Unpacking US Treasury Sanctions On Iran: A Deep Dive Into Financial Warfare

The landscape of international relations is often shaped not just by diplomacy and military might, but also by the potent force of economic measures. Among these, sanctions stand out as a primary tool, and few nations have experienced their pervasive reach quite like Iran. For decades, the United States has employed a complex web of financial restrictions aimed at altering Iran's behavior, with the U.S. Treasury Department at the forefront of this intricate economic strategy. Understanding the nuances of US Treasury sanctions on Iran is crucial for anyone seeking to grasp the complexities of geopolitical leverage and the ongoing struggle for regional and global stability.

These sanctions are far more than mere diplomatic slaps on the wrist; they represent a calculated effort to disrupt illicit financial flows, cripple strategic sectors, and pressure the Iranian regime on multiple fronts, from its nuclear ambitions to its support for proxy groups and its internal human rights record. This article will delve into the mechanisms, targets, and historical context of these powerful financial tools, offering a comprehensive look at how the U.S. Treasury Department wields its influence to shape international policy.

The Architects of Economic Pressure: OFAC and Beyond

At the heart of the United States' economic sanctions regime against Iran, and indeed against various other adversaries, lies the Office of Foreign Assets Control (OFAC). This agency, a vital component of the United States Department of the Treasury, is the principal administrator and enforcer of U.S. economic sanctions programs. OFAC's role is multifaceted: it identifies and designates individuals and entities, issues regulations, and provides guidance to ensure compliance with the intricate web of restrictions.

- Images Of Joe Rogans Wife

- How Tall Is Tyreek Hill

- Meganmccarthy Onlyfans

- Sean Lennon Young

- Rob Van Winkle

While OFAC takes center stage, it's not the sole player. The Department of State's Office of Economic Sanctions Policy and Implementation also bears significant responsibility for enforcing and implementing a number of U.S. sanctions programs. These programs often restrict access to the United States financial system and markets, making it incredibly difficult for sanctioned entities to conduct legitimate international business. This coordinated effort between Treasury and State ensures a comprehensive approach to applying economic pressure, targeting everything from financial transactions to trade in specific goods and services. The sheer scale of OFAC's operations is evident in its history; for instance, the Department of the Treasury’s Office of Foreign Assets Control (OFAC) has sanctioned more than 700 individuals, entities, aircraft, and vessels in relation to Iran, highlighting the extensive reach of these measures.

A Legacy of Sanctions: Since 1979

The imposition of US Treasury sanctions on Iran is not a recent phenomenon but rather a policy that stretches back decades. Following the Iranian Revolution and the seizure of the U.S. Embassy in Tehran, the United States has since 1979 applied various economic, trade, scientific, and military sanctions against Iran. These initial restrictions laid the groundwork for what would become one of the most comprehensive and complex sanctions regimes in modern history. Over the years, these measures have evolved, adapting to new challenges and Iranian strategies, but their core objective has remained consistent: to compel a change in the Iranian regime's behavior.

The legal authorities underpinning these sanctions are diverse, ranging from specific executive orders issued by presidents to acts of Congress. For example, today’s action by the Department of State is often taken pursuant to Executive Order (E.O.) 13846, which authorizes and reimposes certain sanctions with respect to Iran. This layered legal framework allows the U.S. government to respond dynamically to perceived threats, whether they relate to Iran's nuclear program, its support for terrorism, its ballistic missile development, or its human rights abuses. The historical context is crucial because it demonstrates a sustained, bipartisan commitment in the U.S. to leverage economic power as a tool of foreign policy against Iran.

Targeting Iran's Lifeline: The Oil and Petrochemical Sector

Perhaps no sector has been more consistently and aggressively targeted by US Treasury sanctions on Iran than its vast oil and petrochemical industries. These sectors are the primary sources of revenue for the Iranian government, and disrupting them is seen as a direct way to limit the regime's ability to fund its various activities, both domestic and international. The strategy is clear: intensify financial pressure on Iran, limiting the regime’s ability to earn critical energy revenues to undermine stability in the region and attack U.S. interests.

The U.S. Treasury has repeatedly imposed sanctions on entities and vessels involved in transporting illicit Iranian petroleum to foreign markets. The sanctioned ships often move crude oil valued in the hundreds of millions of dollars, representing a significant blow to Iran's export capabilities. This focus intensified significantly during the Trump administration, which issued National Security Presidential Memorandum 2, explicitly calling for the U.S. to “drive Iran’s export of oil to zero.” While achieving zero exports has proven challenging, these sanctions have severely curtailed Iran's oil sales, forcing it to resort to clandestine methods and creating significant economic hardship.

Illicit Networks and Global Reach

The pursuit of illicit oil sales has led to the emergence of sprawling networks that span multiple jurisdictions. The Treasury Department has frequently sanctioned more than 20 companies in networks that have long sent Iranian oil to China, for instance. These actions extend beyond just the ships and the oil itself, targeting the entire ecosystem that facilitates these transactions. Among those sanctioned are often oil brokers in the United Arab Emirates (UAE) and Hong Kong, highlighting the international nature of these illicit operations and the global reach of U.S. enforcement efforts.

The Department of the Treasury’s Office of Foreign Assets Control (OFAC) has sanctioned nearly two dozen firms operating in multiple jurisdictions in virtually every aspect of Iran’s illicit international oil trade. This comprehensive approach aims to dismantle the entire chain, from production to refining and transport. For example, OFAC has designated a “teapot” oil refinery and its chief executive officer for purchasing and refining hundreds of millions of dollars’ worth of Iranian crude oil, including from vessels linked to foreign terrorist organizations like Ansarallah, commonly known as the Houthis. This demonstrates how the oil trade is intertwined with broader security concerns, as the Iranian government allocates billions of dollars’ worth of oil annually to its armed forces to supplement their budget allocations, underwriting their operations.

The Trump Era and the "Drive to Zero"

The "drive Iran's export of oil to zero" policy under President Donald Trump marked a significant escalation in the economic pressure campaign. This was not merely a continuation but an intensification of existing measures, with the goal of completely choking off Iran's primary revenue stream. This aggressive stance led to multiple rounds of sanctions specifically targeting Iranian oil sales and those who facilitate them. The aim was to create maximum economic pressure, forcing Iran to negotiate or alter its behavior under duress.

While the "zero exports" goal was ambitious and perhaps unattainable given the complexities of global oil markets and Iran's determination to circumvent sanctions, the policy undoubtedly inflicted severe economic pain. It forced Iran to innovate its smuggling techniques, rely more heavily on shadow networks, and accept lower prices for its crude. The legacy of this period continues to influence the current approach, with subsequent administrations maintaining significant pressure on Iran's energy sector, often expanding sanctions on its petroleum and petrochemical sectors in response to specific actions, such as Iran’s attacks against Israel.

Dismantling Shadow Banking and Money Laundering

Beyond the visible flow of oil, a more clandestine financial battle is waged against Iran's "shadow banking" networks. These illicit systems are crucial for the Iranian regime, particularly its Ministry of Defense and Armed Forces Logistics (MODAFL) and the Islamic Revolutionary Guard Corps (IRGC), to gain illicit access to the international financial system. The U.S. Treasury understands that cutting off these hidden financial arteries is as critical as stopping oil exports, as they enable a wide range of nefarious activities.

The updated FinCEN advisory highlights Iranian oil smuggling, shadow banking, and weapons procurement typologies, indicating that these are interconnected facets of Iran's illicit financial activities. The Treasury Department’s Office of Foreign Assets Control (OFAC) has been particularly active in designating entities and individuals involved in these networks. These designations target nearly 50 entities and individuals that constitute multiple branches of a sprawling shadow banking network, effectively disrupting the mechanisms Iran uses to move money globally outside of legitimate channels. The goal is to make it increasingly difficult and costly for Iran to finance its military, its proxies, and its other destabilizing actions.

The Zarringhalam Network and Billions Laundered

A prime example of the Treasury's focus on shadow banking and money laundering is the designation of individuals like the Iranian brothers Mansour, Nasser, and Fazlolah Zarringhalam. These individuals, along with over 30 entities tied to them, have collectively laundered billions of dollars through the international financial system. Such networks are vital for Iran to circumvent sanctions, acquire prohibited goods, and fund its various operations. By targeting these specific individuals and their associated entities, OFAC aims to expose and dismantle the complex web of shell companies, front organizations, and illicit financial transactions that underpin Iran's ability to operate globally.

The scale of the money laundering involved – billions of dollars – underscores the importance of these shadow networks to the Iranian regime. The Treasury's actions against them send a clear message: the U.S. will pursue those who facilitate illicit financial activities, regardless of their location or the complexity of their schemes. These designations serve not only to cut off specific funding channels but also to deter others from engaging in similar activities by demonstrating the severe consequences of violating U.S. sanctions.

Curbing Weapons Proliferation and Regional Destabilization

A significant driver behind US Treasury sanctions on Iran is the regime's continued proliferation of advanced weaponry and its support for regional proxy groups that destabilize the Middle East. The U.S. Treasury imposes new sanctions on companies supplying Iran with weapons equipment and importing oil for Yemen's Houthis, directly targeting individuals and entities involved in illicit trade and arms programs. This linkage between financial sanctions and security objectives is a cornerstone of U.S. policy.

Iran's development and export of drones (Unmanned Aerial Vehicles or UAVs) have become a particular concern, given their use by various non-state actors against U.S. interests and allies in the region. The Treasury Department, often in coordination with the U.S. Department of Justice, actively targets networks responsible for the procurement of UAV components on behalf of Iran. These networks often involve entities and individuals based in Iran, the United Arab Emirates (UAE), and the People’s Republic of China (PRC), illustrating the global supply chains that facilitate Iran's military ambitions.

UAVs and Support for Terrorist Proxies

The proliferation of UAVs and other advanced weaponry by Iran is directly linked to its support for designated terrorist organizations and proxy groups. These groups, including the Houthis in Yemen, Hezbollah in Lebanon, and various militias in Iraq and Syria, receive funding, training, and equipment from Iran, enabling them to conduct attacks and sow instability. The U.S. Treasury's sanctions aim to disrupt these supply lines and cut off the financial resources that enable such support.

The actions taken by the Treasury Department are often in direct response to specific acts of aggression or escalation. For instance, the United States has expanded sanctions on Iran’s petroleum and petrochemical sectors in response to Iran’s October 1 attack on Israel, its second direct attack on Israel this year. This immediate and targeted response demonstrates the U.S. commitment to using economic tools to deter further aggression and hold Iran accountable for its actions that undermine regional stability and attack U.S. interests and those of its allies. The sanctions against the "teapot" refinery, which processed oil from vessels linked to the Houthis, further illustrate this direct link between illicit finance and support for terror proxies.

Human Rights and Internal Repression

While often overshadowed by concerns over nuclear proliferation and regional security, human rights abuses within Iran also constitute a significant basis for US Treasury sanctions on Iran. The U.S. government has repeatedly expressed its condemnation of the Iranian regime’s violent repression of its own people, both within Iran’s borders and abroad. These sanctions are distinct from those targeting nuclear or terrorism-related activities, focusing instead on holding accountable those responsible for severe human rights violations.

The Department of the Treasury’s Office of Foreign Assets Control (OFAC) has designated individuals in connection with the Iranian regime’s ongoing, violent repression. These designations often target members of the Islamic Revolutionary Guard Corps (IRGC), which plays a significant role in internal security and suppression of dissent, as well as officials of Iran’s prisons organization. By sanctioning these individuals and entities, the U.S. aims to impose costs on those who enable and carry out the regime's repressive policies, sending a message of solidarity to the Iranian people and signaling international disapproval of the regime's actions against its citizens.

The Strategic Impact and Future Outlook

The strategic impact of US Treasury sanctions on Iran is undeniable. While they have not led to a complete collapse of the Iranian economy or a fundamental change in the regime's ideology, they have severely constrained its financial resources and forced it to operate through increasingly complex and costly illicit channels. The sanctions have limited the regime’s ability to earn critical energy revenues, thereby reducing its capacity to fund its regional proxies and military programs. They have also made it difficult for Iran to access essential goods and services, impacting its domestic economy and the welfare of its citizens.

However, the future outlook for these sanctions remains complex. Iran has consistently demonstrated resilience in circumventing restrictions, developing sophisticated shadow networks and finding new partners. The timing of sanctions is also a critical consideration; the United States has imposed new sanctions on Iran on various occasions, sometimes days before scheduled talks, indicating their use as a bargaining chip or a means to increase leverage. The ongoing interplay between sanctions, diplomacy, and regional events means that the U.S. Treasury's role will continue to be dynamic, adapting to new threats and opportunities.

The effectiveness of sanctions is a subject of ongoing debate among policymakers and analysts. While they undoubtedly inflict economic pain and complicate Iran's strategic calculations, they also carry risks, such as exacerbating humanitarian concerns, pushing Iran further into the arms of rival powers, or failing to achieve their desired behavioral change. Nevertheless, as a powerful non-military tool, economic sanctions, particularly those administered by the U.S. Treasury, will likely remain a central pillar of U.S. foreign policy towards Iran for the foreseeable future.

Conclusion: Navigating the Complexities of Sanctions

The US Treasury sanctions on Iran represent a sophisticated and constantly evolving strategy to exert financial pressure on a defiant regime. From their historical roots in 1979 to their current targeting of oil smuggling, shadow banking, weapons procurement, and human rights abuses, these measures are designed to limit Iran's capacity to fund its destabilizing activities and repress its own people. OFAC, as the primary executor of these sanctions, plays a critical role in identifying, designating, and disrupting the illicit networks that sustain the Iranian regime.

While the effectiveness of sanctions in achieving long-term behavioral change is a subject of ongoing discussion, their immediate impact on Iran's economy and its ability to project power is undeniable. For businesses, financial institutions, and individuals operating in the global economy, understanding these sanctions is not just an academic exercise but a practical necessity to avoid severe penalties. As the geopolitical landscape continues to shift, the U.S. Treasury's economic tools will remain a potent force in the complex and often contentious relationship between the United States and Iran.

We hope this deep dive has provided you with valuable insights into the intricate world of U.S. economic sanctions against Iran. What are your thoughts on the effectiveness of these measures? Share your perspectives in the comments below, or explore our other articles on international finance and geopolitical strategy to deepen your understanding.

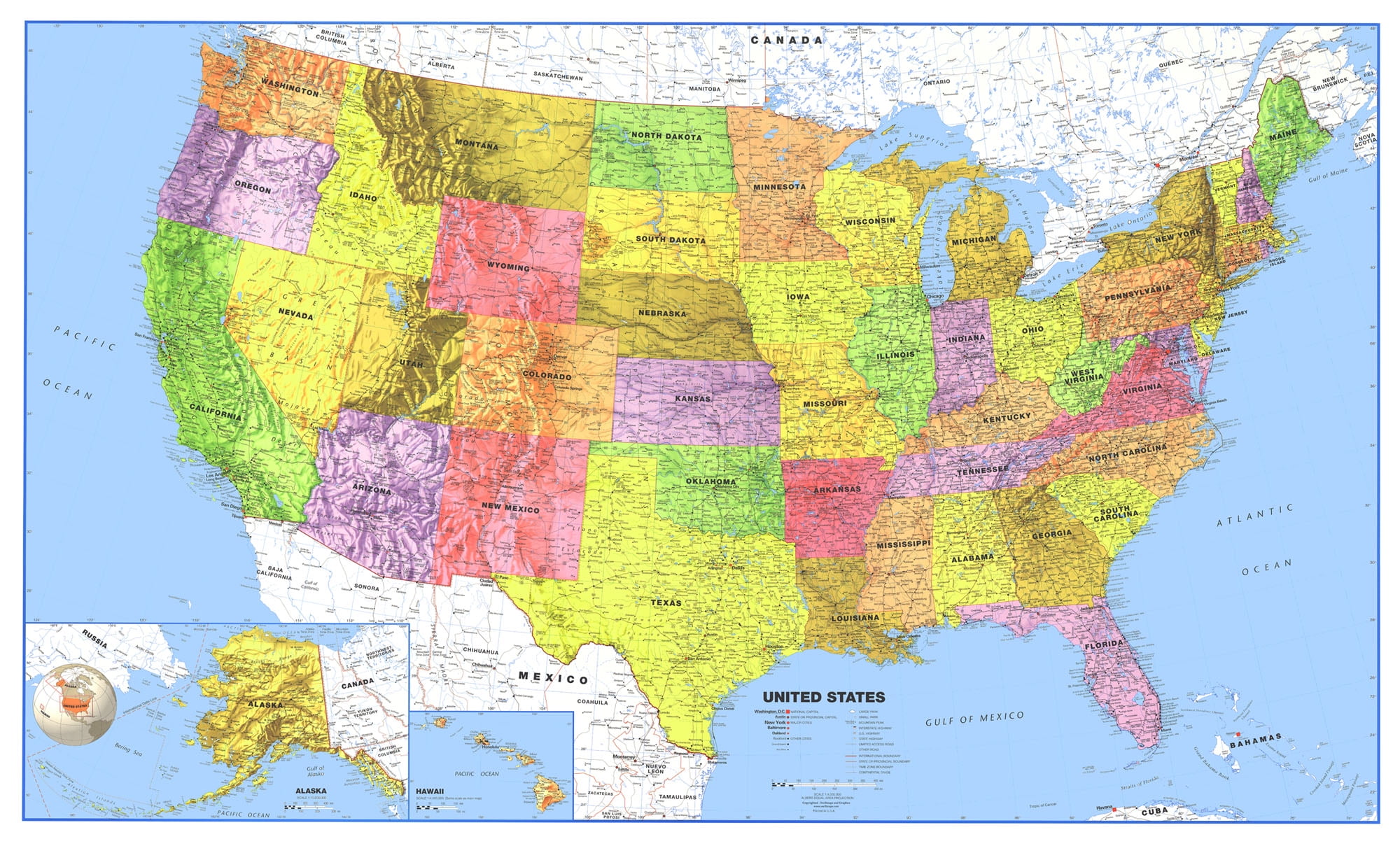

USA Map. Political map of the United States of America. US Map with

United States Map Maps | Images and Photos finder

Mapas de Estados Unidos - Atlas del Mundo