US Treasury Iran Sanctions: Unpacking The Economic Pressure

The United States has long employed economic sanctions as a primary tool in its foreign policy arsenal, particularly concerning Iran. These measures, administered predominantly by the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC), aim to curb Iran's nuclear ambitions, disrupt its support for militant groups, and counter its destabilizing activities in the Middle East. From the immediate aftermath of the Iranian Revolution in 1979 to the recent actions targeting illicit petroleum networks and UAV component procurement, the intricate web of US Treasury Iran sanctions reflects a sustained and evolving strategy of economic coercion.

Understanding the rationale, mechanisms, and far-reaching implications of these sanctions is crucial for anyone interested in international relations, global finance, or the dynamics of power. This article delves into the history, administration, and specific targets of the US Treasury Iran sanctions, providing a comprehensive overview of how Washington leverages its economic might to achieve its national security objectives.

Table of Contents

- A Legacy of Pressure: The Genesis of US-Iran Sanctions

- The Architects of Sanctions: OFAC and the Department of State

- Targeting the Lifeblood: Iran's Petroleum Sector

- Disrupting Destabilization: UAVs and Militant Financing

- Beyond Oil: Broader Economic Restrictions

- The Impact and Implications of US Treasury Iran Sanctions

- Navigating the Complex Landscape: Compliance and Challenges

- Conclusion: The Evolving Strategy of Economic Pressure

A Legacy of Pressure: The Genesis of US-Iran Sanctions

The relationship between the United States and Iran has been fraught with tension for decades, with economic sanctions serving as a consistent feature of Washington's policy. Following the Iranian Revolution and the seizure of the U.S. Embassy in Tehran in 1979, the United States began applying various economic, trade, scientific, and military sanctions against Iran. This marked the beginning of a sustained campaign of economic pressure, which has evolved in scope and intensity over the years, responding to Iran's actions and geopolitical shifts. Initially, the sanctions aimed to pressure Iran over its hostage-taking. Over time, their objectives expanded to include preventing Iran from developing nuclear weapons, countering its ballistic missile program, and curtailing its support for regional proxy groups and terrorist organizations. Each new phase of sanctions has built upon previous measures, creating a layered and comprehensive framework designed to isolate Iran economically and financially from the global system. This long-standing policy underscores the U.S. commitment to using economic tools to address what it perceives as threats to its national security and regional stability.The Architects of Sanctions: OFAC and the Department of State

The intricate machinery of US Treasury Iran sanctions is primarily managed by two key government bodies: the Department of the Treasury's Office of Foreign Assets Control (OFAC) and the Department of State’s Office of Economic Sanctions Policy and Implementation. OFAC is the principal agency responsible for administering and enforcing economic and trade sanctions based on U.S. foreign policy and national security goals. It does so by identifying and blocking the assets of designated persons and entities, and by imposing trade restrictions. The Department of State, on the other hand, plays a crucial role in developing the policy rationale for sanctions and coordinating their implementation, ensuring they align with broader diplomatic objectives. Together, these agencies work to restrict access to the United States for those involved in activities deemed detrimental to U.S. interests. The authority for these sanctions stems from various legal instruments, most notably Executive Orders (E.O.s) issued by the President, as well as specific legislation passed by Congress. For instance, Executive Order (E.O.) 13846 authorizes and reimposes certain sanctions with respect to Iran, particularly targeting its petroleum and petrochemical sectors. Another significant order, E.O. 13902, specifically targets Iran’s petroleum and petrochemical sectors, allowing for the designation of individuals and entities involved in these industries. These legal frameworks provide the necessary teeth for OFAC to impose restrictions, block assets, and enforce compliance across a global network.How Sanctions Work: Comprehensive vs. Selective

OFAC administers a number of different sanctions programs, which can be broadly categorized as either comprehensive or selective. Comprehensive sanctions are typically broad in scope, prohibiting nearly all transactions with a targeted country or regime, often involving a complete trade embargo and asset freezes. While the US Treasury Iran sanctions program is extensive, it tends to be more selective in its application, targeting specific sectors, individuals, and entities rather than imposing a blanket ban on all economic activity. This allows for more precise targeting of illicit activities while attempting to minimize humanitarian impact, though the cumulative effect can still be severe. Selective sanctions, which are more common in the context of Iran, use tools like the blocking of assets and trade restrictions to accomplish specific foreign policy and national security goals. When OFAC designates an individual or entity, all property and interests in property of the designated persons that are in the United States or in the possession or control of U.S. persons are blocked and must be reported to the Department of Treasury’s Office of Foreign Assets Control (OFAC). This means that U.S. financial institutions and individuals are prohibited from engaging in transactions with these designated parties, effectively cutting them off from the U.S. financial system and often, by extension, much of the global financial system due to the dominance of the U.S. dollar and the fear of secondary sanctions. This nuanced approach allows the U.S. to apply pressure strategically, focusing on specific illicit networks and revenue streams.Targeting the Lifeblood: Iran's Petroleum Sector

Iran's petroleum sector is its economic backbone, providing the vast majority of its revenue. Recognizing this, the US Treasury Iran sanctions have consistently and heavily targeted this industry to limit the Iranian government's financial resources. The goal is to reduce Iran's ability to fund its nuclear program, its military, and its support for various militant groups across the region. This strategy involves not only direct sanctions on Iranian oil exports but also on the intricate networks that facilitate the sale and transportation of this illicit petroleum. For example, OFAC has designated Iran’s Minister of Petroleum, Mohsen Paknejad, who oversees the export of tens of billions of dollars’ worth of Iranian oil and has allocated billions of dollars’ worth of oil to Iran’s armed forces for export. Such designations aim to cripple the leadership and infrastructure responsible for the country's oil revenues. The sanctions extend beyond direct officials to encompass the entire supply chain, including shipping companies, brokers, and financial facilitators globally, making it increasingly difficult for Iran to sell its oil on the international market.Recent Escalations and Illicit Oil Networks

The U.S. has shown a continuous commitment to escalating pressure when Iran's actions warrant it. Recently, following Iran’s attack against Israel on October 1, 2024, as well as Iran’s announced nuclear escalations, Washington intensified its pressure. The United States imposed sanctions on 35 entities and vessels that play a critical role in transporting illicit Iranian petroleum to foreign markets. This action imposes additional costs on Iran’s petroleum sector, building upon previous sanctions. Just prior to this, on Monday, the U.S. imposed a fresh round of sanctions targeting Iran's oil industry, hitting more than 30 brokers, tanker operators, and shipping companies for their role in selling and transporting Iranian oil. Among those sanctioned were two shipping companies based in Hong Kong: Unico Shipping Co Ltd and Athena Shipping Co Ltd. These actions demonstrate the U.S. Treasury’s focus on disrupting the shadow networks Iran uses to circumvent sanctions, including those involved in oil smuggling and shadow banking. OFAC has also sanctioned an international network for facilitating the shipment of millions of barrels of Iranian crude oil worth hundreds of millions of dollars to the People’s Republic of China (PRC). This oil was shipped on behalf of Iran’s Armed Forces General Staff (AFGS) and its sanctioned front organizations, highlighting the military's direct involvement in illicit oil trade. Furthermore, a "teapot" oil refinery and its chief executive officer were designated for purchasing and refining hundreds of millions of dollars’ worth of Iranian crude oil, including from vessels linked to Ansarallah, commonly known as the Houthis, and the Iranian Revolutionary Guard Corps (IRGC). These measures underscore the breadth and depth of the US Treasury Iran sanctions aimed at cutting off the regime's funding.Disrupting Destabilization: UAVs and Militant Financing

Beyond the petroleum sector, the US Treasury Iran sanctions also rigorously target Iran's efforts to procure advanced military technology, particularly unmanned aerial vehicles (UAVs), and its financial support for militant groups that launch attacks against the U.S. and its allies. These actions are crucial for global security, as Iran's proliferation of UAVs and its funding of proxies contribute significantly to regional instability. The U.S. Department of the Treasury’s OFAC, in coordination with the U.S. Department of Justice, has specifically targeted a network of six entities and two individuals based in Iran, the United Arab Emirates (UAE), and the People’s Republic of China (PRC) responsible for the procurement of UAV components on behalf of Iran. This focus on UAVs reflects the growing threat posed by Iran's drone capabilities, which have been used in attacks against oil facilities, shipping, and military targets. By disrupting the supply chains for these components, the U.S. aims to degrade Iran's ability to produce and deploy these weapons.The Global Reach of Sanctions: UAE, China, Hong Kong, India

The effectiveness of US Treasury Iran sanctions relies heavily on their extraterritorial reach, impacting entities and individuals across various jurisdictions. The provided data highlights this global scope, with sanctions imposed on dozens of people and oil tankers across China, the United Arab Emirates, India, and other jurisdictions. These individuals and entities are targeted for allegedly helping to finance Iran and its support for militant groups. This demonstrates that the U.S. is willing to impose restrictions on any party, regardless of their location, if they are found to be facilitating Iran's illicit activities. Oil brokers in the United Arab Emirates (UAE) and Hong Kong have been among those sanctioned, illustrating how financial hubs are often exploited by sanctioned entities. Furthermore, an updated FinCEN advisory highlights Iranian oil smuggling, shadow banking, and weapons procurement typologies, indicating the complex financial schemes used to evade sanctions. OFAC has also designated over 30 individuals and entities tied to Iranian brothers Mansour, Nasser, and Fazlolah Zarringhalam, who have collectively laundered billions of dollars through these illicit networks. This global approach is critical to cutting off Iran's access to funds and technology, as it prevents sanctioned entities from simply relocating their operations to less regulated jurisdictions.Beyond Oil: Broader Economic Restrictions

While the petroleum sector and military procurement are major targets, the US Treasury Iran sanctions extend to a much broader range of economic activities. The objective is to apply comprehensive pressure across various sectors of the Iranian economy, making it difficult for the regime to conduct normal international trade and financial transactions. This includes restrictions on banking, shipping, petrochemicals, and even certain metals. The U.S. Treasury imposes new sanctions on companies supplying Iran with weapons equipment and importing oil for Yemen's Houthis, directly targeting individuals and entities involved in illicit trade and arms programs. This indicates a focus on specific revenue streams and strategic assets that enable Iran's destabilizing actions. The cumulative effect of these various sanctions programs is designed to create a significant economic burden on Iran, limiting its ability to fund its domestic programs and foreign policy objectives. The sheer volume of designations is staggering; the Department of the Treasury’s Office of Foreign Assets Control (OFAC) has sanctioned more than 700 individuals, entities, aircraft, and vessels under various Iran-related programs, illustrating the vast scope of these economic restrictions.The Impact and Implications of US Treasury Iran Sanctions

The imposition of US Treasury Iran sanctions has profound and multifaceted impacts, both within Iran and on the global stage. Domestically, the sanctions have severely hampered Iran's economy, leading to currency depreciation, inflation, and difficulties in accessing essential goods and services. This economic strain often translates into public discontent and protests, as the Iranian populace bears the brunt of the international isolation. The government's ability to invest in infrastructure, healthcare, and education is significantly curtailed, affecting the quality of life for ordinary citizens. Internationally, the sanctions complicate trade relations for countries and companies that wish to do business with Iran. The risk of secondary sanctions, where non-U.S. entities can be penalized for engaging in transactions with sanctioned Iranian parties, creates a chilling effect. This forces businesses to choose between access to the U.S. financial system and trade with Iran, with most opting for the former. This dynamic contributes to Iran's economic isolation, even from countries that might otherwise be willing to engage in legitimate trade. Furthermore, the sanctions contribute to geopolitical tensions, as Iran often responds to economic pressure with actions that further destabilize the region, such as accelerating its nuclear program or increasing support for proxy groups. The long-term implications involve a constant dance between economic pressure and regional responses, with no clear end in sight.Navigating the Complex Landscape: Compliance and Challenges

For businesses and financial institutions worldwide, navigating the complex landscape of US Treasury Iran sanctions is a significant challenge. Compliance is paramount, as violations can lead to severe penalties, including hefty fines, reputational damage, and even criminal charges. Companies must implement robust compliance programs, conduct thorough due diligence on their clients and supply chains, and stay updated on the ever-evolving list of sanctioned individuals and entities. This includes understanding the nuances of various Executive Orders, such as E.O. 13846 and E.O. 13902, which specifically target Iran's petroleum and petrochemical sectors, respectively. The dynamic nature of sanctions, with new designations frequently announced, requires constant vigilance. The U.S. Treasury's OFAC regularly updates its Specially Designated Nationals (SDN) list, and businesses must screen against this list to ensure they are not inadvertently engaging with sanctioned parties. The challenge is compounded by Iran's sophisticated methods of evasion, including the use of front companies, shell corporations, and complex financial schemes to obscure the true beneficiaries of transactions. This necessitates advanced analytical capabilities and close cooperation between government agencies and the private sector to identify and disrupt illicit networks. The global reach of these sanctions means that even companies with no direct U.S. nexus must be aware of the potential for secondary sanctions if their activities are deemed to support sanctioned Iranian entities.Conclusion: The Evolving Strategy of Economic Pressure

The US Treasury Iran sanctions represent a cornerstone of American foreign policy towards the Islamic Republic, a strategy that has persisted and adapted for over four decades. From the initial restrictions imposed in 1979 to the recent, targeted actions against illicit oil transport and UAV component networks, the objective remains clear: to exert maximum economic pressure to compel a change in Iran's behavior regarding its nuclear program, regional destabilization, and support for militant groups. The meticulous work of OFAC, in coordination with the Department of State, ensures that these sanctions are not merely symbolic but have tangible effects on Iran's ability to fund its operations. As the geopolitical landscape continues to shift, the application of US Treasury Iran sanctions will undoubtedly evolve. However, their fundamental role as a powerful tool of economic statecraft is unlikely to diminish. For individuals and businesses operating in the global economy, understanding these sanctions is not just a matter of compliance but a critical component of risk management. We encourage you to stay informed on these crucial developments and share your thoughts on the effectiveness and implications of these policies in the comments below. Explore our other articles for more in-depth analyses of international economic policies and their global impact.

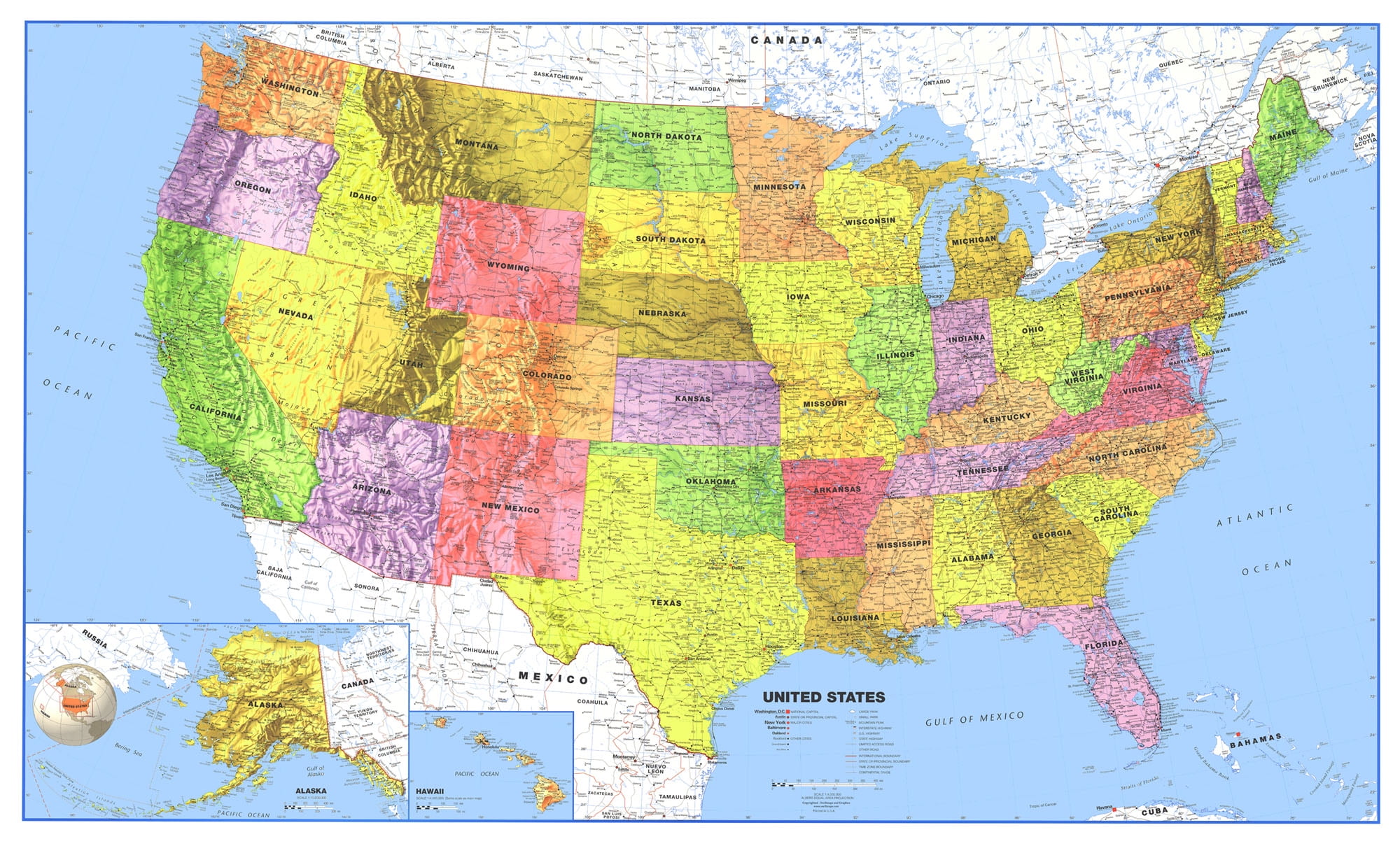

USA Map. Political map of the United States of America. US Map with

United States Map Maps | Images and Photos finder

Mapas de Estados Unidos - Atlas del Mundo