Iran's Economy: Navigating Sanctions, Growth, And Resilience

The economy of Iran is a fascinating and complex subject, representing a unique blend of state control, market dynamics, and a persistent struggle against external pressures. As a mixed economy in transition, it presents a compelling case study of a nation striving for development amidst significant geopolitical challenges. Understanding the intricacies of Iran's economic landscape requires a deep dive into its historical context, current indicators, and the formidable obstacles it continues to face.

Despite its rich natural resources and strategic location, Iran's economic journey has been marked by volatility, largely influenced by international sanctions and internal policy decisions. This article will explore the core components of the Iranian economy, shedding light on its strengths, vulnerabilities, and the remarkable resilience it has demonstrated over the decades. From its dominant hydrocarbon sector to its burgeoning industrial base and vital agricultural output, we will unravel the layers that define one of the Middle East's largest economies.

Table of Contents

- Understanding Iran's Economic Model

- Key Economic Indicators and Global Standing

- The Persistent Challenge of Economic Crisis

- The Dominant Role of Sanctions

- Pillars of the Iranian Economy: Key Sectors

- Iranian Trade Balance: A Sign of Adaptability

- Recent Economic Performance and Growth

- The Resilience of Iran's Economy: Looking Forward

Understanding Iran's Economic Model

The economy of Iran is best characterized as a mixed economy in transition, a system that combines elements of both state planning and market mechanisms. Historically, it has maintained a voluminous public sector, though this has seen significant reduction in recent years, decreasing from an estimated 80% to below 50%. This shift indicates a gradual move towards greater private sector involvement, yet a substantial portion of the economy remains centrally planned, estimated at around 60%. This dual structure presents both opportunities for growth and inherent challenges in terms of efficiency and resource allocation. At its core, the Iranian economy is profoundly dominated by the production and export of hydrocarbons, primarily oil and natural gas. This reliance on energy resources makes the nation highly susceptible to global oil price fluctuations and international sanctions targeting its energy sector. Despite this heavy dependence, Iran possesses a diverse industrial base. The Tehran Stock Exchange, for instance, hosts over 40 industrial companies, signifying a vibrant, albeit often overlooked, manufacturing segment. This industrial capacity, coupled with its vast natural resources, positions Iran as one of the few large economies in the region with significant potential beyond just oil and gas.Key Economic Indicators and Global Standing

To truly grasp the scale and scope of the economy of Iran, it is essential to examine its key macroeconomic indicators and its standing on the global stage. These figures provide a snapshot of its financial health and its relative position among other nations, offering insights into its economic weight and the challenges it faces.GDP and Rankings

Iran holds a notable position in the global economic landscape. In terms of nominal GDP, it is recognized as the largest economy in the Middle East. Globally, it ranks as the 21st largest economy by purchasing power parity (PPP), indicating a significant domestic market and production capacity when adjusted for local prices. Looking at specific years, the data presents a dynamic picture: * In 2022, Iran demonstrated a solid economic position with a GDP of 413.49 billion USD, placing it at the 34th position globally. This figure was slightly less than Bangladesh, which recorded a GDP of 460.20 billion USD in the same year. * For 2024, the estimated GDP for Iran is 370.921 billion euros (approximately 401.357 billion USD), which places Iran as the 41st largest economy among the 196 countries for which GDP data is published. This fluctuation in ranking and nominal value underscores the impact of external factors and internal economic adjustments on Iran's performance.Public Debt Profile

Understanding a nation's public debt is crucial for assessing its fiscal stability. In 2022, Iran's public debt stood at 131.832 billion euros, which represented 36.93% of its GDP. This debt-to-GDP ratio is relatively modest compared to many developed and developing nations, suggesting a degree of fiscal prudence or perhaps limited access to international borrowing markets due to sanctions. On a per capita basis, Iran's public debt was 1,553 euros per person in 2022. These figures highlight that while Iran faces significant economic challenges, its sovereign debt burden, at least in 2022, was not excessively high, providing some room for maneuver if conditions were to improve.The Persistent Challenge of Economic Crisis

Currently, the economy of Iran is grappling with a profound economic crisis, characterized by a confluence of internal vulnerabilities and external pressures. This crisis significantly impacts its development trajectory and overall stability, creating a challenging environment for businesses and citizens alike.Decades of Inflation

One of the most defining features of Iran's economic crisis is the decades-long battle against persistently high inflation. The country has experienced stubbornly elevated inflation rates, often hovering in the range of 35% and higher. This rampant inflation erodes purchasing power, creates economic uncertainty, and complicates long-term planning for both individuals and businesses. It is a symptom of deeper structural issues, often exacerbated by currency depreciation, supply chain disruptions, and the impact of sanctions on imports and production costs.Internal and External Pressures in 2023

The economic situation in Iran in 2023 was marked by a series of internal and external challenges that profoundly impacted its development and stability. The ongoing international sanctions, particularly those imposed by the United States and other countries, have led to a substantial reduction in Iran's capacity for international trade and development. These restrictions limit access to global financial systems, hinder foreign investment, and complicate the export of its primary revenue-generating assets, such as oil. The cumulative effect of these pressures has led to a significant deterioration in the current economic situation, making it difficult for the country to achieve sustainable growth and improve living standards for its population.The Dominant Role of Sanctions

The impact of economic sanctions on the economy of Iran cannot be overstated; they are arguably the single most influential external factor shaping its trajectory since 1979. These measures, primarily imposed by the United States and its allies, aim to pressure the Iranian government over its nuclear program, human rights record, and regional activities. While they have not achieved their stated goal of transforming the regime, their effects on the broader Iranian society and economy have been profound and multifaceted. Sanctions have severely restricted Iran's capacity for international trade and development. They have made it exceptionally difficult for Iran to sell its oil on the global market, access foreign currency, and procure essential goods and technologies. This has led to a reduction in foreign investment, hindered the modernization of key industries, and created significant challenges for ordinary citizens through inflation and scarcity. A critical, albeit perhaps unintended, consequence of these sanctions has been the impediment of the formation of a robust middle class. By limiting economic growth and opportunity, sanctions have disproportionately affected segments of the population that would otherwise thrive in a more open economy. Paradoxically, some analyses suggest that sanctions have inadvertently strengthened political elites who, operating within an authoritarian state structure, are often better positioned to circumvent or profit from the restricted economic environment. This creates a cycle where the very measures designed to weaken the regime may, in some ways, entrench it further by centralizing economic power. Despite the immense pressure, Iran has shown remarkable resilience and adaptability. Recent reports indicate that Iran has been exporting more oil than ever in the last six years, even as the United States and the European Union consider new sanctions. This suggests that Iran has developed sophisticated methods to circumvent restrictions, find new markets, or engage in creative trade mechanisms. This ability to adapt, though costly, highlights the enduring challenge of using sanctions as a sole tool for policy change and underscores the complex interplay between geopolitics and the real-world economy of Iran.Pillars of the Iranian Economy: Key Sectors

Beyond hydrocarbons, the economy of Iran is supported by a diverse range of sectors that contribute significantly to its GDP and employment. These sectors demonstrate the country's potential for economic diversification and its capacity to sustain itself despite external pressures.Hydrocarbons and Industry

As previously mentioned, the hydrocarbon sector remains the backbone of the Iranian economy. Its vast oil and gas reserves are the primary source of export revenue, funding government operations and development projects. However, the country has also made efforts to develop its industrial base. The Tehran Stock Exchange lists over 40 industrial companies, indicating a significant manufacturing presence. This includes various industries, from basic goods to more complex manufacturing, striving to reduce reliance on imports and create domestic employment. The industrial sector, though often overshadowed by oil, plays a crucial role in the nation's economic resilience.Agriculture: A Foundation of Resilience

The primary sector, particularly agriculture, is a vital component of Iran's economy, thriving due to its diverse climate and abundant natural resources. With approximately 29% of its land dedicated to agriculture, Iran boasts a significant capacity for food production. The country cultivates a wide variety of crops and produces animal products, ensuring a degree of food security and contributing to rural livelihoods. Key agricultural outputs include: * Cereals like wheat and barley * Industrial crops such as cotton and tobacco * Sugar cane and sugar beet * A wide array of fruits and vegetables, including tomatoes, potatoes, onions, and oranges * Dairy products (milk) and poultry Sheep farming is also predominant, primarily for wool production, which feeds into the traditional and globally renowned Persian carpet weaving industry. This deep-rooted agricultural sector provides a critical buffer against external shocks, supporting domestic consumption and offering export potential for certain specialized products.Mining and Automotive: Emerging Drivers

Beyond agriculture and hydrocarbons, Iran possesses significant potential in its mining sector. In 2016, Iran confirmed substantial investments totaling 10 billion USD from Chinese and European firms in its mining sector. This highlights the country's rich mineral reserves, including copper, iron ore, zinc, lead, and coal, which can be crucial for future industrial development and export diversification. The automotive sector is another significant economic heavyweight in the Persian economy. It is one of the largest non-oil industries and a major employer. The sector has seen significant foreign investment and partnerships. For instance, the French firm PSA Peugeot Citroën signed an agreement worth 400 million euros with its local partner, Iran Khodro, underscoring the potential and strategic importance of this industry. Despite the challenges posed by sanctions which often disrupt supply chains and access to technology, the automotive industry continues to be a vital part of Iran's manufacturing base, catering to a large domestic market. Traditional industries like textile manufacturing, particularly the intricate production of Persian carpets, and pearl fishing in the Strait of Hormuz area, also contribute to the economy, preserving cultural heritage while generating income.Iranian Trade Balance: A Sign of Adaptability

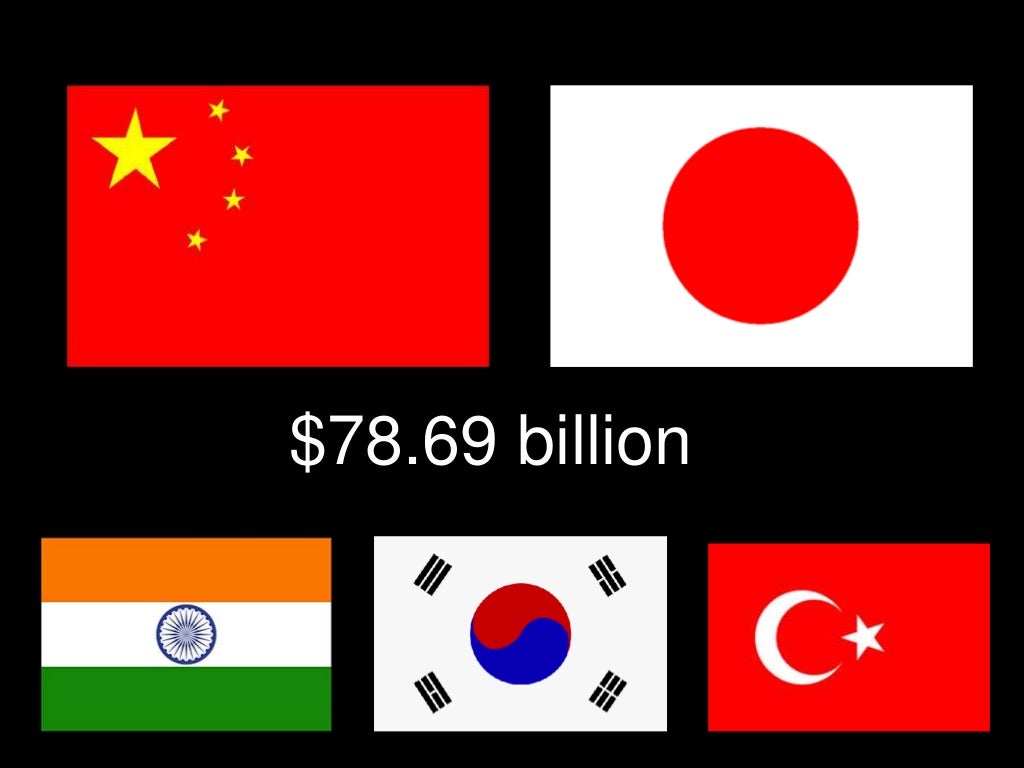

The trade balance is a critical indicator of a country's economic health and its ability to compete in international markets. For the economy of Iran, the trade balance figures, particularly in recent years, reveal a remarkable degree of adaptability and resilience in the face of persistent international sanctions. In 2023, Iran recorded a trade surplus of 28.946 billion euros (approximately 25.9119 billion USD), which accounted for 8.4% of its GDP. While this is a substantial surplus, it represents a decrease compared to the surplus achieved in 2022, which was 37.3234 billion euros (approximately 39.3015 billion USD), or 10.45% of GDP. This consistent trade surplus, even if slightly reduced, is a testament to Iran's efforts to boost non-oil exports and manage imports effectively under restrictive conditions. It suggests that despite severe limitations on its primary export (oil), Iran has managed to generate sufficient foreign currency through other means, including the export of petrochemicals, agricultural products, and industrial goods, as well as by finding creative ways to sell its oil. This ability to maintain a positive trade balance despite intense pressure underscores the complex and often clandestine nature of Iran's international economic engagements, highlighting its determination to circumvent sanctions and sustain its economy.Recent Economic Performance and Growth

The recent economic performance of Iran provides further insights into its ongoing challenges and periods of growth. While the overall picture is one of navigating deep-seated issues, there have been pockets of positive movement. The Gross Domestic Product (GDP) of Iran in 2024 grew by 3.5% compared to 2023. This growth rate, while positive, is 1.5 percentage points lower than the 5% growth recorded in 2023. These figures indicate that while the economy of Iran continues to expand, the pace of growth has somewhat moderated. Such fluctuations are typical for an economy operating under significant constraints, where growth can be sporadic and heavily influenced by external factors like changes in global oil prices or the enforcement of sanctions. The analysis of the current situation reveals that Iran's economy has undergone significant changes in recent years, primarily due to a series of sanctions and geopolitical tensions that have impacted its growth and development. The current economic situation is marked by uncertainty and the challenges the country faces. However, the reported GDP growth rates suggest that the Iranian economy possesses an underlying capacity for resilience and recovery, even if the path forward remains fraught with obstacles. This resilience is often attributed to its large domestic market, diverse economic sectors, and the government's strategic planning to mitigate the effects of external pressures.The Resilience of Iran's Economy: Looking Forward

The economy of Iran is a compelling narrative of a nation's enduring struggle for stability and prosperity amidst profound internal and external pressures. From its foundational mixed economic model with a substantial state presence to its dominant hydrocarbon sector and burgeoning industrial and agricultural capabilities, Iran presents a unique case study in economic resilience. The persistent challenges of high inflation, deep economic crises, and, most notably, the pervasive impact of international sanctions, have shaped its economic trajectory for decades. Despite these formidable obstacles, Iran has consistently demonstrated an ability to adapt and survive. The maintenance of a positive trade balance, even if fluctuating, and recent positive GDP growth rates, underscore its capacity to find pathways for economic activity. The development of its non-oil sectors, including a robust agricultural base, a growing mining industry, and a significant automotive sector, points towards a strategic effort to diversify and reduce reliance on oil, a crucial step for long-term stability. The cultural significance of events like Nowruz, the Persian New Year, also subtly reflects a deep-rooted national identity and collective resilience that permeates all aspects of life, including the economy. Looking ahead, the future of the Iranian economy will undoubtedly continue to be shaped by the interplay of geopolitical forces and internal policy decisions. The ongoing debate about the effectiveness of economic sanctions, which have prevented the formation of a strong middle class but failed to transform the regime, will remain central to its development. For businesses, policymakers, and individuals interested in global economics, understanding the nuances of Iran's economic landscape is more critical than ever. We hope this comprehensive overview has provided valuable insights into the complex and dynamic economy of Iran. What are your thoughts on Iran's economic resilience? Do you believe sanctions are effective in achieving their goals? Share your perspectives in the comments below, or explore more of our articles on global economic trends.

economia iran

Iran Budget 2024

Iran - Resources and power | Britannica