Iran's Rial: Unraveling The Complexities Of Iranian Money

Navigating the financial landscape of any nation requires a deep understanding of its currency, and for Iran, this journey is particularly intricate. The Iranian Rial, often shrouded in a veil of economic sanctions and geopolitical tensions, presents a unique case study for travelers, investors, and anyone interested in global finance. This article aims to demystify the intricacies of Iranian money, offering a comprehensive guide to its history, its current standing, and the practical realities of using it.

From its symbolic representation to its daily utility, the Iranian Rial tells a story of resilience, adaptation, and constant flux. Understanding the dynamics of Iran's currency is not merely about knowing exchange rates; it's about grasping the socio-economic fabric of a nation that operates under unique financial constraints. Join us as we explore the fascinating world of the Rial, providing insights grounded in factual data and practical advice for those interacting with this distinctive monetary system.

Understanding the Iranian Rial: A Historical Perspective

The official unit of Iranian currency is the Rial. While the symbol ﷼ is technically associated with it, it's important to note that this symbol is not in common use. Instead, you'll frequently see abbreviations like 'rl/rls' in Persian or 'ir' in Latin contexts. The currencies of Iran are issued in the form of banknotes and coins, much like any other modern economy. However, the authority behind their issuance is a crucial detail. According to the Monetary and Banking Act of Iran (MBAI), the government holds the sole authority to issue notes and coins, a right that is exclusively vested in Bank Markazi Iran (the Central Bank of the Islamic Republic of Iran), subject to the provisions of this act. This centralized control over the money supply is fundamental to understanding the economic policies and financial stability efforts within the country.

The Rial's journey through time reflects Iran's socio-political transformations. Its denominations have evolved to meet the needs of a growing economy and changing purchasing power. For instance, in the 1940s, 5-Rial denominations were introduced, followed by 10-Rial notes in the 1960s, reflecting a gradual increase in the value of transactions and the need for higher-value currency. These historical shifts provide a backdrop to the current state of Iranian money, which continues to adapt to both internal and external pressures.

The Birth of the Central Bank and Currency Evolution

A pivotal moment in the history of Iranian money occurred in 1961 with the establishment of the Central Bank of the Islamic Republic of Iran. This institution assumed the critical responsibilities for issuing money and overseeing the nation's monetary policy. Before its creation, various entities might have had a hand in currency issuance, but the formation of a dedicated central bank brought a unified and systematic approach to managing the Rial. This move was essential for modernizing Iran's financial system, enabling better control over inflation, interest rates, and the overall economic health of the nation. The Central Bank's role became even more pronounced in subsequent decades, particularly as Iran navigated periods of significant political and economic change, including the challenges posed by international sanctions.

The evolution of denominations also speaks volumes about economic trends. The introduction of larger notes like 5 and 10 Rials in the mid-20th century was a response to economic growth and increased transactional volume. Over time, as inflation became a more persistent challenge, even higher denominations would become necessary, a trend that continues to shape the physical appearance and practical use of Iranian money today. The Central Bank's ongoing efforts to manage the currency's value and availability remain a central pillar of Iran's economic strategy.

Post-Revolutionary Changes and Denominations

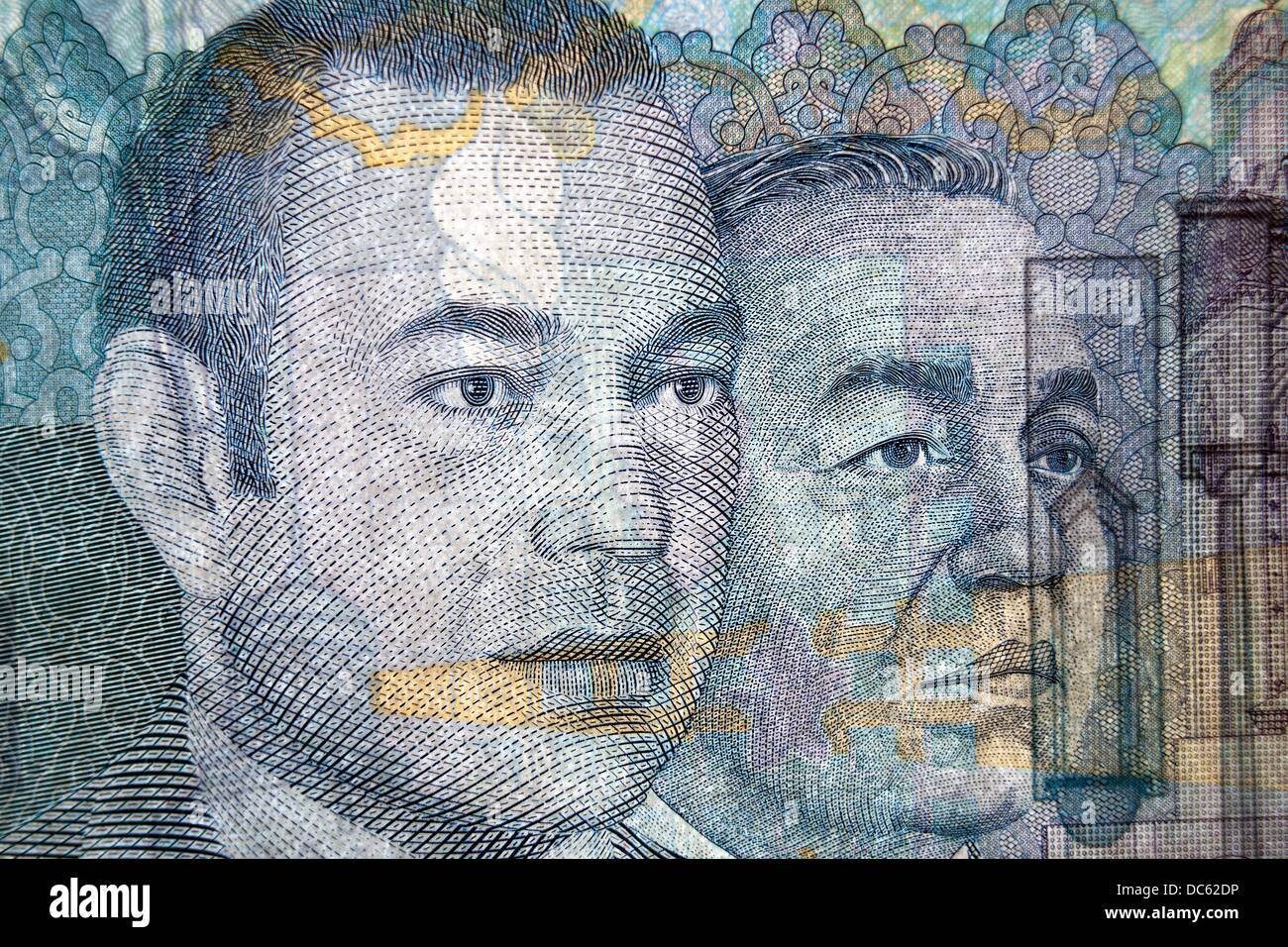

The year 1979 marked a profound turning point for Iran with the Islamic Revolution, and its impact extended directly to the nation's currency. Following the revolution, designs and seals were added over the portrait of the Shah on existing banknotes, symbolizing the new political order. This was not merely a cosmetic change; it represented a fundamental shift in the national identity and governance, which was immediately reflected in the symbols of state power, including its money. These alterations served as a visible declaration of the new Islamic Republic's authority and its break from the previous monarchy.

Beyond these initial symbolic changes, the post-revolutionary era has seen continuous adjustments to the denominations of Iranian money. While the Rial remains the official unit, the practical purchasing power of lower denominations has significantly diminished over the decades due to inflation. This has led to the common use of the "Toman" in everyday transactions, where 1 Toman equals 10 Rials. For example, if something costs 10,000 Rials, Iranians will typically say it costs 1,000 Tomans. This informal system can be confusing for foreigners but is essential for daily life in Iran. The ongoing need for higher denominations to cope with inflation is a persistent challenge, influencing everything from the size of banknotes to the very real value of money in the pockets of ordinary Iranians.

The Rial's Value in a Global Context: Exchange Rates and Tools

Understanding the true value of the Iranian Rial requires looking beyond its numerical denominations and considering its exchange rate against major global currencies. The Rial has experienced significant fluctuations, largely influenced by economic sanctions, oil prices, and geopolitical events. For anyone looking to convert currency, whether it's Mexican Pesos (MXN) to Iranian Rials (IRR) or Iranian Rials to US Dollars (USD), reliable conversion tools are indispensable. Websites like Wise (formerly TransferWise) and Xe offer real-time exchange rates, historical data, and currency charts, making it easier to analyze the evolution and current status of exchange rates. For instance, you can easily convert Iranian Rials to Mexican Pesos with real-time data or convert 1 Iranian Rial to US Dollar using their free currency converters. These platforms provide mid-market rates, which are generally the most accurate reflection of a currency's value.

However, it's crucial to remember that online rates represent the market average, and the rates you encounter in Iran, especially for cash exchanges, might differ. The exchange rate for 1 Iranian Rial to Mexican Peso today might be approximately 【﷼1 = $0.0004526】 (as per a specific date example), but this is a digital rate. The actual experience on the ground, particularly due to the unique banking situation in Iran, can be quite different. These tools also allow you to set up email alerts for exchange rate changes, which is particularly useful for tracking volatile currencies like the Rial.

Navigating Online Converters

Online currency converters are powerful tools for gaining an initial understanding of the Rial's value. Services like Wise and Xe provide comprehensive data, allowing users to convert MXN to IRR, analyze the evolution and current state of Mexican Pesos/Iranian Rials exchange rates, and even receive free email alerts on exchange rate status. You can convert 1 Iranian Rial to US Dollar, obtain live mid-market exchange rates, historical rates, and currency data and charts. These platforms make it easy to convert Iranian Rials into Mexican Pesos with real-time data. They are invaluable for planning international transactions or simply staying informed about global currency movements. However, it's vital to use these tools as a guide rather than a definitive source for cash exchange rates within Iran, as the on-the-ground reality often presents different figures due to market dynamics and sanctions.

For example, a converter might show a specific conversion rate for 1 Iranian Rial to Mexican Peso on a given day, such as Wednesday, June 11, 2025 (a future date used in the data, indicating hypothetical planning). While these "online currency conversion songs" based on exchange rates are useful, they don't always reflect the practicalities of physical cash exchange in a country under sanctions. Always check multiple sources and be aware that the actual rate you get when exchanging physical cash can vary.

The Reality of Exchange on the Ground

When you are physically in Iran, the process of exchanging money takes on a different dimension compared to what online converters might suggest. In Iran, commerce still largely relies on cash, so it is imperative to carry sufficient cash for your entire stay. The most useful foreign currencies are US Dollars and Euros, and larger denomination bills (e.g., $100 US dollars or €100 or more) are preferred and generally yield a better exchange rate. This preference for large bills is a common characteristic in economies where the local currency has depreciated significantly, and foreign currency is highly sought after.

Tourists traveling to Iran face a significant challenge: you cannot use your Visa or Mastercard credit cards to withdraw money from ATMs or for payments. This is because Iranian banks are still subject to international sanctions. Therefore, travelers must bring enough cash to cover the full duration of their stay. While official exchange offices exist, you will also see people on the street dedicated to changing money. However, this option is generally not recommended due to security concerns and potentially unfavorable rates. If you are from a country (such as small countries in Africa or South America) whose currency is not a major currency, it is advisable to convert your money into US dollars or Euros before coming to Iran. This ensures you have a readily exchangeable currency upon arrival, simplifying your financial transactions in the country.

Sanctions and Their Impact on Iranian Money

The economic sanctions imposed on Iran, particularly by the United States after the 1979 revolution, have profoundly shaped the landscape of Iranian money. These sanctions have isolated Iran from the global financial system, making international banking transactions exceptionally difficult. The inability of tourists to use credit cards like Visa or Mastercard in Iran is a direct consequence of these restrictions, as Iranian banks are cut off from the international payment networks. This forces a cash-based economy for visitors and complicates financial dealings for residents.

The sanctions also play a critical role in how Iran uses its financial resources. When funds are released, as in the case of the five Americans who were imprisoned in Iran and later freed as part of a broader agreement between the United States and Iran, the conditions for their use are often highly scrutinized. The US government, for instance, often stipulates that such money can only be used for "food, medicine, agriculture, and payments to third parties" for humanitarian purposes. However, Iranian officials, including President Ebrahim Raisi, have repeatedly stated that they will spend the money "as we need" or "as we want," indicating a divergence in interpretation and control over these funds. This tension highlights the ongoing struggle over financial sovereignty and the impact of sanctions on Iran's ability to manage its own economy. The research by UDEF, for instance, tracking the millionaire movement of money received by a society chaired by Iranian citizen Alizadeh Azimi Mahmoud since 2012 from various sources, underscores the complex and often opaque nature of financial flows under sanctions, as entities seek alternative channels for transactions.

Practical Advice for Travelers: Managing Cash in Iran

For any traveler planning a trip to Iran, understanding the unique financial environment is paramount. As previously mentioned, Iran remains largely a cash-based society, a direct consequence of the ongoing international sanctions that restrict access to global banking networks. This means your Visa or Mastercard will be virtually useless for withdrawing money from ATMs or making purchases. Therefore, the most crucial piece of advice is: bring enough physical cash to cover your entire stay. This cannot be stressed enough, as unexpected expenses can arise, and you won't have the convenience of a card to fall back on.

When it comes to the type of currency to bring, US Dollars and Euros are by far the most useful and widely accepted. Furthermore, larger denomination bills, such as $100 US dollars or €100 or more, are preferred by money changers and generally yield a better exchange rate. This is because larger bills are easier to verify and handle for money exchangers, and they carry a higher perceived value. While you might encounter individuals on the street offering to change money, this option is generally not recommended due to potential risks of fraud or unfavorable rates. It's always safer to use official exchange offices or reputable money changers, often found near bazaars or in major city centers. If you are from a country with a less commonly exchanged currency, it is highly advisable to convert your funds into USD or EUR before arriving in Iran to ensure a smooth and efficient exchange process upon your arrival. Planning your finances meticulously before your trip will significantly enhance your travel experience in Iran.

Sending Money to Iran: Challenges and Possibilities

Sending money to Iran can be particularly challenging, depending on your current location and the specific regulations governing financial transactions with the country. The United States imposed sanctions on Iran after the 1979 revolution, and these sanctions have created a complex legal and practical environment for money transfers. While the US government generally maintains the discretion to permit transfers of money to loved ones in Iran, especially for humanitarian purposes, the actual process can be arduous and fraught with restrictions. This often involves navigating specific licenses or exemptions, and not all financial institutions are willing or able to facilitate such transfers due to the high compliance burden and risk associated with Iranian transactions.

Despite these difficulties, certain avenues exist for sending funds. Some specialized money transfer agencies or informal networks might facilitate transfers, though their legality and reliability can vary. When such transfers are possible, the cost might not exceed 0.5% of the transferable amount, subject to a personalized maximum limit, making it relatively affordable if a channel is found. Furthermore, some agencies claim remarkably fast transfer durations, with almost all money transfer agencies assuring fund transfers of less than five minutes to recipients in Iran. However, these claims must be viewed with caution and verified with the specific provider, as the overall process from initiation to receipt can still be lengthy due to intermediary steps and regulatory checks. It's crucial to research thoroughly and use only trusted, verified services to avoid scams and ensure compliance with international regulations when attempting to send money to Iran.

The Geopolitical Dance: How Global Events Shape the Rial

The value and stability of the Iranian Rial are inextricably linked to geopolitical events and international relations. The intricate dance between global powers and Iran often sends ripples through the country's economy, directly impacting its currency. For instance, headlines like "Wall Street falls due to Trump's threats to Iran" illustrate how heightened tensions with Iran can affect the stock market, even far beyond its borders. Such geopolitical friction creates uncertainty, which in turn can lead to capital flight, reduced foreign investment, and a depreciation of the local currency.

Moreover, the price of oil, a cornerstone of Iran's economy, is another significant factor. When the price of oil rises, it generates an impact on basic products and services, both within Iran and globally. For Iran, higher oil prices generally mean increased revenue, which can theoretically strengthen the Rial. Conversely, a drop in oil prices, often influenced by global supply and demand or political maneuvers, can severely strain Iran's economy and put downward pressure on its currency. The interplay of sanctions, oil revenues, and international political rhetoric creates a highly volatile environment for the Iranian Rial, making it one of the most sensitive currencies to global events. This constant state of flux means that the "money today" in Iran is always a reflection of broader geopolitical currents, far beyond simple economic indicators.

The Human Element: Daily Life and the Rial's True Value

Beyond the charts and exchange rates, the true value of Iranian money is experienced in the daily lives of its people. The phrase "in this video we will talk about money, the strange way things have to be paid here in Iran and how much money is really worth here" perfectly encapsulates the unique reality of financial transactions in the country. Due to high inflation and the informal use of "Toman" (where one Toman equals ten Rials), navigating prices can be confusing for newcomers. Locals often quote prices in Tomans, while banknotes are denominated in Rials, requiring a mental conversion for every transaction. This constant mental arithmetic highlights the practical challenges faced by ordinary Iranians in their daily economic activities.

The impact of economic pressures on daily life is profound. When the value of the Rial fluctuates, it directly affects the purchasing power of families, making essential goods and services more expensive. The ongoing debate about how released funds are spent – whether for "food, medicine, agriculture, payments to third parties" as stipulated by some international bodies, or "as we need" as asserted by Iranian officials – directly touches upon the welfare of the Iranian populace. Iranians have repeatedly stated that they will spend the money as they want, reflecting a desire for national autonomy over economic resources. This struggle over financial control and the constant adaptation to economic realities define the human element of Iranian money, where its true worth is measured not just in exchange rates, but in its ability to provide for basic needs and aspirations.

The Future of Iran's Currency: Challenges and Outlook

The future of the Iranian Rial is inherently tied to the resolution of geopolitical tensions and the efficacy of domestic economic policies. The currency faces significant challenges, primarily stemming from persistent inflation, the impact of international sanctions, and the need for greater integration into the global financial system. While the Central Bank of Iran continues its efforts to stabilize the Rial and manage the money supply, external pressures often dictate its trajectory. The ongoing fluctuations in the Rial's value necessitate constant monitoring, with real-time information on the Iranian Rial (IRR) exchange rates against over 120 world currencies being crucial for businesses and individuals alike.

Looking ahead, any significant shift in the Rial's stability would likely depend on breakthroughs in international diplomacy, particularly regarding the nuclear deal and the lifting of sanctions. Such developments could potentially lead to increased foreign investment, greater access to international banking, and a more stable economic environment. Domestically, efforts to diversify the economy beyond oil, curb inflation, and implement structural reforms will also play a vital role in strengthening the Rial. However, until these fundamental issues are addressed, the Iranian Rial will likely continue to operate under unique constraints, requiring careful navigation and a keen understanding of its complex dynamics for anyone engaging with Iran's financial landscape.

Conclusion

The Iranian Rial is far more than just a unit of currency; it is a barometer of Iran's complex history, its economic resilience under pressure, and its ongoing relationship with the global community. From its origins and the establishment of the Central Bank to the profound impact of post-revolution changes and international sanctions, the Rial's journey reflects a nation constantly adapting to unique circumstances. For travelers, understanding the cash-based reality and the importance of bringing major foreign currencies like USD or EUR is paramount. For those looking to send or receive money, navigating the intricate web of sanctions and specialized transfer services requires careful research and adherence to regulations.

The Rial's value is not merely determined by economic fundamentals but is heavily influenced by geopolitical events and the delicate balance of international relations. Ultimately, the true worth of Iranian money is felt in the daily lives of its citizens, who navigate inflation and unique payment systems with remarkable resilience. As Iran continues to chart its economic course, the Rial will remain a fascinating subject, embodying the challenges and aspirations of a nation. We hope this comprehensive guide has provided you with valuable insights into the world of Iranian money. Do you have experiences with the Iranian Rial or further questions? Share your thoughts in the comments below, or explore our other articles for more insights into global currencies and economies.

- Tyreek Hill Hight

- Sahara Rose Ex Husband

- Noarmsgirl Only Fans

- How Tall Is Tyreek Hill

- Terry Leslie Mcqueen

Plano de dinero hi-res stock photography and images - Alamy

Consejos: Como Conseguir Dinero Al Instante

Imagen gratis: monedas, metal, pilas, dinero, Rica, fortuna, Penny