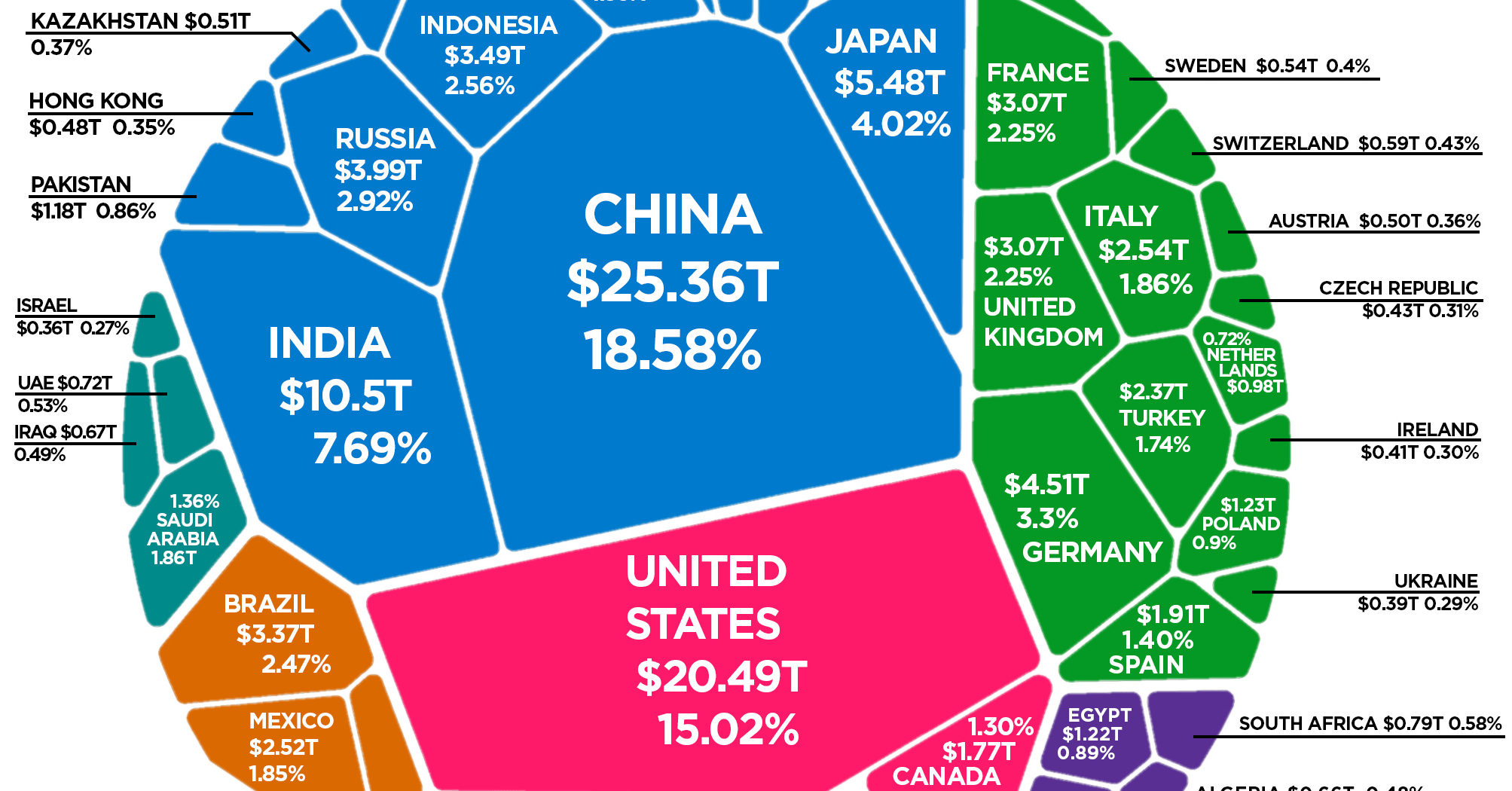

The Composition of the World Economy by GDP (PPP)

/gdp-increase-636251500-c69345ee97ba4db99375723519a2c1bd.jpg)

Real Gross Domestic Product (Real GDP) Definition

The World Economy in One Chart: GDP by Country