How Much Oil Comes From Iran? Unpacking A Global Energy Puzzle

The question of "how much oil comes from Iran" is far more complex than a simple number; it delves into the intricate web of global energy supply, geopolitics, and economic strategy. Iran, a nation with vast hydrocarbon wealth, has historically been a pivotal player in the international oil market. Understanding its role requires a deep dive into its reserves, production capacities, export patterns, and the significant geopolitical factors that continuously shape its output and sales. This exploration is crucial for anyone seeking to comprehend the dynamics of global energy security and the forces influencing oil prices worldwide.

From its immense proven reserves to its fluctuating export volumes influenced by international sanctions and shifting alliances, Iran's contribution to the world's oil supply is a topic of constant scrutiny. This article aims to demystify these complexities, providing a comprehensive overview of Iran's position as an oil producer and exporter, shedding light on who its main customers are, and examining the broader implications for the global energy landscape.

Table of Contents

- Iran's Place in the Global Oil Landscape

- Iran's Oil Production: Bouncing Back

- Who Buys Iranian Oil? Unveiling Key Export Destinations

- The Economic Lifeline: Why Oil Exports Matter to Iran

- US Oil Imports from Iran: A Shifting Landscape

- Geopolitical Tensions and the Future of Iranian Oil

- The Volatile Nature of Oil Markets and Iran's Role

- Looking Ahead: The Future Trajectory of Iranian Oil

- Conclusion

Iran's Place in the Global Oil Landscape

When discussing how much oil comes from Iran, it's essential to first establish Iran's fundamental position within the global energy architecture. Iran is not just another oil producer; it holds some of the world’s largest deposits of proved oil, making it a heavyweight in terms of potential supply. Its strategic location in the Middle East, coupled with its vast reserves, means that its output and export policies have far-reaching implications for international energy markets.

The sheer scale of Iran's oil wealth is staggering. This nation is a foundational pillar of global oil supply, consistently ranking among the top countries in terms of proven reserves. This inherent capacity underscores why "how much oil comes from Iran" is a question that resonates deeply across geopolitical and economic spheres. Any significant shift in its production or export capabilities can send ripples throughout the global economy, affecting everything from gasoline prices at the pump to the strategic calculations of major powers.

A Giant in Reserves: How Much Oil Does Iran Have?

To truly appreciate Iran's significance, one must look at its proven reserves. With about 157 billion barrels of proven crude oil, Iran holds approximately a quarter (24 percent) of the Middle East’s and 12 percent of the world’s proven oil. More specifically, Iran held 157,530,000,000 barrels of proven oil reserves in the world as of 2016, ranking #4 globally and accounting for about 9.54% of the world’s total oil reserves of 1,650,585,140,000 barrels. This places Iran in an elite group of nations with the capacity to influence global supply for generations.

The longevity of these reserves is also remarkable. Iran has proven reserves equivalent to 239.2 times its annual consumption levels, indicating that, under normal circumstances, it possesses enough oil to meet its domestic needs and continue significant exports for over two centuries. This long-term potential is a critical factor in understanding the enduring importance of how much oil comes from Iran to the world market, regardless of short-term fluctuations.

- Arikytsya Lesked

- Allshdhub

- When Did Jennifer And Brad Divorce

- Brennan Elliott Wife Cancer

- Photos Jonathan Roumie Wife

Iran's Oil Production: Bouncing Back

While reserves indicate potential, actual production figures show Iran's active contribution to global supply. Despite facing significant international sanctions, Iran's oil production has shown remarkable resilience and growth in recent years. Oil production in Iran has increased around 75 percent to about 3.4 million barrels a day from depressed 2020 levels. This recovery highlights Iran's determination and capability to bring its oil back to market, even under restrictive conditions.

Recent data continues to illustrate this trend. Production was reported at 3,280.000 thousand barrels per day in January 2025, a slight decrease from the previous number of 3,293.000 thousand barrels per day for December 2024. These figures underscore a consistent, high level of output, demonstrating Iran's ongoing efforts to maximize its oil revenue. The question of how much oil comes from Iran, therefore, is not just about static reserves but about dynamic production levels that respond to internal and external pressures.

Who Buys Iranian Oil? Unveiling Key Export Destinations

Understanding how much oil comes from Iran also necessitates examining where this oil goes. Despite the re-imposition of oil sanctions by the Trump administration in October 2018, Iran has managed to maintain significant export volumes by finding alternative markets and circumventing restrictions. In March 2024, Iranian exports reached 1.82 million barrels per day, the highest rate since October 2018, just before those sanctions were reinstated. This surge indicates a robust, albeit often clandestine, network of buyers.

Exports were reported at 1,322.634 thousand barrels per day in December 2023, marking a notable increase from the previous number of 900.632 thousand barrels per day for December 2022. Looking at the long-term trend, exports data is updated yearly, averaging 2,122.500 thousand barrels per day from December 1980 to 2023, with 44 observations. This historical context shows that Iran has consistently been a major exporter, adapting to various global shifts over decades. The current rebound in exports is a testament to its persistent efforts to keep its oil flowing to international markets, directly influencing how much oil comes from Iran to the global supply chain.

China: Iran's Steadfast Customer

When discussing Iran's oil exports, one country stands out as its primary customer: China. China, the world's largest crude importer, has consistently been Iran's top customer, demonstrating a significant reliance on Iranian crude despite geopolitical pressures. According to shiptracking data, China bought an average of 1.05 million barrels per day (bpd) of Iranian oil in the first 10 months of 2023. This volume represents a substantial portion of Iran's total exports, highlighting the critical role China plays in sustaining Iran's oil economy.

The relationship between China and Iran in the oil trade is symbiotic. An estimated 15 percent of China’s oil imports comes from Iran, according to Andon Pavlov, a senior refining and oil products analyst at Kpler, a firm in Vienna that specializes in tracking Iranian oil flows. This figure underscores China's strategic decision to continue importing from Iran, likely benefiting from discounted prices due to the sanctions. For Iran, China provides a vital outlet for its oil, ensuring that a significant portion of "how much oil comes from Iran" finds a destination.

The Economic Lifeline: Why Oil Exports Matter to Iran

The revenue generated from oil exports is not merely a number; it is the lifeblood of Iran's economy and a critical component of its national budget. Export growth substantially impacts Tehran’s budget since oil exports accounted for more than 40 percent of Iran’s total export revenue in 2023. This dependence means that fluctuations in oil prices and export volumes directly affect the government's ability to fund public services, development projects, and its broader strategic objectives.

The importance of this revenue explains Iran's persistent efforts to circumvent sanctions and maintain its export levels. Every barrel of oil sold contributes significantly to the national coffers, enabling the country to navigate economic challenges and pursue its foreign policy agenda. Therefore, the question of how much oil comes from Iran is intrinsically linked to the nation's economic stability and its capacity to exert influence regionally and globally. The higher the export volumes, the more financial flexibility Tehran possesses.

US Oil Imports from Iran: A Shifting Landscape

While Iran is a major global oil producer, the dynamics of US crude oil imports from Iran have seen significant shifts over time, particularly due to geopolitical factors and sanctions. Historically, the United States, being a major oil consumer, had imported oil from various countries, including Iran. However, the relationship has evolved dramatically. Because the U.S. consumes more oil than it produces each day, oil must be imported from other countries to meet demand. This fundamental need for imports means that the US market is always looking for supply, but political considerations heavily influence from whom it buys.

According to data from the U.S. Energy Information Administration (EIA), US crude oil imports measure the monthly number of barrels imported from Iran to the United States. These numbers, released by the EIA, can give an idea of the total import of crude oil to the US from Iran. However, due to stringent sanctions, direct imports have largely ceased or been reduced to negligible levels in recent years. For instance, United States imports from Iran was US$6.29 million during 2024, according to the United Nations Comtrade database on international trade. This figure, while present, is a minuscule fraction compared to Iran's overall export capacity and the vast scale of US oil imports from other nations, reflecting the impact of sanctions.

Understanding US Import Data from Iran

When examining specific data points, it's crucial to understand the context. For example, "US crude oil import from Iran is at a current level of 752 thousand barrels in October 2023." While this number might appear significant at first glance, it's important to note that such figures, especially under sanction regimes, can sometimes represent indirect flows, re-exports, or historical data being reported with a lag. Furthermore, the EIA often withholds data to avoid disclosure of individual company data (indicated by "W = withheld"), which can make a complete picture challenging to ascertain.

The reporting methodology also plays a role: crude oil and unfinished oils are reported by the PAD district in which they are processed, while all other products are reported by the PAD district of entry. This technical detail can affect how "how much oil comes from Iran" is quantified for US consumption. In essence, while Iran remains a global oil powerhouse, its direct contribution to US energy supply has been severely curtailed by policy, making its impact on the US market more indirect through global price effects rather than direct supply.

Geopolitical Tensions and the Future of Iranian Oil

The future of how much oil comes from Iran is inextricably linked to geopolitical tensions, particularly in the Middle East. The region is a critical artery for global oil supply, and any major conflict that cuts off supply lines from the region could result in a global economic shock that sends oil above $100 per barrel. Prices last reached that point in March 2022, after Russia's actions in Ukraine, illustrating how quickly geopolitical events can impact oil markets. Iran's position, bordering the Strait of Hormuz, a vital chokepoint for oil shipments, gives it immense strategic leverage.

The ongoing sanctions against Iran, primarily led by the United States, are a direct consequence of these geopolitical tensions. These measures aim to limit Iran's access to international financial systems and technology, thereby curbing its oil exports and, consequently, its revenue. However, as seen with the recent surge in exports, Iran has developed sophisticated methods to circumvent these restrictions, often relying on a network of intermediaries and shadow fleets. This cat-and-mouse game between sanctions and evasion significantly influences the actual volume of how much oil comes from Iran to the global market.

Navigating Policy Options: The US Perspective

From the perspective of major powers like the United States, managing Iran's oil output involves complex policy considerations. Analysts have highlighted that the U.S. appears to have three broad policy options in relation to Iran’s oil output. One option is maintaining the status quo, with output at around three million barrels per day, implying continued sanctions but with an acknowledgment of Iran's ability to sustain a certain level of exports. Other options might include increasing pressure to further reduce exports or, conversely, engaging in diplomatic efforts that could lead to a relaxation of sanctions in exchange for concessions on other issues.

Each policy option carries significant implications for global oil prices and market stability. A decision to significantly tighten sanctions could reduce how much oil comes from Iran, potentially driving up prices, while a loosening of sanctions could bring more Iranian oil to the market, potentially lowering prices. These decisions are not made in a vacuum but are part of a broader strategic calculus involving nuclear proliferation, regional stability, and international alliances.

The Volatile Nature of Oil Markets and Iran's Role

The global oil market is inherently volatile, susceptible to a myriad of factors ranging from supply disruptions and demand fluctuations to geopolitical events and economic policies. Iran, given its substantial reserves and historical role as a major exporter, plays a significant part in this volatility. When considering how much oil comes from Iran, it's not just the volume that matters, but the stability and predictability of that supply.

Sanctions, political unrest, and regional conflicts involving Iran or its neighbors can introduce considerable uncertainty into the market. Traders and analysts constantly monitor developments related to Iran, as any news regarding its production capacity, export routes, or diplomatic relations can trigger immediate price reactions. The market's sensitivity to potential supply disruptions from the Middle East, a region where Iran is a key player, underscores its critical importance. Even the mere threat of a conflict that could impede the flow of oil through vital shipping lanes can send shockwaves through the market, illustrating the profound impact of Iran's role on global energy security.

Looking Ahead: The Future Trajectory of Iranian Oil

The future trajectory of how much oil comes from Iran remains a subject of intense speculation and depends heavily on a confluence of internal and external factors. Domestically, Iran's ability to maintain and upgrade its oil infrastructure, which has suffered from years of underinvestment due to sanctions, will be crucial. Investment in new technologies and exploration could unlock even more of its vast reserves, potentially increasing its long-term production capacity.

Internationally, the most significant variable is the future of sanctions. A potential diplomatic breakthrough could see a lifting or easing of restrictions, allowing Iran to re-enter mainstream global oil markets with full force. This would likely lead to a substantial increase in exports, potentially reshaping supply-demand dynamics and influencing global oil prices. Conversely, a tightening of sanctions or heightened regional tensions could further constrain Iran's ability to export, despite its proven resilience in finding alternative buyers. The balance between these forces will ultimately determine how much oil comes from Iran in the years to come, impacting energy consumers and producers worldwide.

Conclusion

In conclusion, the question of "how much oil comes from Iran" reveals a multifaceted narrative of immense natural wealth, geopolitical complexities, and economic resilience. Iran possesses some of the world's largest proven oil reserves, making it an indispensable, albeit often contentious, player in the global energy landscape. Despite stringent international sanctions, Iran has demonstrated a remarkable ability to sustain significant production and export volumes, largely through its robust trade relationship with countries like China, which remains its steadfast customer.

The revenue generated from these oil exports is vital for Iran's economy, underscoring its relentless efforts to navigate and circumvent restrictions. While direct US imports from Iran have dwindled due to sanctions, Iran's influence on the global oil market remains profound, primarily through its impact on overall supply and prices, especially given its strategic position in a volatile region. As we look to the future, the volume of oil flowing from Iran will continue to be shaped by the intricate interplay of its domestic capabilities and the ever-evolving geopolitical environment. Understanding these dynamics is crucial for anyone seeking to comprehend the forces that drive global energy markets.

What are your thoughts on Iran's role in the global oil market? Do you believe sanctions will ultimately curtail its exports, or will it continue to find ways to supply its customers? Share your perspectives in the comments below, and don't forget to explore our other articles on global energy trends!

- Tyreek Hill Height And Weight

- Allmobieshub

- How Tall Is Katt Williams Wife

- Misav Com

- Seo Rank Tracking Software With Tasks

Iran Supply Cut Not a Problem, There's Enough Oil: IEA

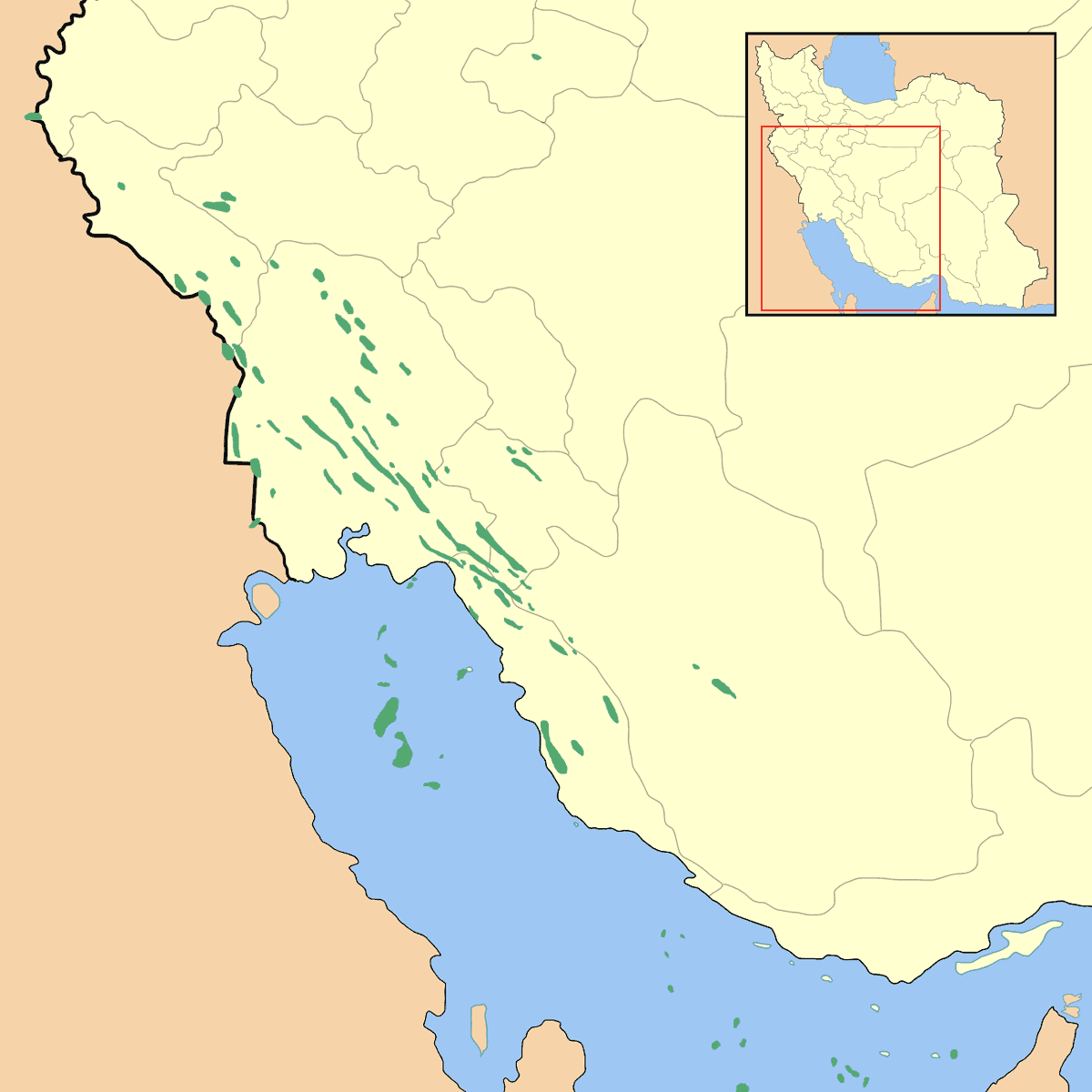

Iran Oil Map - MapSof.net

108002207-17201983492024-07-05t165111z_347121946_rc2wo8ac9gxe_rtrmadp_0