US Sends Money To Iran: Unpacking The Complex Financial Flows

The phrase "US sends money to Iran" often sparks intense debate and confusion, conjuring images of direct financial aid or even illicit payments. However, the reality behind this seemingly straightforward statement is far more intricate, involving a complex web of international agreements, frozen assets, sanctions, humanitarian concerns, and even personal remittances. Understanding the nuances of these financial flows is crucial to grasping the dynamics of US-Iran relations and the broader geopolitical landscape.

This article aims to dissect the various instances where money has flowed, or been allowed to flow, towards Iran from the United States or through international mechanisms influenced by US policy. We will explore significant historical contexts, recent high-profile transfers, and even the often-overlooked channels of personal remittances, all while dispelling common misconceptions and providing a clear, evidence-based perspective on a highly sensitive topic.

Table of Contents

- Understanding the Nuance: Is the US "Sending" Money to Iran?

- The JCPOA Era and Unfrozen Assets: A Look Back

- The $6 Billion Transfer: A Prisoner Exchange Amidst Scrutiny

- Debunking Misinformation: Common False Claims

- Personal Remittances and the Iranian Diaspora: A Separate Flow

- The Broader Implications of Financial Transfers

- Future Outlook and Ongoing Challenges

- Conclusion

Understanding the Nuance: Is the US "Sending" Money to Iran?

The perception that the **US sends money to Iran** is a common point of contention, often fueled by headlines and political rhetoric. However, it's crucial to distinguish between direct financial aid—which the US generally does not provide to Iran due to long-standing sanctions and hostile relations—and the unfreezing or transfer of Iranian funds that were previously held abroad due to international sanctions. These are not funds directly disbursed from the US Treasury as a form of assistance. Instead, they are Iran's own assets, typically derived from oil sales or other legitimate economic activities, that have been frozen in foreign banks as part of international sanctions regimes. When these funds are "released" or "transferred," it means that the US, often in coordination with other nations, issues waivers or takes actions that allow these assets to become accessible to Iran, albeit often with strict conditions on their use. This distinction is vital for a clear understanding of the financial dynamics at play, especially when discussing instances where the US appears to be facilitating money flows to Iran.The JCPOA Era and Unfrozen Assets: A Look Back

A significant period that saw the unfreezing of Iranian assets was in 2015, following the signing of the Joint Comprehensive Plan of Action (JCPOA), commonly known as the Iran nuclear deal. In 2015, as part of this international deal with Iran, the Islamic Republic agreed to cut back on its nuclear program in exchange for sanctions relief. This relief included the unfreezing of billions of dollars in Iranian assets held in banks around the world. It is important to clarify that the US did not give $150 billion to Iran in 2015, as some misleading claims have suggested. Instead, estimates of Iran's frozen assets varied, with some figures reaching up to $150 billion globally, but these were Iran's own funds, not US taxpayer money. The JCPOA infused Iran with cash by making these previously inaccessible funds available. This influx of liquidity was a key incentive for Iran to comply with the nuclear restrictions. Right before the United States reimposed sanctions in 2018, Iran’s central bank controlled more than $120 billion in foreign exchange reserves. This substantial amount highlights the economic impact of the sanctions relief under the JCPOA and, conversely, the severe economic pressure applied when sanctions were reimposed by the Trump administration. The debate around the JCPOA often revolved around whether the economic benefits Iran received would be used for legitimate purposes or to fund malign activities, a concern that continues to resurface with any discussion of financial transfers involving Iran.The $6 Billion Transfer: A Prisoner Exchange Amidst Scrutiny

One of the most recent and highly publicized instances of money flowing to Iran, or rather, being unfrozen for Iran, involved a $6 billion transfer in 2023. This transaction was directly linked to a prisoner exchange deal between the United States and Iran. The Biden administration cleared the way for the release of five American citizens detained in Iran by issuing a waiver for international banks to transfer $6 billion in frozen Iranian money. This was a direct diplomatic maneuver aimed at securing the freedom of US nationals. President Biden publicly stated, "Five innocent Americans who were imprisoned in Iran are finally coming home." In return, five Iranians held in the United States were also allowed to leave. The mechanics of this specific transfer involved the US issuing a sanctions waiver for banks to transfer $6 billion (£4.8 billion) of frozen Iranian funds from South Korea to Qatar. This arrangement was designed to ensure that the funds were accessible to Iran but with significant oversight and restrictions on their use. The move, while successful in bringing Americans home, immediately drew intense scrutiny and criticism, particularly from Republican lawmakers and critics of the Biden administration's approach to Iran.Humanitarian Aid or Ransom? The Debate

The $6 billion transfer quickly became a focal point of a heated debate: was it a legitimate humanitarian arrangement or effectively a "ransom payment"? The State Department insists that none of the $6 billion recently released to Iran by the US in a prisoner exchange was used to fund the Hamas attack on Israel. They maintain that the funds were unfrozen with strict restrictions, specifically that they be used for humanitarian purposes, such as purchasing food, medicine, and other essential goods. The argument is that these funds are held in a restricted account in Qatar and can only be accessed for pre-approved humanitarian transactions, not for military or illicit activities. However, critics argue that money is fungible. Even if the $6 billion is technically earmarked for humanitarian aid, they contend that it frees up other Iranian funds that would have otherwise been spent on these essential items, allowing those other funds to be diverted to support proxy groups or advance its nuclear program. This perspective suggests that any significant financial relief, regardless of its stated purpose, ultimately benefits the Iranian regime's broader agenda. As one statement noted, "it sure doesn’t look good," implying that the optics of the transfer, especially in the wake of regional conflicts, created a perception problem for the administration.The Controversy and Political Fallout The political fallout from the $6 billion transfer was immediate and severe. Republicans have sought to link $6 billion in unfrozen Iranian funds to the weekend attacks on Israeli civilians, despite the State Department's denials. A new ad from the National Republican Senatorial Committee claimed the US was indirectly funding Iran's proxies. Republican critics of the transaction continued to denounce the payments, arguing that they emboldened the Iranian regime and provided it with resources, directly or indirectly, that could be used for destabilizing activities in the Middle East. The debate intensified around whether the Biden administration was defending the $6 billion deal with Iran effectively. Critics often highlighted that this transfer of funds to Iran is cumulatively more significant than the president’s recent $6 billion ransom payment in return for five hostages, implying a pattern of concessions that critics believe only encourages further hostile actions from Tehran. The argument is that such financial transactions, even for humanitarian purposes or prisoner exchanges, weaken the US's leverage and provide a lifeline to a regime that remains a primary sponsor of terrorism.

Debunking Misinformation: Common False Claims

In the age of social media, complex international financial transactions are often simplified and distorted, leading to widespread misinformation. A prominent example is the false claim that "Joe Biden gave $16 billion to Iran." Social media posts distort the sources of the money to falsely claim such figures. It is crucial to reiterate that the Iranian money has been unfrozen with restrictions that it be used for humanitarian purposes, and it is Iran's own money, not a direct gift or aid from the US Treasury. The $6 billion figure, while substantial, is a far cry from $16 billion, and the context of a prisoner exchange for unfrozen assets is entirely different from a direct payment. These false narratives often conflate different financial flows, misrepresent the nature of the funds, and ignore the stringent conditions placed on their use. The continuous spread of such misinformation makes it challenging for the public to understand the true nature of US-Iran financial interactions and the delicate balance of diplomacy, sanctions, and humanitarian concerns that shape them. Understanding that the **US sends money to Iran** only in the context of unfreezing their own assets under specific conditions is vital to counter these misleading claims.Personal Remittances and the Iranian Diaspora: A Separate Flow

Beyond the high-stakes government-level financial transfers, there's another, less publicized but equally important, flow of money from the United States to Iran: personal remittances. This involves individuals sending money to family and friends in Iran, a common practice for the large Iranian diaspora living in the US and other Western countries. Unlike the government-to-government (or rather, government-facilitated) transfers, these are non-commercial and personal in nature. While sanctions make direct banking relationships between US and Iranian banks virtually non-existent, it is still possible to send money from one country to another, including from the US to Iran, albeit through specialized services and workarounds. These services cater to the needs of individuals who wish to support their families or conduct other non-commercial transactions. We review specialist Iranian money transfer services as well as major players that use workarounds to deliver remittances to Iran. These providers navigate the complex regulatory environment to ensure funds reach recipients.Navigating Sanctions for Personal Transfers Transferring money from Iran to the United States, or vice versa, involves navigating a complex web of regulations designed to comply with U.S. sanctions. The Iranian Transactions and Sanctions Regulations (ITSR) authorize the transfer of funds that are noncommercial and personal in nature to or from Iran or for or on behalf of an individual ordinarily resident in Iran, other than an individual whose property and interests in property are blocked pursuant to specific sections of the regulations, subject to certain restrictions and limitations. This means that while broad financial sanctions are in place, specific carve-outs exist for humanitarian and personal remittances, acknowledging the needs of ordinary citizens. These regulations are meticulously crafted to prevent the flow of funds to the Iranian government or sanctioned entities while allowing for essential personal transactions.

Cost and Speed of Personal Transfers The cost of sending money from the US to Iran, and the speed at which it reaches recipients, can vary significantly depending on the service provider and the method used. For instance, it is possible to wire money from the US to Iran and have the money reach the recipients in a short time, often within days. Over the last 7 days, sending money from the United States to Iran through MoneyGram had an average fee of 7.33 USD, making it one of two money transfer providers compared for overall speed of sending money from the United States to Iran. You can also use a bank to write a check to the recipients in their country, though this method might be slower and involve more logistical hurdles due to the lack of direct banking ties. The varying costs and speeds reflect the inherent complexities and the specialized nature of these services, which must operate within the strict confines of US sanctions while facilitating legitimate personal transfers.

The Broader Implications of Financial Transfers

The various ways in which the **US sends money to Iran**, or facilitates the transfer of Iranian funds, carry profound implications for international relations, regional stability, and humanitarian efforts. Each financial flow, whether it's the unfreezing of billions under a nuclear deal or the allowance of personal remittances, is a carefully weighed decision with potential diplomatic, economic, and security consequences. The unfreezing of assets under the JCPOA, for instance, was intended to incentivize Iran's nuclear compliance but also sparked concerns about its potential to fund malign activities. Similarly, the $6 billion prisoner exchange, while achieving a humanitarian goal, ignited a political firestorm over its perceived impact on Iran's regional behavior. These financial transactions underscore the intricate balance the US attempts to strike between exerting pressure on the Iranian regime through sanctions and engaging in diplomatic or humanitarian efforts. The ongoing debate highlights the challenges of isolating a nation economically without inadvertently harming its civilian population or sacrificing opportunities for de-escalation. The continuous flow of money, even under strict conditions, is a constant reminder of the complex and often contradictory objectives of US foreign policy towards Iran.Future Outlook and Ongoing Challenges

The landscape of financial transfers between the US and Iran remains highly dynamic and fraught with challenges. The underlying tension between the two nations, driven by geopolitical rivalries, nuclear ambitions, and regional proxy conflicts, ensures that any financial flow will continue to be meticulously scrutinized. The future outlook for significant financial transfers largely depends on the trajectory of diplomatic engagement, the enforcement of sanctions, and the evolving security situation in the Middle East. Ongoing challenges include the difficulty of ensuring that unfrozen funds are used strictly for their intended purposes, the persistent spread of misinformation that complicates public understanding, and the humanitarian imperative to ensure that sanctions do not unduly punish ordinary Iranian citizens. As long as sanctions remain a primary tool of US foreign policy towards Iran, the debate over how and why money moves between the two nations will persist, shaping not only their bilateral relationship but also the broader international order.Conclusion

The narrative surrounding "US sends money to Iran" is far more nuanced than typically portrayed. It is not about direct aid but primarily involves the unfreezing of Iran's own assets, often as part of complex diplomatic agreements or humanitarian efforts. From the billions unfrozen under the JCPOA to the recent $6 billion transfer for a prisoner exchange, these financial flows are carefully managed and subject to intense political scrutiny and public debate. Simultaneously, personal remittances from the Iranian diaspora continue through specialized channels, navigating a complex web of sanctions to support families. Understanding these distinctions is crucial to grasping the intricate relationship between the two nations. We hope this article has provided clarity on the various facets of money flowing towards Iran, debunking common myths and highlighting the complexities involved. The ongoing discussions about these financial transfers underscore the delicate balance between diplomacy, sanctions, and humanitarian concerns in US foreign policy. What are your thoughts on these complex financial dealings? Share your perspectives in the comments below, and consider exploring other articles on our site for more insights into international relations and economic policy.

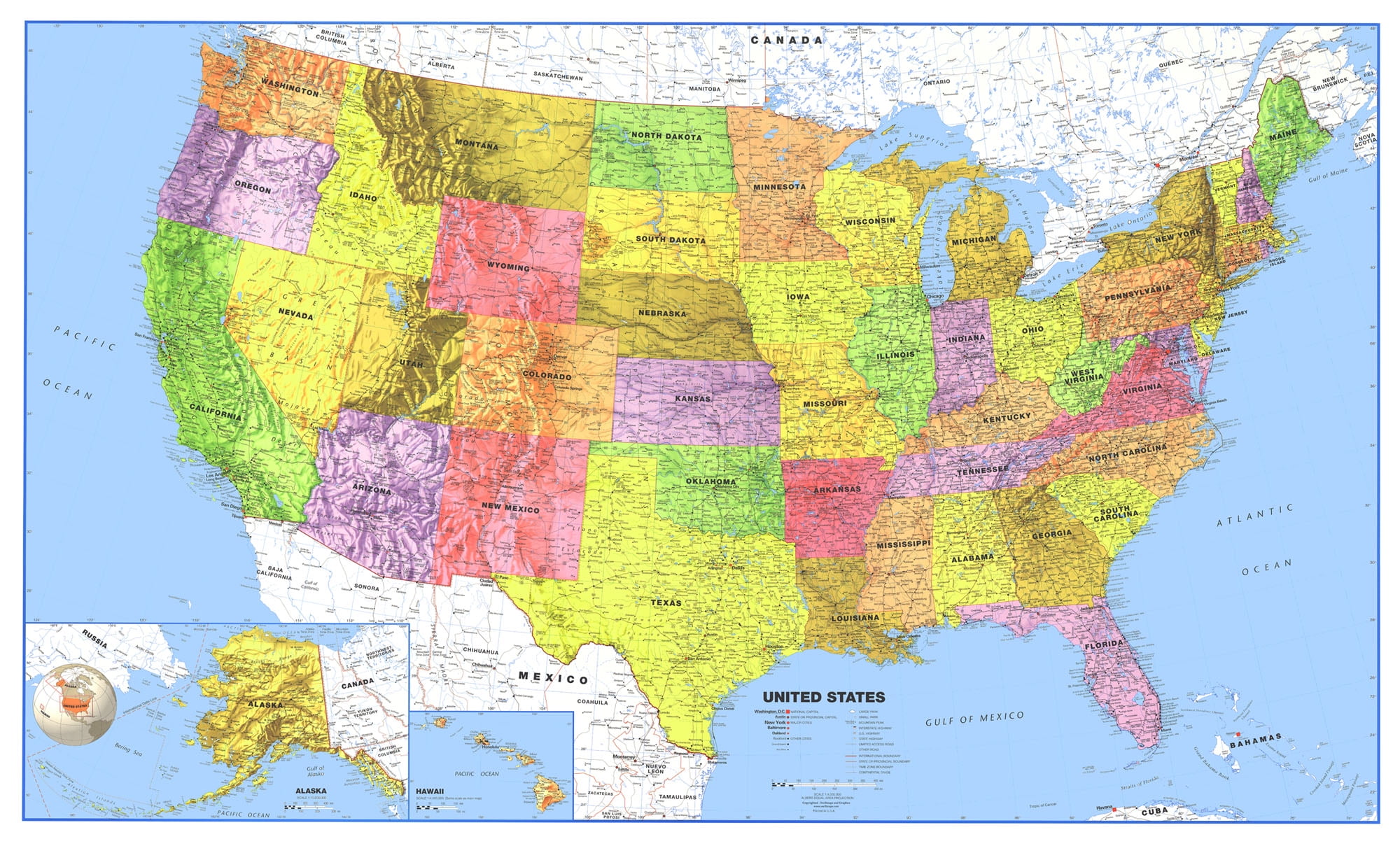

USA Map. Political map of the United States of America. US Map with

United States Map Maps | Images and Photos finder

Mapas de Estados Unidos - Atlas del Mundo