The Economic Clash: Iran's GDP Vs. Israel's Resilience

Table of Contents

- Understanding Gross Domestic Product (GDP)

- Nominal GDP: A First Look at Economic Size

- The Power of Purchasing Power Parity (PPP)

- Divergent Economic Structures and Foundations

- The Cost of Conflict: Economic Strain and Resilience

- GDP Per Capita: A Different Perspective

- Global Economic Ripples: Beyond Borders

- Conclusion: A Complex Economic Tapestry

Understanding Gross Domestic Product (GDP)

Before diving into the specifics of the GDP of Iran vs. Israel, it's essential to grasp what Gross Domestic Product (GDP) truly represents. In simple terms, GDP is the total monetary value of all finished goods and services produced within a country's borders in a specific time period, usually a year. It's a widely used measure of a country's economic health and size. A higher GDP generally indicates a larger and more productive economy. However, GDP can be measured in different ways, leading to varying figures and interpretations. The two most common methods are nominal GDP and GDP based on Purchasing Power Parity (PPP). Nominal GDP measures the value of goods and services at current market prices, without adjusting for inflation or differences in living costs between countries. PPP GDP, on the other hand, adjusts for these differences, providing a more accurate picture of the real volume of goods and services produced and the actual purchasing power within a country. This distinction is particularly crucial when comparing economies like Iran and Israel, where currency valuations and domestic price levels can vary significantly. Understanding these nuances is key to a comprehensive comparison of the GDP of Iran vs. Israel.Nominal GDP: A First Look at Economic Size

When comparing the raw economic output, or nominal GDP, Iran generally presents a larger figure than Israel. According to available data, Iran, with a GDP of approximately $454 billion, ranks as the 29th largest economy in the world. In contrast, Israel, with a GDP of around $370.6 billion, is ranked 34th globally. Other estimates suggest Iran’s GDP is approximately $482.4 billion, while Israel has a GDP of $272.7 billion. These figures, representing annual GDP at market prices, consistently show Iran having a larger overall economic footprint in terms of nominal output. This difference in nominal GDP highlights Iran's sheer scale, benefiting from its larger population and vast natural resources, particularly oil and gas. While Israel's economy is highly developed and efficient, Iran's larger landmass and population base contribute to a higher aggregate nominal output. It's worth noting that these figures can fluctuate based on various factors, including global commodity prices, exchange rates, and the impact of international sanctions, which have historically played a significant role in shaping Iran's economic performance. Nevertheless, the initial comparison of the GDP of Iran vs. Israel, based on nominal values, points to Iran's greater size.The Power of Purchasing Power Parity (PPP)

While nominal GDP offers a snapshot of economic size at current market prices, Purchasing Power Parity (PPP) provides a more nuanced and often more accurate comparison of living standards and the actual size of an economy's domestic spending power. PPP adjusts for differences in the cost of goods and services between countries, essentially asking: "How much would it cost to buy the same basket of goods and services in each country?" When we look at the GDP of Iran vs. Israel through the lens of PPP, the picture changes quite dramatically. In terms of purchasing power parity, a measure of domestic spending and economic resilience, Iran ranks 22nd globally with a substantial $1.44 trillion economy. This places Iran significantly higher than its nominal GDP ranking, underscoring the relatively lower cost of living and higher domestic purchasing power within the country. In stark contrast, Israel ranks 51st globally at $471 billion in PPP terms, according to the Global Firepower Index 2025. This significant divergence highlights that while Iran's nominal GDP might be larger, its PPP GDP is vastly superior, indicating a much greater capacity for domestic consumption and economic activity when accounting for local prices. This difference in the GDP of Iran vs. Israel based on PPP is a critical factor in understanding their respective economic strengths and the quality of life they can provide their citizens.Divergent Economic Structures and Foundations

Beyond the raw numbers of GDP, the underlying structures and foundations of the Iranian and Israeli economies tell a compelling story of their distinct paths and inherent strengths and weaknesses. These differences are crucial for understanding the long-term sustainability and resilience of each nation's economic model. The comparison of the GDP of Iran vs. Israel is incomplete without examining what drives their respective economies.Iran's Economy: Oil, Sanctions, and Diversification Efforts

Iran's economy is notably marked by statist policies, inefficiencies, and a significant reliance on its vast oil and gas exports. This dependence on hydrocarbons makes the economy vulnerable to fluctuations in global oil prices and, crucially, to international sanctions. Years of strict American and European sanctions, coupled with economic mismanagement, have wreaked havoc on the Iranian economy and the value of its currency, even before recent geopolitical escalations. This reliance on oil, coupled with the persistent threat of sanctions, makes sustained military investment precarious, as the revenue streams are highly susceptible to external pressures. Despite these challenges, Iran also possesses significant agricultural, industrial, and service sectors. The country has made efforts towards diversification, but the shadow of oil dependency and the impact of sanctions remain dominant features. The statist nature of the economy means that a large portion of economic activity is controlled or influenced by the government, often leading to inefficiencies and hindering private sector growth. This complex interplay of resources, policies, and external pressures defines the unique challenges and opportunities within Iran's economic landscape, directly impacting its GDP.Israel's Economy: Tech Prowess and Global Integration

In stark contrast, Israel's economy is characterized by its remarkable resilience, high level of innovation, and deep integration into the global economy. It has recovered better than most advanced, comparably sized economies, demonstrating its robustness even in the face of regional instability. A significant milestone was Israel's formal accession to the OECD in 2010, signaling its commitment to international economic standards and practices. Israel's economy has also weathered regional upheavals, such as the Arab Spring, largely because strong trade ties outside the Middle East have insulated its economy from spillover effects. The nation is a global leader in technology, with robust tech exports forming a cornerstone of its economic success. This vibrant tech sector, often dubbed "Startup Nation," attracts significant foreign investment and drives innovation across various industries. Furthermore, Israel maintains a substantial $223.6 billion forex reserve, providing a strong buffer against economic shocks. This diversified, innovation-driven, and globally integrated model offers a stark contrast to Iran's more resource-dependent and state-controlled economy, explaining much about the differing resilience seen when comparing the GDP of Iran vs. Israel.The Cost of Conflict: Economic Strain and Resilience

The ongoing geopolitical tensions and direct conflicts in the Middle East have profound economic implications for both Iran and Israel. These nations are now locked in a "parallel war of numbers," where missile interceptions cost millions, oil exports can vanish overnight, and households brace for tax hikes. The economic burden of security and conflict is a significant factor shaping their respective GDP trajectories.The Gaza Conflict's Toll on Israel

Israel's economy has been significantly strained by the ongoing Gaza conflict. By the end of 2024, the war in Gaza had cost Israel over 250 billion shekels, equivalent to approximately $67.5 billion. This immense expenditure impacts various sectors, from defense spending to reconstruction and social support programs. Despite these significant costs and ongoing conflicts, Israel’s economy demonstrated remarkable resilience, growing by 3.4 percent in Q1 2025. This growth was supported by its robust tech exports and the substantial forex reserve mentioned earlier, which provides a crucial cushion against economic shocks. The ability of Israel's economy to continue growing amidst such intense conflict highlights its underlying strength and adaptability, a key differentiator in the comparison of the GDP of Iran vs. Israel.Broader War Scenarios and Their Economic Fallout

The specter of a broader war between Iran and Israel casts an even longer shadow over their economies. According to Israeli economist Yacov Sheinin, a broader conflict with Iran could potentially push costs to an staggering $120 billion, or 20% of Israel's GDP. This illustrates the immense economic risk associated with escalating tensions. The initial direct conflict with Iran, though brief, cost an estimated 5.5 billion shekels ($1.6 billion) in just two days, primarily due to defensive measures like missile interceptions. For Iran, the economy’s reliance on oil—coupled with sanctions—makes sustained military investment precarious. Any disruption to oil exports or further tightening of sanctions in the event of a broader conflict would severely cripple its revenue streams, making it difficult to finance prolonged military engagements or recover economically. Both nations face a scenario where military expenditures escalate, potentially leading to significant tax hikes for citizens and a diversion of resources from productive sectors. This mutual vulnerability to the economic costs of conflict is a defining feature of their current geopolitical standoff, directly influencing the stability and growth of the GDP of Iran vs. Israel.GDP Per Capita: A Different Perspective

While total GDP figures provide an overall measure of a country's economic size, GDP per capita offers a crucial insight into the average economic output and, by extension, the average standard of living of its citizens. It is calculated by dividing the total GDP by the country's population. Even if a country has a large overall GDP, a very large population can result in a lower GDP per capita, indicating that the wealth is spread thinner among its people. The provided data mentions the comparison of Iran vs. Israel in terms of GDP per capita (dollars and euros), implying that this metric presents a different picture than the total GDP. While specific figures for GDP per capita were not provided in the "Data Kalimat," it is generally understood that Israel, with its smaller population and highly advanced economy, tends to have a significantly higher GDP per capita than Iran. This means that, on average, Israelis enjoy a higher level of economic prosperity and access to goods and services compared to Iranians. This distinction is vital because it shifts the focus from raw economic power to the individual citizen's economic well-being, offering a more nuanced understanding of the economic realities when comparing the GDP of Iran vs. Israel.Global Economic Ripples: Beyond Borders

The economic and geopolitical tensions between Iran and Israel do not exist in a vacuum; they send ripples across global markets, affecting economies far beyond the Middle East. The interconnectedness of the modern financial system means that significant events in one region can trigger reactions worldwide, impacting investor confidence and market stability. For instance, news of Israel's attacks has caused European equities to drift down. Germany’s DAX and France’s CAC 40, two major European stock indices, fell a little more than 1.1 percent at the end of a recent week, while the UK’s FTSE 100 also experienced declines. These immediate market reactions underscore how sensitive global investors are to the stability of the Middle East. Any escalation in the conflict, or even heightened rhetoric, can lead to increased volatility in oil prices, disruptions in trade routes, and a general flight to safety among investors, impacting everything from commodity markets to stock exchanges. This global economic interconnectedness means that the economic performance and stability of both Iran and Israel, and the dynamics between them, have implications that extend far beyond their borders, influencing the broader international economic landscape.Conclusion: A Complex Economic Tapestry

The economic comparison of the GDP of Iran vs. Israel reveals a complex and multifaceted picture, far beyond a simple "which is better" assessment. While Iran boasts a larger nominal GDP and a significantly higher Purchasing Power Parity (PPP), reflecting its vast resources and larger domestic market, its economy remains heavily reliant on oil exports and is perpetually challenged by international sanctions and internal inefficiencies. This makes its economic future, particularly its capacity for sustained military investment, inherently precarious. Israel, on the other hand, despite a smaller nominal GDP and PPP, showcases remarkable resilience, driven by a dynamic, globally integrated, and innovation-led economy, particularly its robust tech sector. Its ability to grow even amidst intense conflict, supported by strong trade ties and substantial forex reserves, highlights a fundamentally different economic model focused on diversification and high-value industries. The ongoing conflicts, particularly the war in Gaza and the potential for a broader confrontation with Iran, impose significant economic strains on both nations, forcing them to divert substantial resources towards defense and recovery. Ultimately, the economic performance of both Iran and Israel is inextricably linked to their geopolitical realities. Each possesses unique strengths and vulnerabilities that shape their capacity to navigate regional instability and global economic shifts. Understanding these economic underpinnings is crucial for anyone seeking to comprehend the broader dynamics of the Middle East. What are your thoughts on the economic trajectories of Iran and Israel? Do you believe one model is more sustainable in the long run? Share your insights in the comments below, or explore other related articles on our site to deepen your understanding of global economic affairs.- Courtney Henggeler

- How Tall Is Tyreek

- Jenna Ortega Leaked

- Jesse Metcalfe Children

- Photos Jonathan Roumie Wife

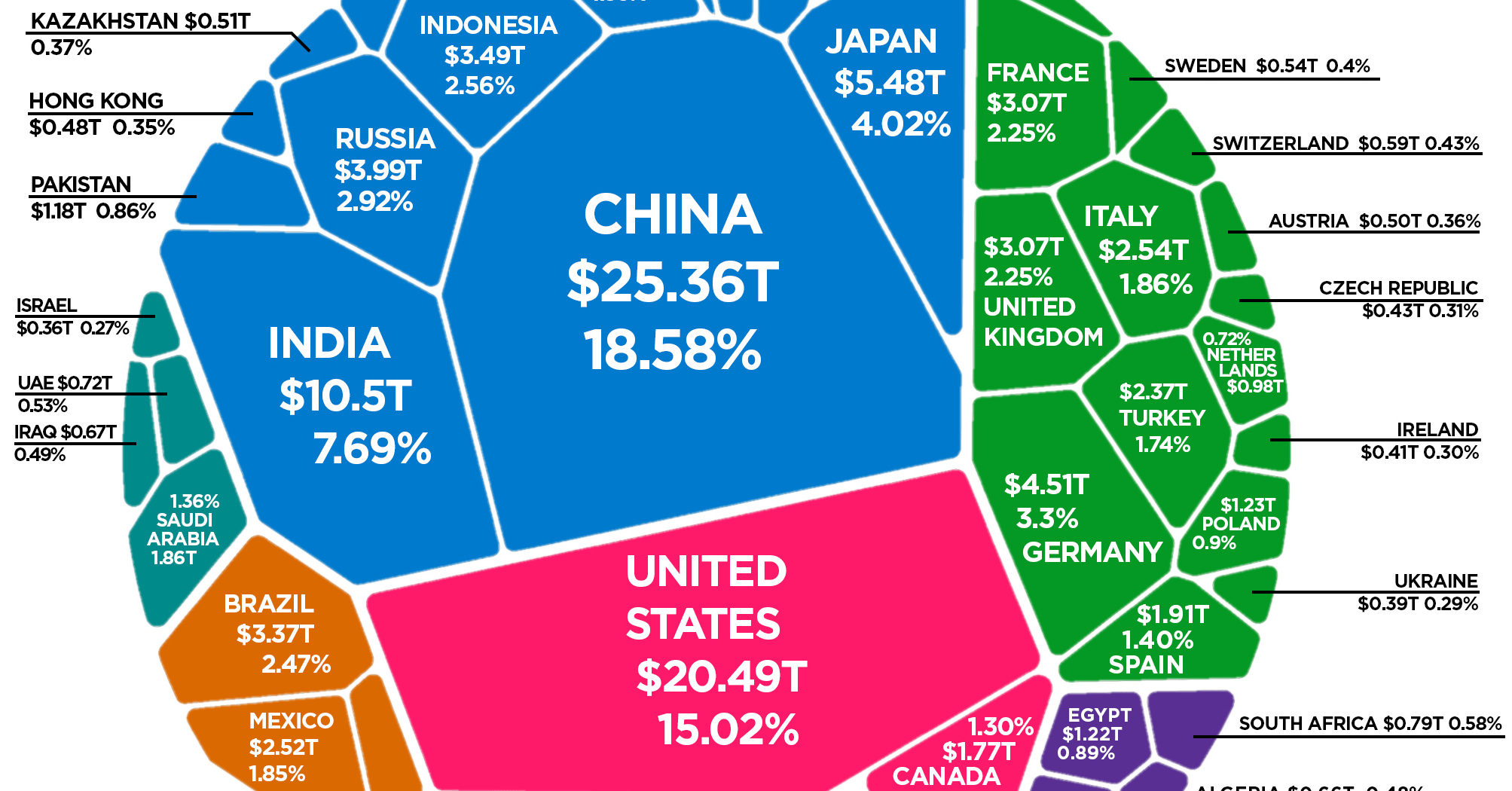

The Composition of the World Economy by GDP (PPP)

/gdp-increase-636251500-c69345ee97ba4db99375723519a2c1bd.jpg)

Real Gross Domestic Product (Real GDP) Definition

The World Economy in One Chart: GDP by Country