Did The US Pay Iran? Unraveling The Complex Financial Ties

The question, "did the US pay Iran?" often surfaces in discussions about international relations, sparking intense debate and often, misinformation. It's a query that touches upon sensitive geopolitical issues, including nuclear proliferation, hostage diplomacy, and the intricate web of global finance. To truly understand the nature of these financial transactions, we must delve beyond sensational headlines and examine the specific contexts, historical debts, and international agreements that shaped them.

This article aims to provide a comprehensive, nuanced, and fact-based exploration of the various financial dealings between the United States and Iran, separating myth from reality. We will dissect the major instances where funds moved or were unfrozen, clarifying whether these were "payments" in the traditional sense, the release of Iran's own assets, or settlements of long-standing disputes. Our goal is to equip you with a clear understanding of these complex events, grounded in verifiable information and expert insights.

Table of Contents

- Setting the Stage: The US-Iran Relationship

- The Nuclear Deal: JCPOA and its Financial Implications

- The $1.7 Billion Payment: A Historical Debt, Not Ransom?

- The 2023 Prisoner Swap: The $6 Billion Controversy

- Hostage Diplomacy and its Implications

- US Sanctions: The Other Side of the Coin

- The Broader Geopolitical Chessboard

- The Nuance of "Paying" Iran

Setting the Stage: The US-Iran Relationship

To fully grasp the intricacies of whether the US paid Iran, it's essential to understand the historical context of the relationship between these two nations. For decades, particularly before the 1979 Islamic Revolution, Iran was a crucial strategic partner for the United States in the Middle East. In the 1960s and 1970s, Iran was the largest partner of the U.S. Foreign Military Sales (FMS) program. This extensive military cooperation involved significant financial transactions, with Iran purchasing vast quantities of advanced weaponry and equipment from the United States. These sales often involved upfront payments, deposits, and various financial arrangements that would later become central to disputes after the revolution.

- Corde Broadus

- When Did Jennifer And Brad Divorce

- Aitana Bonmati Fidanzata

- Aja Wilson Boyfriend

- Arikystsya Leaked

The overthrow of the Shah and the establishment of the Islamic Republic dramatically altered this dynamic. The new Iranian government quickly adopted an anti-American stance, leading to the seizure of the U.S. embassy in Tehran and the subsequent hostage crisis. In response, the United States froze billions of dollars in Iranian assets held in U.S. banks and institutions. This freeze, initially a punitive measure, laid the groundwork for future financial negotiations and claims, creating a complex legal and economic entanglement that would persist for decades. Understanding this historical backdrop is key to deciphering later "payments" or asset releases, as they often stemmed from these pre-existing financial claims rather than new aid or direct transfers.

The Nuclear Deal: JCPOA and its Financial Implications

One of the most significant moments in recent US-Iran financial history revolves around the Joint Comprehensive Plan of Action (JCPOA), commonly known as the Iran nuclear deal. In 2015, as part of an international deal with Iran called the Joint Comprehensive Plan of Action, Iran agreed to cut back on nuclear activities in exchange for sanctions relief. This agreement, negotiated by the P5+1 (the five permanent members of the UN Security Council—China, France, Russia, the United Kingdom, and the United States—plus Germany) and the European Union, aimed to prevent Iran from developing nuclear weapons. A central component of the deal was the lifting of international sanctions, which had severely crippled Iran's economy and isolated it from the global financial system.

The lifting of sanctions had a profound effect. The JCPOA infused Iran with cash, as its access to previously frozen funds and international markets was restored. Right before the United States reimposed sanctions in 2018, Iran’s central bank controlled more than $120 billion in foreign exchange reserves. This was not money "given" by the US, but rather Iran's own assets that had been held in banks around the world due to sanctions. The release of these funds allowed Iran to re-engage with the global economy, conduct international trade more freely, and access its own revenue from oil sales and other exports. The perception that the US "paid Iran" through the JCPOA often conflates the unfreezing of Iran's own assets with direct financial aid, which is a crucial distinction.

Debunking the $150 Billion Myth

A persistent misconception surrounding the JCPOA is the claim that the United States gave Iran $150 billion. This figure gained traction, particularly during the Trump administration, with former President Donald Trump stating that the nuclear deal with Iran gave the country $150 billion, including $1.8 billion from the United States in cash. While the $150 billion is the highest estimate we've seen, and the one often cited, it's important to clarify its nature. The United States did not give $150 billion to Iran in 2015. This figure, often quoted, represented the estimated total value of Iran's frozen assets worldwide that became accessible after sanctions were lifted as part of the JCPOA. These were Iran's own funds, primarily from oil revenues, held in foreign banks and inaccessible due to international sanctions. The US facilitated the unfreezing of these assets by lifting its own sanctions, but it did not directly transfer this amount from its own treasury to Iran.

The $1.7 Billion Payment: A Historical Debt, Not Ransom?

Beyond the unfreezing of assets, another significant financial transaction that has often led to the question "did the US pay Iran?" is the $1.7 billion payment made in 2016. After implementation of the Iran deal, the United States sent $1.7 billion to Iran. This payment was a settlement of a long-standing financial dispute related to military equipment purchased by Iran before the 1979 revolution. By January 2016, the countries had struck a deal—the US would pay Iran $1.7 billion, which amounts to about $300 million in interest on top of the originally frozen assets (accounting for inflation and lost interest over decades).

The payment consisted of an initial $400 million, which was Iran's money held in a U.S. trust fund since 1979. This fund was established to pay for military equipment that Iran had purchased but never received due to the revolution and the subsequent freezing of assets. The remaining $1.3 billion represented accumulated interest on that original $400 million, calculated over 36 years. The Obama administration allowed $1.7 billion in cash to go to Iran earlier this year, a move that drew significant criticism, with some now claiming this was a ransom payment for the return of American citizens that were being held hostage by Iran. However, the U.S. government maintained that the payment was solely the resolution of a legitimate financial claim at the Iran-U.S. Claims Tribunal in The Hague, an international court established to resolve financial disputes between the two countries.

The Context of Frozen Assets

To fully appreciate the $1.7 billion payment, it's crucial to understand the context of the frozen assets. When the Iranian revolution occurred in 1979, the United States froze approximately $12 billion in Iranian assets, including military equipment, bank deposits, and other properties. This was a direct response to the hostage crisis at the U.S. embassy in Tehran. Over the years, many of these claims were adjudicated through the Iran-U.S. Claims Tribunal. The $400 million was part of a larger sum Iran had paid into a Pentagon trust fund for military equipment that was never delivered after the Shah was overthrown and diplomatic ties were severed. The payment was not a new transfer of U.S. taxpayer money to Iran but rather the return of Iran's own funds, plus interest, as determined by an international legal process. The decision to make this payment in cash, rather than through electronic transfers, was cited by Treasury Department spokeswoman Dawn Selak, who said in a statement the cash payments were necessary because of the “effectiveness of U.S. and international sanctions,” which isolated Iran from the international finance system, making traditional banking channels difficult or impossible to use.

The 2023 Prisoner Swap: The $6 Billion Controversy

More recently, the question of "did the US pay Iran" re-emerged with significant intensity surrounding a prisoner swap in September 2023. The United States announced an agreement with Iran to secure freedom for five U.S. citizens who’d been detained in the country in exchange for allowing Iran to access $6 billion of its own assets. This deal saw five Americans jailed for years in Iran and widely regarded as hostages on their way home to the United States. The last pieces in a controversial swap mediated by Qatar fell into place when the funds were moved.

In return, five Iranians held in the United States were also allowed to leave, and—crucially—$6 billion in previously frozen Iranian assets was freed up. It is vital to underscore that this $6 billion was not a payment from the U.S. treasury. It was Iran's own money, specifically revenue from oil sales, that had been held in South Korean banks due to U.S. sanctions. The $6 billion was transferred out of South Korea when U.S. waivers allowed it. The money was transferred to Qatar, a Middle East nation that sits across the Persian Gulf from Iran, to be held in restricted accounts.

Why Cash Payments? The Sanctions Factor

The method of transferring funds, particularly the use of cash in some instances or transfers via third countries, often raises questions. As Treasury Department spokeswoman Dawn Selak said in a statement, the cash payments were necessary because of the “effectiveness of U.S. and international sanctions,” which isolated Iran from the international finance system. When a country is heavily sanctioned, its ability to conduct transactions through conventional banking channels is severely limited. This forces alternative methods, which can appear less transparent but are often the only viable way to move funds in such circumstances. The $6 billion transfer to Qatar, for instance, was a direct result of these financial restrictions, ensuring the money could be moved without directly violating existing sanctions.

Controls and Concerns Over the $6 Billion

Despite the U.S. government's assertion that the $6 billion was Iran's own money, concerns were immediately raised about how Iran might use these funds. To address these concerns, the U.S. and Qatari governments have agreed to block Iran from accessing any of the $6 billion it gained access to as part of a prisoner swap deal for purposes other than humanitarian aid. This means the funds are held in a restricted account in Qatar and can only be used for approved humanitarian purposes, such as purchasing food, medicine, or agricultural products, with strict oversight. The U.S. Treasury Department emphasized that the funds would not be available to the Iranian regime for any other use, including military or nuclear programs. This control mechanism aims to mitigate fears that the unfreezing of assets could directly fund illicit activities, although critics remain skeptical about the enforceability of such restrictions.

Hostage Diplomacy and its Implications

The financial transactions between the U.S. and Iran, particularly the $1.7 billion payment in 2016 and the $6 billion asset release in 2023, have been inextricably linked to the issue of American citizens detained in Iran. Five Americans jailed for years in Iran and widely regarded as hostages were on their way home to the United States as part of the 2023 swap. This connection has led many to characterize these financial movements as "ransom payments." Indeed, the Iran deal included a ransom payment for hostages, according to some interpretations of the facts.

While the U.S. government consistently denies paying ransom, arguing that these were either settlements of legal claims or the release of Iran's own restricted funds, the timing of these financial actions coinciding with the release of detainees creates a strong perception of quid pro quo. Critics argue that such arrangements incentivize Iran to continue detaining foreign nationals for leverage. This delicate balance between securing the freedom of unjustly held citizens and avoiding the appearance of paying ransom is a persistent challenge in U.S. foreign policy, making the question of "did the US pay Iran" a highly charged one.

US Sanctions: The Other Side of the Coin

It's impossible to discuss financial dealings between the US and Iran without acknowledging the pervasive role of U.S. sanctions. These sanctions are a primary tool of U.S. foreign policy aimed at pressuring Iran over its nuclear program, support for terrorism, and human rights abuses. Right before the United States reimposed sanctions in 2018, Iran’s central bank controlled more than $120 billion in foreign exchange reserves. However, with the U.S. withdrawal from the JCPOA under the Trump administration and the re-imposition of "maximum pressure" sanctions, Iran's access to these funds and the global financial system was once again severely curtailed.

The effectiveness of these sanctions is precisely why the financial transactions discussed earlier are so complex. They create a situation where conventional banking is impossible, necessitating alternative mechanisms for any legitimate financial dealings, such as settling historical debts or facilitating humanitarian trade. Furthermore, following the release of the Americans in 2023, the U.S. issued new sanctions against Iran targeting Tehran’s Ministry of Intelligence and former Iranian President Mahmoud Ahmadinejad. This illustrates the ongoing U.S. strategy of applying financial pressure even while engaging in specific, limited financial transactions for diplomatic purposes, highlighting the multi-faceted nature of their relationship.

The Broader Geopolitical Chessboard

The financial relationship between the US and Iran is not an isolated phenomenon but part of a much larger and volatile geopolitical chessboard in the Middle East. Every financial transaction, every sanction, and every diplomatic maneuver is viewed through the lens of regional power dynamics and international security. For instance, Israel's stunning and sprawling operation overnight targeting Iran's nuclear facilities, missile sites, scientists, and generals followed eight months of intensive clandestine preparations. Such operations, often covert, highlight the intense efforts by regional and international actors to counter Iran's strategic capabilities, particularly its nuclear ambitions. The operation launched a new war in the Middle East that could draw in the U.S., demolished any hopes of a nuclear deal, and dealt arguably a significant blow to Iran's program.

The constant tension and occasional overt actions by various parties underscore the precarious nature of stability in the region. The financial dealings, whether seen as concessions or pragmatic solutions, are always scrutinized for their potential impact on Iran's regional influence, its military capabilities, and its nuclear program. This broader context is crucial for understanding why the question "did the US pay Iran" evokes such strong reactions and why the details of these financial transfers are subject to intense debate and political interpretation.

The Nuance of "Paying" Iran

So, did the US pay Iran? The answer is nuanced and depends entirely on how one defines "pay."

- The $1.7 Billion: This was a settlement of a historical debt. The US returned Iran's own money, plus interest, that had been held in a trust fund for military equipment purchased by the Shah's government before the 1979 revolution. It was a resolution of a legal claim, not a new financial gift or aid. While the timing coincided with prisoner releases, the U.S. government maintains it was a separate legal obligation. Donald Trump is right on this one, in the sense that the Obama administration allowed $1.7 billion in cash to go to Iran, but the context of it being a debt repayment is critical.

- The $6 Billion: This was the unfreezing and transfer of Iran's own oil revenues, previously held in South Korean banks due to sanctions. The U.S. facilitated its transfer to a restricted account in Qatar, where it is intended for humanitarian use only. Again, this was not money from the U.S. treasury but Iran's own assets.

- The $150 Billion: This figure refers to the total estimated value of Iran's global assets that became accessible after international sanctions were lifted as part of the JCPOA. The U.S. did not transfer this amount; it merely allowed Iran to access its own money by lifting its sanctions.

In essence, the United States has not given Iran direct financial aid or "payments" from its treasury in the way one might typically understand foreign aid. Instead, the financial transactions have involved:

- The resolution of long-standing legal debts.

- The unfreezing of Iran's own assets that were held captive by international sanctions.

The question "did the US pay Iran" is a complex one, steeped in decades of history, international law, and high-stakes diplomacy. While the U.S. has facilitated the release of Iran's own frozen assets and settled historical debts, these actions are distinct from direct financial aid or "ransom payments" as often portrayed. By understanding the specific contexts of the $1.7 billion settlement and the $6 billion asset release, we can gain a clearer picture of these intricate financial dealings. It's a relationship defined by sanctions, negotiations, and the persistent pursuit of national interests on both sides.

We hope this comprehensive breakdown has shed light on this frequently misunderstood topic. What are your thoughts on these financial transactions and their implications? Share your perspective in the comments below, and don't forget to explore our other articles on international relations and geopolitical developments.

Trump’s Iran tweet and THE LONG HISTORY OF SHOUTING IN ALL CAPS - The

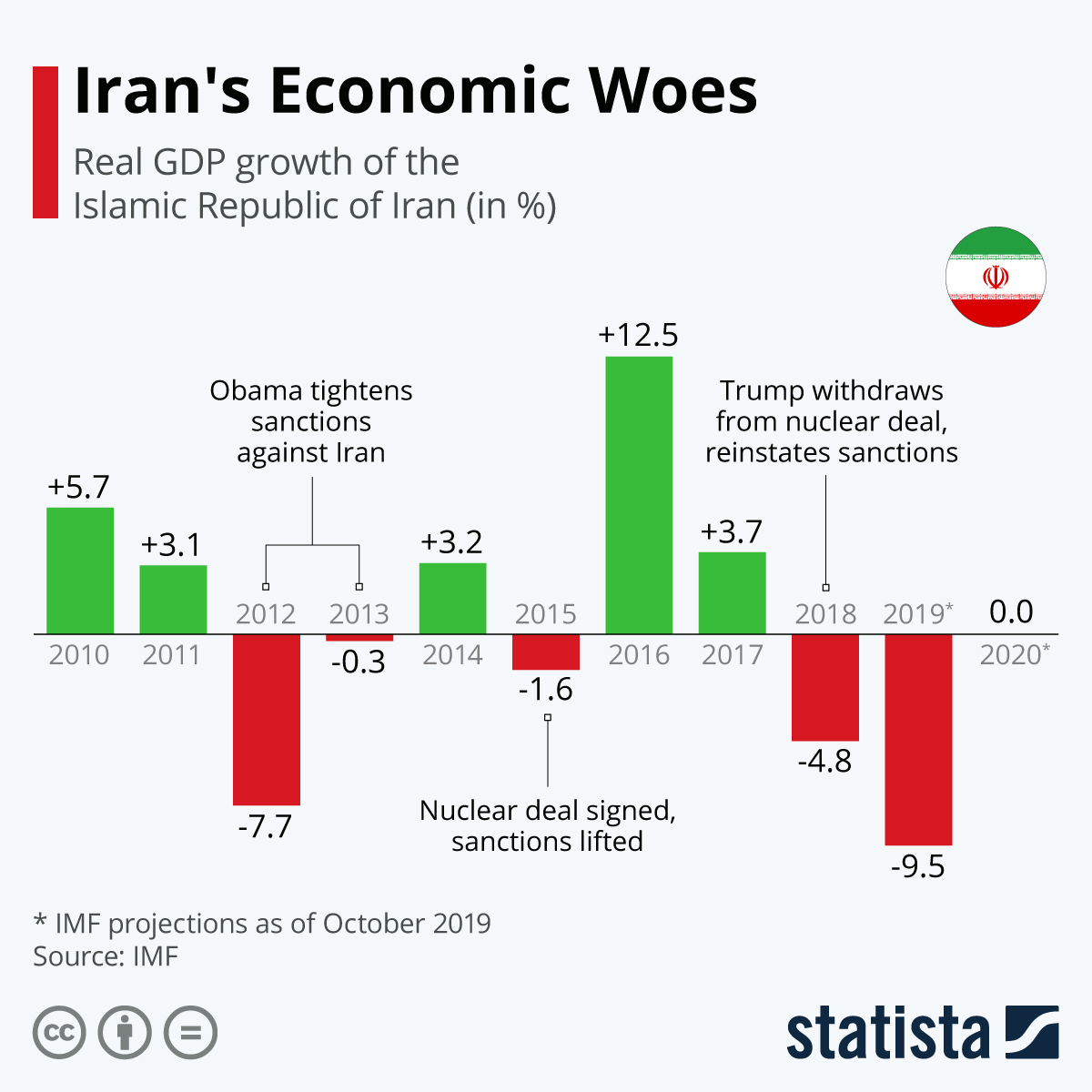

Chart: Iran's Economic Woes | Statista

Republicans slam Biden’s deal to free Americans in Iran as ‘appeasement