Iran's Currency Unveiled: Rial Vs. Toman Explained

Navigating the intricacies of a foreign currency can often be one of the most perplexing aspects of international travel or business. When it comes to Iran, this challenge is amplified by a unique dual-currency system that can leave even seasoned travelers and investors scratching their heads. Understanding Iran's official currency, the Rial, and its commonly used counterpart, the Toman, is crucial for anyone engaging with the country's vibrant culture and economy. This comprehensive guide aims to demystify the Iranian monetary system, providing clarity on its history, current usage, and the economic factors that shape its value.

From the bustling bazaars of Tehran to the ancient ruins of Persepolis, the question of "What is the official currency of Iran?" often arises. While the answer might seem straightforward on paper, the reality on the ground presents a fascinating interplay between official denominations and everyday linguistic convenience. This article will delve into the nuances of the Iranian Rial (IRR), explore the pervasive use of the Toman, and shed light on the economic forces, including international sanctions, that have shaped Iran's monetary landscape.

Table of Contents

- The Official Currency of Iran: The Iranian Rial (IRR)

- The Toman: Iran's Everyday Currency

- A Brief History of Iranian Currency

- The Impact of Inflation and International Sanctions

- Navigating Iranian Currency as a Traveler

- The Rial's Place in the Global Economy

- Key Takeaways for Understanding Iran's Money

The Official Currency of Iran: The Iranian Rial (IRR)

At its core, the official currency of Iran is the Rial (ریال in Persian), formally known as the Iranian Rial, with the ISO 4217 code IRR. This is the legal tender recognized by the government and used for all official transactions across the country. You will find the Rial printed on all banknotes, minted on coins, and used in official documents, bank receipts, and any formal currency exchange. The Central Bank of the Islamic Republic of Iran is the sole authority responsible for issuing and regulating the Iranian Rial, ensuring its circulation and maintaining the nation's banking system. No other bank or entity has the authority to issue this currency.

Historically, the Rial was introduced as the official currency in 1932, replacing the Toman as the primary unit of account. It is theoretically divided into 100 subunits called dinars. However, due to the Rial's significantly low value, these fractional units are rarely, if ever, used in daily transactions. The concept of a "dinar" remains largely a historical footnote in practical terms, with the smallest circulating coin, at one point, being the 50-dinar coin, which ceased to be a significant part of the monetary cone long ago.

Understanding the Rial's Denominations and Divisions

The Iranian Rial is minted in various denominations to facilitate transactions. Currently, coins are typically found in denominations of 10, 50, 100, 500, 1,000, 2,000, and 5,000 Rials. Banknotes are issued in much higher denominations, reflecting the currency's low purchasing power and the impact of inflation over the years. The importance of Iran's coins extends beyond their monetary value; they are an important part of the country's rich history and culture, often featuring significant national symbols or figures.

Throughout history, the composition and size of these coins have changed. For instance, in 1944, silver coin mintings saw a reduction in their size. That same year also marked the cessation of production for coins valued less than 25 dinars. In 1945, 10-rial silver coins were introduced, but by 1953, silver was no longer used in coin manufacturing, a period when the 50-dinar coin was considered the smallest unit in the monetary system. These shifts highlight the evolving economic conditions and resource availability within Iran over the decades.

- Noarmsgirl Only Fans

- How Tall Is Al Pacino In Feet

- Downloadhubcontect

- How Tall Is Tyreek Hill

- Shyna Khatri New Web Series

The Central Bank's Role in Issuing the Rial

The Central Bank of the Islamic Republic of Iran stands as the bedrock of the nation's financial system. As the sole issuer of the Iranian Rial, it holds immense responsibility for monetary policy, currency stability, and the overall health of the economy. This institution is not merely a bank but also the banking system of the government, tasked with managing the country's reserves, controlling inflation, and ensuring the smooth flow of financial transactions. The Rial is issued and regulated exclusively by this central authority, making it the only legitimate source of currency in Iran.

The bank's decisions directly influence the value and availability of the Rial. In an economy often subject to external pressures and internal challenges, the Central Bank's role becomes even more critical. Its actions determine the denominations of banknotes and coins, the timing of their issuance, and strategies to mitigate economic volatility. The integrity of the national currency, the Rial, rests squarely on the shoulders of this powerful institution, which strives to maintain confidence in Iran's monetary system despite the prevailing economic climate.

The Toman: Iran's Everyday Currency

While the Iranian Rial is the official currency, anyone visiting Iran or engaging in daily transactions will quickly discover that the Toman is the currency unit predominantly used by Iranians in their everyday lives. This can be a source of considerable confusion for travelers. Prices in shops, restaurants, and markets are almost always quoted in Tomans, and people will discuss payments in Tomans, even though the physical banknotes and coins are denominated in Rials. The conversion is straightforward: one Toman equals ten Rials. So, if a merchant tells you something costs 23,000 Tomans, they are referring to 230,000 Rials.

This dual system is deeply ingrained in Iranian culture and daily commerce. It's not merely a preference but a practical necessity born out of economic realities. The use of the Toman simplifies transactions by effectively removing a zero from the end of Rial figures, making large numbers more manageable to articulate and comprehend. This informal practice has become so widespread that it is more common to hear prices quoted in Tomans than in Rials, despite the latter being the legal tender printed on all currency.

Why the Toman? Bridging the Gap of Inflation

The primary reason for the widespread adoption of the Toman in daily life is severe inflation. Over the years, the Iranian Rial has experienced significant devaluation, leading to very large numerical values for even small purchases. For instance, an item that might cost 20,000 Rials becomes 2,000 Tomans, which is much easier to say and process mentally. This informal redenomination helps to streamline verbal communication in an economy where the official currency has many zeros.

The Toman was, in fact, the official currency in Iran until the adoption of the Iranian Rial. Its continued use in common parlance serves as a historical echo and a practical solution to the challenges posed by high inflation. While the Rial is the currency seen on official bills, receipts, and bank documents, the Toman is the term that truly reflects the purchasing power understood by the average Iranian. This distinction is vital for travelers and anyone looking to conduct business in Iran, as misinterpreting prices can lead to significant overpayment or confusion.

A Brief History of Iranian Currency

Iran, a country situated in the Middle East, is renowned for its rich history, culture, and complex economy, all of which are reflected in its monetary evolution. The history of Iranian currency is a fascinating journey that mirrors the nation's political and economic transformations. Before the Rial, the Toman held the official status as Iran's currency. This historical lineage explains why the Toman remains so deeply embedded in the public consciousness and daily transactions, even after its official replacement.

The Iranian Rial was officially introduced as the country's legal tender in 1932, marking a significant shift in the monetary system. This change aimed to modernize and standardize the currency in line with international practices of the time. However, the transition didn't completely erase the Toman from public use. Instead, it created a unique situation where the new official currency coexisted with the popular, unofficial unit of account, a dynamic that continues to define Iran's monetary landscape today.

From Toman to Rial and Back Again (in common usage)

The journey from Toman to Rial and its subsequent re-emergence in everyday conversation is a testament to the resilience of popular custom in the face of official decree. When the Rial became the official currency, it was intended to be the sole unit of account. However, as the Rial's value depreciated over time, the Toman naturally reasserted itself as a more convenient unit for daily pricing due to its simpler numerical representation (one Toman equals ten Rials). This informal redenomination became a practical necessity to manage the increasing number of zeros on price tags.

The constant battle against inflation meant that people found it easier to drop a zero from the Rial amount and refer to it as a Toman. This phenomenon is a unique aspect of Iran's economy, where the official currency (Rial) and the commonly used term (Toman) diverge. This historical evolution underscores the adaptive nature of economic practices in response to persistent inflationary pressures, making the understanding of both terms essential for anyone interacting with the Iranian economy.

The Impact of Inflation and International Sanctions

The Iranian Rial's value has been significantly impacted by a combination of high domestic inflation and stringent international sanctions. These sanctions, particularly those imposed by major global economies like the United States and the European Union in the 21st century, primarily stemming from Iran's nuclear program, have severely exacerbated the currency's depreciation. For instance, the data indicates that the Rial lost a staggering 21% of its value in 2018 alone, a clear indicator of the immense pressure on the currency. This continuous devaluation is the primary driver behind the common practice of quoting prices in Tomans, as it simplifies communication by reducing the number of zeros.

The sanctions have isolated Iran from the global financial system, limiting its access to foreign exchange markets and making it difficult to trade its currency freely. This situation contributes to the Iranian Rial being largely a non-convertible currency, meaning it is not freely traded on the world's foreign exchange markets. The inability to freely exchange the Rial globally further complicates international trade and investment, contributing to the economic challenges faced by the country. Despite these hurdles, Iran's GDP was reported at $1.08 billion in 2021, with an expected increase to $1.14 billion in 2022, indicating some level of economic activity persists amidst the pressures.

Navigating Iranian Currency as a Traveler

For travelers, understanding the Iranian currency can initially be quite confusing. Many visitors are unaware that Iran effectively operates with two currency names: the official Rial and the commonly used Toman. It is absolutely crucial for travelers to grasp the difference between Toman and Rial to avoid misunderstandings and potential overpayments. When you are in the country, you will hear prices quoted in Tomans far more frequently than in Rials. Remember, the conversion is simple: 1 Toman equals 10 Rials.

For example, if a taxi driver says the fare is "20,000 Tomans," they are asking for 200,000 Rials. Always clarify if unsure, asking "Rial or Toman?" or confirming the number of zeros. Due to the sanctions, international credit and debit cards are generally not accepted in Iran, making cash king. Therefore, it is essential to carry sufficient cash for your entire trip. While you can exchange Iranian Rials when currency markets are open (24 hours a day, 5 days a week, opening Monday morning in Sydney and closing Friday at 5 PM New York time), it's advisable to exchange a good portion of your money upon arrival to avoid inconvenience. Websites like Uppersiaviaje.com often provide up-to-date information on Iranian currency for travelers.

The Rial's Place in the Global Economy

The Iranian Rial, designated with the symbol "IRR" and ISO code 4217, occupies a unique and somewhat isolated position in the global financial landscape. Unlike major currencies such as the US Dollar, which has long been a pillar of the world economy and a basis for global exchange rates and quotations, the Rial is largely a non-convertible currency. This means it is not freely traded on international foreign exchange markets. The lack of an official symbol for the Rial further underscores its limited international presence, though Iran uses the word "ریال" itself as its identifier, and the Iranian standard ISIRI 820 defined a symbol for use in typewriters, with ISIRI 2900 and ISIRI 3342 defining a character code for it.

The restrictions on its convertibility are primarily due to the international sanctions and the country's managed exchange rate system. While you can buy, sell, and exchange Iranian Rials within the country or through specific channels where foreign exchange markets are open, its role in global trade and finance is significantly curtailed. This contrasts sharply with currencies like the US Dollar, the official currency of the United States of America, which serves as a benchmark for countless international transactions. The Rial's limited global reach is a direct consequence of Iran's economic and political circumstances, making it primarily a domestic currency rather than a global player.

Key Takeaways for Understanding Iran's Money

Understanding Iran's currency system, centered around the Iranian Rial and the commonly used Toman, is crucial for anyone engaging with the country, whether as a traveler or an investor. The official currency of Iran is the Rial, which is printed on all physical money and used in official documents. However, due to persistent inflation, Iranians predominantly use the Toman in daily conversations and transactions, where 1 Toman equals 10 Rials. This dual system, while initially confusing, becomes intuitive once the simple conversion is understood.

The Central Bank of Iran is the sole issuer of the Rial, overseeing its denominations and regulating the nation's banking system. The currency's history reflects significant economic shifts, including the impact of international sanctions that have led to considerable devaluation and limited its global convertibility. For visitors, carrying sufficient cash is paramount, as international card services are generally unavailable. Always clarify prices in "Rial" or "Toman" to ensure accurate transactions. By grasping these fundamental distinctions, you can navigate Iran's unique monetary landscape with confidence and ease, ensuring a smoother experience in this fascinating country.

We hope this comprehensive guide has demystified the complexities of Iran's currency for you. Have you traveled to Iran? What was your experience with the Rial and Toman? Share your thoughts and tips in the comments below! If you found this article helpful, please consider sharing it with others who might benefit from this information, or explore other articles on our site for more insights into global currencies and travel tips.

La evolución de la moneda oficial de Noruega

El dólar beliceño: la moneda oficial de Belice

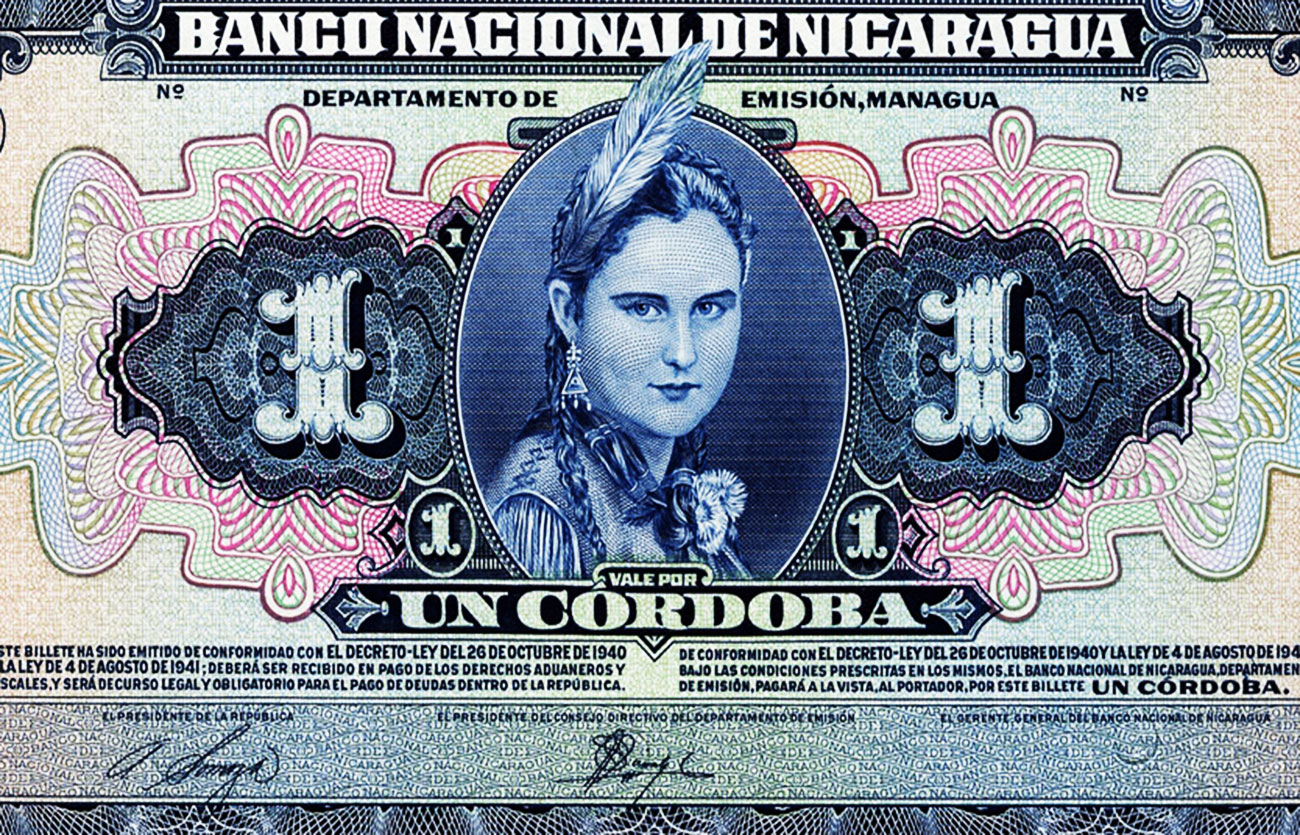

Cuál es la moneda de Nicaragua – Sooluciona